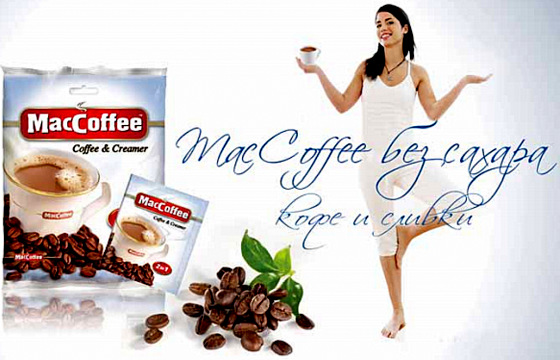

Food Empire's brand of instant coffeemix is No.1 in Russia.

Food Empire's brand of instant coffeemix is No.1 in Russia.

Picture: annual report

Food Empire reported achieving 1H2013 profit after tax of US$9.1 million as compared to US$8.7 million in 1H12.

We met up last Friday with Chin Tze Ting, personal assistant to the chairman of Food Empire, for clarity on certain parts of the business.

Food Empire is in a state of transition -- it has just tweaked its business model, and it is constructing two new plants in Iskandar, Johor to produce ingredients for its coffeemix business.

In the meantime, its sales continues to enjoy high gross margins in the 40-50% range.

Chin Tze Ting of Food Empire.

Chin Tze Ting of Food Empire.

Photo by Leong Chan Teik>> Russian market: Food Empire Holdings dominates the instant coffeemix segment in Russia where it has some 50% market share. Big names such as Nestle dominate in other coffee segments.

Russia contributed US$136.9 million (or 58%) of Food Empire's total revenue last year, which means the market has recovered back to its pre-global financial crisis levels.

The coffeemix segment, along with the broad coffee market, is expected to grow with Russia's economic growth.

But the coffeemix business will not expand spectacularly, which is why Food Empire is seeking growth from other endeavours, including upstream integration and M&A.

And while its main offering is coffeemix, it has ventured into freeze-dried coffee and soluble coffee in Russia.

Aside from Russia, there will be growth from two other key markets (Ukraine and Kazakhstan) in the high single-digit or low double-digit percentages. Russia grew 14% in 1H this year while Eastern Europe and Central Asia, 12.7%.

Food Empire has a market share of about 40% in Ukraine, and 70% in Kazakhstan, according to AC Nielsen findings.

>> Greenfield projects: Food Empire has four greenfield projects that will be the springboard for its next phase of growth.

In Malaysia, these are a non-dairy creamer plant and a potato chips plant, both in Iskandar, and a packaging plant in Klang.

In India, it is an instant coffee powder plant.

"We are looking for stability in commodity prices by manufacturing our own ingredients," said Tze Ting. The key ingredients for coffeemix are non-diary creamer, coffee and sugar.

The plants in Johor and Klang will start operations by the end of this year and production will be ramped up over perhaps 12 months.

Depreciation costs, fixed costs and financing costs related to these plants are expected to be a drag on the company's profitability for a while.

The greenfield projects cost about USD60 million with 60-70% of that sum expected to come from external loans.  Food Empire's Kracks tastes just as good as the market leader.

Food Empire's Kracks tastes just as good as the market leader.

Photo: Food Empire>> Why potato chips? Food Empire has a brand of potato chips called 'Kracks' which is currently OEM-produced.

When its own US$9-million plant is ready, it could even be an OEM for other parties.

On why Food Empire has ventured into potato chips, Tze Ting said: "It's easy to sell. Kracks has sold very well in countries like Ukraine and Kazakhstan. You'd be surprised to know that on supermarket shelves, you'd see either Pringles or our Kracks. We have had some success."

Kracks retails at a lower price than Pringles and tastes just as good.

Sales last year amounted to USD13 million.

>> Change of business model: Food Empire has modified its business model in Russia since the start of this year.

For the Russian market, it used to buy raw materials and sell them to an entity in Russia which is also one of its main distributors. (This is the major customer referred to in the annual report which accounted for a whopping US$130.8 million of revenue in 2012).

The raw materials are then used in Food Empire's factory in Russia to produce Food Empire products for which Food Empire would charge a fee (termed 'marketing service fee' in Food Empire's financial statements).

Subsequently, the entity and other distributors would distribute the products to the market.

While this has served Food Empire well, especially in the early years when it was not familiar with the import procedures and the market, Food Empire has streamlined the process.

Food Empire now buys the raw materials, imports them into Russia, produces its coffeemix products in its factory and then sells them to its distributors.

This has resulted in an improvement in its gross margins. But it has also hiked staff costs and inventory levels.

In addition, Food Empire has assumed new currency risks because it buys the raw materials in USD and sells its finished products in the Russian currency. Previously, it bought in USD and sold the raw materials to the importer in USD -- a natural currency hedge.

Food Empire has made the same change to its business model in Ukraine.

Recent stories:

OSK-DMG'S selection of small cap jewels for 2013

FOOD EMPIRE's 2012 annual report sweeps international awards

..............................Food Empire........Super

Branded products.........$300m............$355m

Food Ingredients..............0...............$164m

Total revenue...............$300m............$519m

Attributable profit............$26m..............$79m

Net margin.......................9%...............15%

EPS..............................5c.................14c

NAV..............................38c.................72c

Price-earnings ratio..........13.....................31

Super's revenue from branded products is not much higher than Food Empire's.

Super's overall revenue is much higher because of sales of food ingredients. When Food Empire's creamer and coffee powder factories are in full production, and sell parts of their output, the gap between the two companies may narrow.

More importantly, using its own food ingredients to produce branded coffee will bring Food Empire's 9% net margin closer to Super's 15%.

Net margin will also be helped when Food Empire produces potato chip from its own factory instead of relying on OEM now.

Is the low valuation of Food Empire (13 times profit vs Super's 31 times) justified? It seems that investors are very concerned about political and currency risks of Russia and the former CIS states, where Food Empire derives 90% of its revenue.