"Rock" is a regular contributor to the NextInsight forum. He works in the technical field in the oil & chemical industry and is due to retire this year, after which he will devote more time to investments and his two grandchildren. I have made yearly contributions to my Supplementary Retirement Scheme (SRS) account from 2007 to 2012.

I have made yearly contributions to my Supplementary Retirement Scheme (SRS) account from 2007 to 2012.

I decided to do so because the SRS offers attractive tax benefits. Contributions to SRS are eligible for tax relief, investment returns are accumulated tax-free, and only 50% of withdrawals from SRS are taxable at retirement.

My SRS account monies have been invested in stocks. By 2007, I had chalked up many years of experience as a stock investor and increasingly prefer stocks which offer capital protection and passive income.

From 2007 to 2010, my contribution was @ $11,475 per year. Total = $45,900.

From 2011 to 2012, my contribution was @ $12,750 per year. Total = $25,500.

Total contribution from 2007 to 2012 = $71,400.

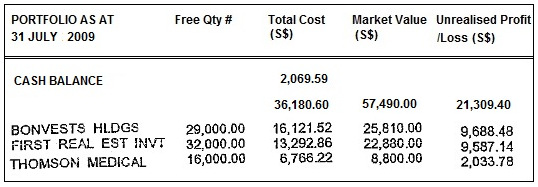

Let me share my investing experience with my SRS portfolio. In Year 3, ie 2009, the portfolio value plus cash as @ 31st July 2009 totalled $59,559 (See image below)

As @ July 2009 I have made 3 yearly contributions totalling $34,425.

Profit as @ 31st July 2009 = $25,134 even though in 2008, the world markets were hit by the global credit crisis and in March 2009, the ST Index was at its lowest.

Taking advantage of the fall in stock prices, I bought stocks over the next two years.

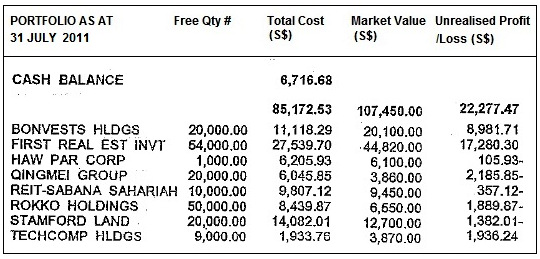

As a result, my SRS portfolio value plus cash as @ 31st July 2011 totalled $114,166 (See image below).

I made 2 contributions in 2010 and 2011 of $11,450 and $12,750, respectively.

Total contribution made to my SRS by July 2011 = $58,650.

Profit as @ 31st July 2011 = $55,516

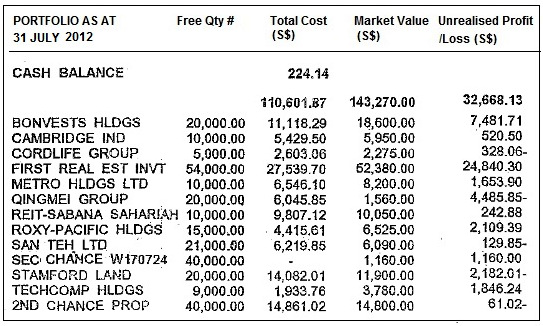

A year later, my SRS portfolio value plus cash as @ 31st July 2012 = $143,494. (See image below)

By July 2012 I had made another contribution of $12,750. Total = $71,400 (ie, total contribution from 2007 to 2012).

Profit as @ 31st July 2012 = $72,094

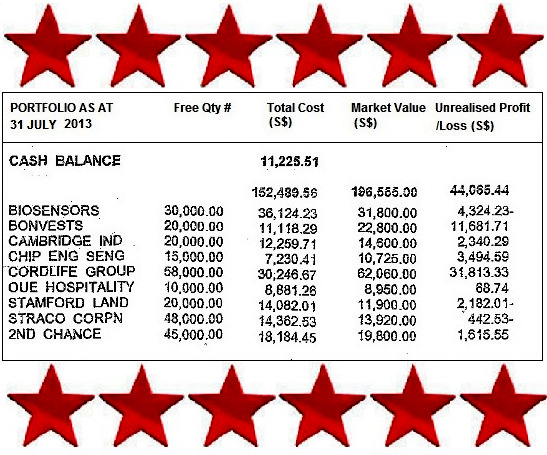

A year later, my portfolio value plus cash as @ 31st July 2013 plus $1,000 dividends = $208,780 (see image below).

