A strong set of earnings drew a good turnout of analysts and fund managers to Riverstone's 2Q2013 results briefing. In the background, NRA Capital analyst Jackie Lee (left) with CFO Lim Sing Poew (wearing a necktie). Executive chairman Wong Teek Son (with necktie, in the foreground) is busy with other analysts. Photo by Leong Chan Teik

A strong set of earnings drew a good turnout of analysts and fund managers to Riverstone's 2Q2013 results briefing. In the background, NRA Capital analyst Jackie Lee (left) with CFO Lim Sing Poew (wearing a necktie). Executive chairman Wong Teek Son (with necktie, in the foreground) is busy with other analysts. Photo by Leong Chan Teik

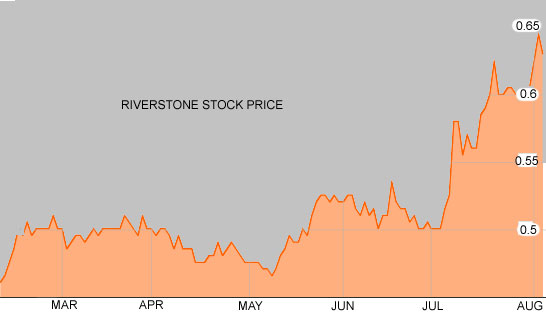

A MALAYSIAN company listed on SGX is catching the attention of investors: Riverstone’s stock price has surged almost 40% year-to-date to 63 cents recently, outperforming the FTSE ST All-Share Index (which returned to January levels).

Riverstone is a leading maker of clean room and healthcare gloves headquartered in Malaysia, exporting to customers worldwide. And Malaysia, with its abundance of rubber trees, is a country that exports more than 60% of the world’s supply of rubber gloves.

According to Research and Markets, the natural rubber glove sector is growing 10% a year, thanks to growing health awareness, increased spending on healthcare in emerging markets and the occurrence of new infectious diseases.

In addition to natural rubber gloves, Riverstone is now focusing on nitrile gloves, made of synthetic material that does not trigger latex allergy in users the way natural rubber gloves do. Global demand for nitrile gloves is estimated to increase by 20% a year.

The strong industry outlook is translating into strong earnings growth and a steady dividend payout.

Riverstone has declared a 2.3 RM sen (0.86 SG ct) interim dividend after posting a 31.2% year-on-year increase in 2Q2013 profit attributable to shareholders to RM 14.4 million (S$5.7 million).

In fact, the company has consistently paid dividends every year since its IPO in 2006, and the payout ratio has been generous, ranging from 35.5% to 56.5% of its earnings.

“We hope to pay more dividends as our earnings grow,” said CFO Lim Sing Peow.

Its 2Q2013 revenue grew 15.5% year-on-year to reach RM 90.4 million (S$35.5 million), as an increase in production capacity filled demand for healthcare gloves.

Gross margin improved 5.1 percentage points to reach 26.7%, helped by improved productivity and favorable raw material prices. Net profit rose 31.2% to RM 14.4 million (S$5.7 million). Riverstone's stock price has surged almost 40% in the past six months. Bloomberg data

Riverstone's stock price has surged almost 40% in the past six months. Bloomberg data

Strong take-up of additional capacity

”Increased capacity is always utilized because the market is growing,” said Executive Chairman Wong Teek Son during its results briefing on Tue morning at One Raffles Quay.

Riverstone has 4 factories in Malaysia, Thailand and China with a combined annual capacity of 3.1 billion gloves, 600 million pieces of finger cots, 1,500 tons of clean room packaging materials and over 40 million pieces of face masks as at 31 December 2012.

It has announced plans to construct a new single former glove production dipping line in Thailand for RM 2.855 million (US$892,000) with a capacity for 90 million gloves a year by 1Q2014.

The business is not without risks: A weaker US dollar against the Malaysian ringgit will impact profits since exported gloves are priced in US dollars, and rising latex and crude oil prices will also eat into margins until this higher cost is passed down to consumers.

Below is a summary of the questions raised by analysts and fund managers at the briefing and the replies provided by the Chairman and the CFO.

Q: Gross margin is at its peak. Can you maintain these margin levels?

This depends on how the cost of raw materials fluctuates. Also, revenue contribution from healthcare and clean room gloves is currently 50:50 with 70% of production volumes from medical gloves and 30% from clean room gloves. Clean room gloves command better margins. So, our margins will dip if the proportion of healthcare gloves increases.

Riverstone is a market leader in clean room gloves. Company photosQ: How have raw material prices fluctuated?

Riverstone is a market leader in clean room gloves. Company photosQ: How have raw material prices fluctuated?

1H2013 raw material prices were about 10% to 15% lower than in 1H2012.

Q: How do you maintain margins in the face of competition?

Riverstone is different from other glove manufacturers because we have two glove types – clean room and medical.

Margins of clean room gloves are double that of medical gloves. One way to lift margins is to give priority to clean room gloves.

Another way is to fully utilize the capacity that we have by streamlining the production of medical gloves.

There are different weights for medical gloves: 3g, 3.2g, 3.5g, and so on. We can reduce the product range to offer only 3.2g and 3.5g medical gloves.

Q: What is your currency exposure?

We have a natural hedge as our nitrile gloves are exported worldwide and sold in US dollars. Our raw materials are also purchased in US dollars.

Q: What is your product differentiation?

We have different finishing and coatings for different types of gloves. One good example is the forensic glove, which needs to provide a safe barrier for law enforcement applications, and not pass on prints. Then, there are gloves that we coat with collagen, and this requires some technology.

Related stories:

RIVERSTONE: Insights Into Its Business Model -- And A New Hit Product

RIVERSTONE: Steady Dividends, Rising Production Capacity