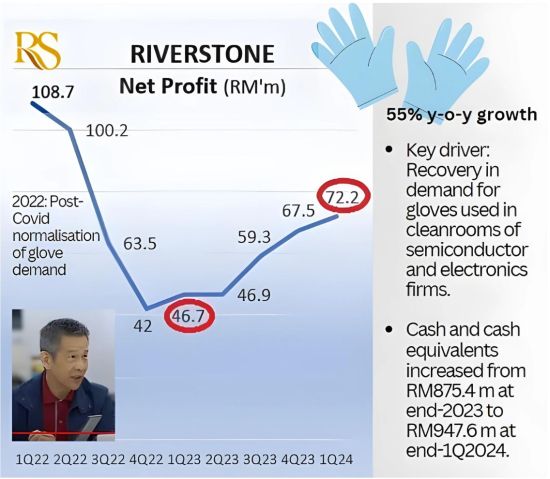

Riverstone manufactures gloves mainly from its base in Taiping, Malaysia. Its other factories are in Malaysia, Thailand and China. • A glove is a glove -- to the uninitiated. But there is a wide chasm between prices of gloves for use in healthcare and those for use in electronics cleanroom settings. Riverstone manufactures gloves mainly from its base in Taiping, Malaysia. Its other factories are in Malaysia, Thailand and China. • A glove is a glove -- to the uninitiated. But there is a wide chasm between prices of gloves for use in healthcare and those for use in electronics cleanroom settings. In 1Q24, the average selling price of cleanroom gloves was US$90 per 1,000 pieces. Healthcare gloves? Only US$28. These were what Singapore-listed Riverstone Holdings (market cap: S$1.3 billion) was able to charge. • The gross margin for cleanroom gloves was 55%. Much less was the margin for healthcare gloves: 24%. The key driver for Riverstone's profitability has long been cleanroom gloves. They meet high specifications required for sensitive environments like semiconductor and electronics manufacturing. These gloves protect products from human contamination and static electric charges. • As the semiconductor and electronics industries recover, look out for Riverstone's cleanroom glove segment to be the flag bearer for its growth. • The chart below shows Riverstone's upward profit trajectory in the past 5 quarters. Analysts say Riverstone's business momentum going forward is positive: Demand is rising for not just cleanroom but also healthcare gloves. That's why Riverstone is adding production lines for both glove types.  Inset: Wong Teek Son, CEO Inset: Wong Teek Son, CEO• Healthcare glove inventories in the market have been depleting after the excessive stocking during the pandemic. As normalised demand now returns, this is busy times for Riverstone. Furthermore, Riverstone has recently been developing customised gloves for use in specific medical practices or environments, enhancing their functionality for various medical tasks. Such gloves fetch higher profit margins compared to generic ones. With that background on Riverstone, read CGS-CIMB's report below for details of Riverstone's sterling performance in 1Q2024 .... |

Check out how Riverstone outshines its peers:

|

How Riverstone outshines its peers |

|||||||

|

Company |

Stock (local |

3-year EPS CAGR |

P/BV |

Recurring ROE (%) CY24F |

EV/EBITDA (x) CY24F CY25F

|

Dividend Yield CY24F |

|

|

Riverstone |

0.78 |

11.7%

|

2.27 |

17.5% |

7.4 |

7.3 |

7.4% |

|

M’sia-listed peers |

|||||||

|

Hartalega |

2.89

|

na

|

2.06 |

2.3% |

33.4

|

18.9

|

0.0%

|

|

Kossan |

2.29 |

na |

1.50 |

1.2%

|

29.7

|

15.1

|

0.0% |

|

Supermax |

0.87 |

na |

0.51

|

0.1%

|

3.9

|

1.8

|

0.0% |

|

Top Glove |

0.92 |

na |

1.31

|

-2.3%

|

35.9

|

15.5 |

0.0% |

|

Overall average |

11.7%

|

1.53

|

3.8%

|

22.0

|

11.7

|

1.5%

|

|

|

Source: CGS-CIMB |

|||||||

Riverstone has a resilient business producing high-margin cleanroom gloves as well as customised gloves for the healthcare sector.

Riverstone has a resilient business producing high-margin cleanroom gloves as well as customised gloves for the healthcare sector.

Excerpts from CGS-CIMB report

Analyst: Ong Khang Chuen, CFA

■ 1Q24 net profit of RM72m (+7% qoq, +55% yoy) was a slight beat, riding on cleanroom’s volume recovery and healthcare segment’s mix improvement.

■ RSTON sees strong demand improvement across both segments in 2Q24F, and has ramped up hiring. We forecast c.14% qoq volume growth in 2Q24F. |

|||||

| 1Q24: Strong start to the year with cleanroom demand recovery |

Riverstone’s (RSTON) 1Q24 net profit of RM72m (+7% qoq, +55% yoy) came in slightly ahead of both our/Bloomberg consensus expectations, at 27% of FY24F.

Revenue grew to RM250m in 1Q24 (+9% qoq, +5% yoy), helped by cleanroom glove segment volume recovery, while GPM (-0.5% pts qoq, +13.1% pts yoy) was driven by product mix improvement in the healthcare glove space.

Utilisation rate improved across both segments; we estimate sales volume grew 9% qoq in 1Q24.

RSTON declared a quarterly DPS of 4.0 sen (RM) for 1Q24, translating into a dividend payout ratio of 82%.

| Healthcare glove demand picking up meaningfully in 2Q24F |

RSTON observed meaningful improvement in demand for generic healthcare gloves in 2Q24F given the narrower price spread between Chinese and Malaysian glove players, and has started to increase hiring of workers to keep up with the new orders.

We forecast RSTON’s healthcare glove volumes could improve c.15% qoq in 2Q24F.

Customised healthcare gloves remain a priority, and RSTON is adding 800m piece production capacity p.a. to cater for this, and expects it to be partially commissioned by end-FY24F.

| Cleanroom glove volumes also improving well |

RSTON’s cleanroom segment saw volume and revenue improve c.9% qoq in 1Q24, and we expect 13% yoy volume growth in FY24F, riding on continued recovery of the electronics manufacturing sector.

RSTON’s blended ASP for the cleanroom segment remained healthy at c.US$90/carton in 1Q24, as price reductions for specific SKUs were offset by a product mix upgrade.

RSTON remains confident that segment GPM can be kept at c.50%, and sees opportunities to increase its cleanroom presence in the US, post the recent merger of Ansell and Kimberly Clark’s cleanroom operations.

RSTON will also increase its cleanroom processing capacity by c.30% by end-FY24F.

Reiterate Add as we expect RSTON to deliver EPS growth of c.35% yoy in FY24F, riding on strong glove demand recovery. |

Full report here.

Read also: RIVERSTONE: While peers continue to bleed, it makes lots of profit -- & pays dividends