(Dividends yet to come from Biosensors and Cambridge REIT total about $1,000.)

Profit as @ 31st July 2013 = $137,380.

The key factor in my success story is, invest in under-valued and growth stocks for as long as possible.

Similar to Sandy Chin, whose CPF investment successful story is published on NextInsight, my investing approach is: do not over-trade but to invest in the long-term growth of a company. Build up a portfolio of core stocks.

My core stocks:

> Bonvest: average price 55cts

> First REIT: average price 41.5cts. Sold all 58 lots at average price of $1.35.

> Thomson Medical: average price 42cts. Accepted delisting offer @ $1.75.

> Cordlife: Added last year @ 52cts.

Straco owns and operates the Shanghai Ocean Aquarium which is sited within walking distance of other tourist attractions such as the Oriental Pearl Tower and The Bund. Photo: InternetMy latest stocks are Straco at an average price of 29.5cts, and Biosensors (average $1.20). I believe over time these 2 stocks will perform.

Straco owns and operates the Shanghai Ocean Aquarium which is sited within walking distance of other tourist attractions such as the Oriental Pearl Tower and The Bund. Photo: InternetMy latest stocks are Straco at an average price of 29.5cts, and Biosensors (average $1.20). I believe over time these 2 stocks will perform.

I made losses in Qingmei and Rokko. Important lesson -- cut loss on under-performing stocks rather than average down on them.

The sweetest experience of all for me was to outperform the bear market of 2008 when the ST Index was at 1456 at its lowest point in March 2009, and during the PIIGS Crisis in 2011.

Invest in the long-term growth of a company and you can sleep well. In addition, I have the benefit of income tax savings for the last 6 years by investing through SRS.

For more information on the SRS scheme, click here.

Related stories:

INVESTOR: How My Stocks Bought With CPF Savings Have Done (2013)

ISAAC CHIN: "My portfolio's up 25% despite market correction"

My investment approach had been the same, holding for long term. Most time made money during bull market & lost it back during bear market. In the early days I look out to analyst recommendation for guidance but usually the news are outdated. After I have learn to access to SGX & others source for information which help greatly in my decision. I have learned much from Warren Buffet principles of investment. Built a strong portfolio of winning stocks, sell off the losers.

Knowledge does not guarantee success. It is attributed to the godly principles that I had learned that make the difference. I'm able condition myself better to overcome fear and greed. Seek godly wisdom in order to make wise decision. Focus on business growth rather than focus on profit. Those who know the story of Joseph will know that it was through crisis that will present the greatest opportunities. I have learned to manage risks & review my portfolio regularly.

God Bless

How long have you been investing in stocks and was there a time when your investing approach was very different?

Cordlife oversea is taking shape gradually. I believe there is good potential for business growth.

Biosensors has a good product in the long run it will still above to perform. I may cut loss and see how they can overcome their problems and royalty lost.

Thanks Joes.

My current personal portfolios about 50% stocks and 50% cash.

My personal belief limited upside because the market is drive by QE3. I feel headwind ahead.

Thanks for your interest. If we are not fearful & greedy, to beat CPF interest is very simple. There are many stocks with good stable business which offer more than CPF 2.5%.

I ask a few friends who are over 55 year old where you park you CPF money. The reply – leave it in CPF because bank interest very low and stocks are risky.

There are many who are still holding on to the losers or pennies stocks because these people “sell the winners and keep the losers”

I feel honor by your complements especially coming from an experience and successful investor like you. Thanks so much Isaac.

Thanks for your interest. You can find in the forum under “Sound Investment” I have posted many write-out which may be helpful. Examples: “Risk Managements” & “Investment Pitfall” and how I stock-pick.

I don’t waste time focusing on daily share price. In fact there are more to life than wasting time watching the computer screen. Don’t work for the money but let your money work for you.

I keep track of news, check into SGX announcement & review my portfolios. Important is to keep all the winners and sell off the losers. Don’t focus on profit but instead on the business of the stocks. Knowledge will help you but seek wisdom. Wisdom will help us make the wise decision. (Story of King Solomon)

Able to over-come fear and greed. (I have learn godly principles that we are a channel of God’s blessing & blessing comes with responsibilities)

In current environment how much % of stock do you advocate?