L-R: Boon Yoon Chiang, Ong Kian Min, Tan Guek Ming, William Fong (CFO), Tan Wang Cheow (Executive Chairman), Sudeep Nair (CEO), Tan Joon Hong (COO), Lew Syn Pau, Hartono Gunawan, Koh Yew Hiap.

L-R: Boon Yoon Chiang, Ong Kian Min, Tan Guek Ming, William Fong (CFO), Tan Wang Cheow (Executive Chairman), Sudeep Nair (CEO), Tan Joon Hong (COO), Lew Syn Pau, Hartono Gunawan, Koh Yew Hiap.

Photos by Ong Chin Keet  Time & date: 3 pm, 23 April 2013.

Time & date: 3 pm, 23 April 2013.

Venue: Marina Mandarin Hotel

FOOD EMPIRE Holdings chalked up US$20.5 million in net profit in 2012, up 36.6% year on year.

Sales growth was recorded in all the Group’s three regions – Russia (5.8%), Eastern Europe and Central Asia (4.5%) and in Other Markets (5.2%).

At the AGM, shareholders approved the payment of a first and final dividend of 1.231 Singapore cents per share.

Q: Can you explain why it has taken the company 4 years (from 2008) to recover to the same level of revenue? Shareholder Jimmy Chua asked about liquidity ratios and the investment property of Food Empire.Tan Wang Cheow (Executive Chairman): We were impacted by the currency exchange of the Russian rouble and the USD. Prior to the 2008 global financial crisis, it was 23 roubles to a USD. At the peak of the crisis, it was 40 roubles to a USD. Last year, it was 30-33 roubles to a USD. We were impacted because our sales were in USD.

Shareholder Jimmy Chua asked about liquidity ratios and the investment property of Food Empire.Tan Wang Cheow (Executive Chairman): We were impacted by the currency exchange of the Russian rouble and the USD. Prior to the 2008 global financial crisis, it was 23 roubles to a USD. At the peak of the crisis, it was 40 roubles to a USD. Last year, it was 30-33 roubles to a USD. We were impacted because our sales were in USD.

Q: Why have the liquidity ratios gone down in recent years?

Tan Wang Cheow: In 2011, we bought a piece of land in Playfair Road for an investment property and we have built a factory in Ukraine. This year, we have started building on the piece of land which is next to our HQ, which will be completed next year. You will see outgoing cashflow.

Then there is a creamer plant in Iskandar, Johor, and a potato chips plant which can produce 350 kg per hour, which will be completed by Aug this year. We also will have a packing plant to take over the 2 plants in Singapore and Johor for completion in August this year. And we are putting up a coffee plant in India by end of next year.

Q: Regarding the projects, how much do they total and how are you going to fund them?

Tan Wang Cheow: The total is US$70 million, of which 60% will have external financing.  Shareholder SK Gan asked about stock options. Q: What are your plans for the piece of land to build an investment property?

Shareholder SK Gan asked about stock options. Q: What are your plans for the piece of land to build an investment property?

Tan Wang Cheow: We found an opportunity to buy the empty piece of land next to our office. It turned out to be a very good deal.

The land cost was S$8 million and an appraisal we did at end of last year was $11-12 million. Construction cost would be $7.5 million. By the time it is completed, it would be worth $20-25 million.

Q: I am happy to learn that the company intends to go into new markets in Asia. Perhaps the CEO can elaborate on that.

Tan Wang Cheow: In the past few years, we have made moves to enter into the Phillipines, Malaysia, Indonesia, Myanmar and Vietnam.

Sudeep Nair (CEO): Over the last 20 years we have developed our business the CIS markets and we are market leaders in almost all the markets. But we have kind of missed out on the opportunities in Southeast Asia particularly. We have started some steps in the Phillipines, Malaysia, and Myanmar. This year our task is to build our Middle East business out of Dubai and we have exploratory business in Africa.

Q: Do you have a numerical target for how the Asian markets will eventually contribute out of the total?

Sudeep Nair: Internally, we have targets but we can't disclose them.

Q: The creamer plant -- how much will we use and how much is for outsourcing?

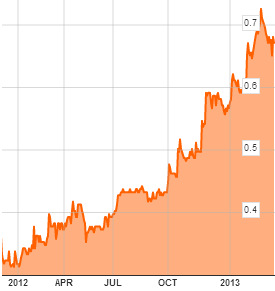

Tan Wang Cheow: We have earmarked 30-50% for our own consumption. The rest we will find a market for industrial use.  Food Empire stock more than doubled in 2012, and has continued to firm up in 2013 year to date. At 67 cents a share, the company has a market cap of S$357 million. Chart: BloombergQ: My friend recommended that I buy Food Empire stock when it was 30-something cents. I waited ...and became a shareholder only 10 days ago. I'm impressed that you are trying to build a global brand and your geographical diversification. You are not a large company, so is there a risk you are spreading yourself too thin?

Food Empire stock more than doubled in 2012, and has continued to firm up in 2013 year to date. At 67 cents a share, the company has a market cap of S$357 million. Chart: BloombergQ: My friend recommended that I buy Food Empire stock when it was 30-something cents. I waited ...and became a shareholder only 10 days ago. I'm impressed that you are trying to build a global brand and your geographical diversification. You are not a large company, so is there a risk you are spreading yourself too thin?

Sudeep Nair: The risks exist only if you go into unknown markets and you do a large acquisition. But if you are building organically in any market, it is all about your commitment and resources.

It took us 20 years to build the business in Russia. If you are talking about, say, Africa, it will take many years and a gradual investment.

It will all be within the budget we set and if we see it is very tough, we can always decide to stop if there is no light at the end of the tunnel.

Q: The company paid about US$1.3 million in income tax, or about 5% in tax rate. Why was it so low? The ample post-AGM food spread....Tan Wang Cheow: We are structured in such a way that our operations accrue from Dubai where there is no tax.

The ample post-AGM food spread....Tan Wang Cheow: We are structured in such a way that our operations accrue from Dubai where there is no tax.

Recent stories:

FOOD EMPIRE: Focusing growth efforts in Asia, Middle East, Africa

FOOD EMPIRE: US$21 m net profit in FY12, upstream projects taking shape