• Like its Malaysian glove-producing peers, Riverstone Holdings is riding on a recovery in demand for its products. But in so many ways, Riverstone is heading in a direction that will potentially bring about more profitability. • Firstly, it is prioritising cleanroom glove production over healthcare gloves. As CEO Wong Teek Son said in an earnings call this week: "We will give priority to cleanroom. For example, we are not engaging new workers, so if any cleanroom glove shipment is more urgent, we just divert some of the labor to take care of the cleanroom segment."

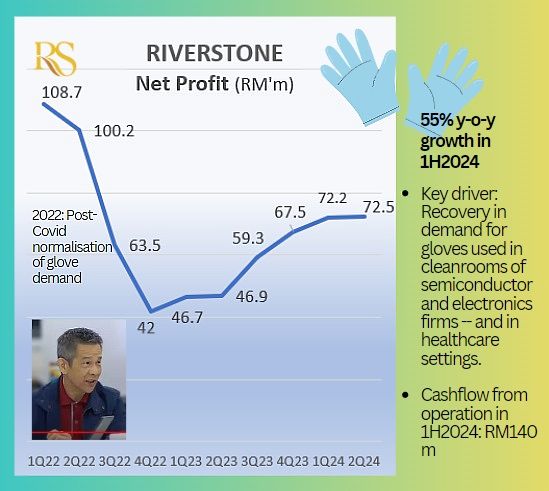

For healthcare gloves, there will be six new lines for customized products, with three commissioned this year and three next year. • The reason for the emphasis on cleanroom gloves is no mystery: Higher profit margins. Cleanroom gloves have a significantly higher gross profit margin compared to healthcare gloves. Cleanroom gloves contribute 70% of the gross profit despite lower sales volume (20% of total volume). Market position: Riverstone clearly has a strong competitive position in cleanroom gloves, often being the sole provider for many customers in this segment (see Q&A box). • The chart below shows Riverstone's upward profit trajectory in the past 6 quarters.  Inset: Wong Teek Son, CEO Inset: Wong Teek Son, CEO• The key driver for Riverstone's profitability has long been cleanroom gloves. They meet high specifications required for sensitive environments like semiconductor and electronics manufacturing. These gloves protect products from human contamination and static electric charges. • As the semiconductor and electronics industries recover, look out for Riverstone's cleanroom glove segment to be the flag bearer for its growth. With that background on Riverstone, read UOB Kay Hian's report below for details of Riverstone's performance in 1H2024 .... |

Riverstone has a resilient business producing high-margin cleanroom gloves as well as customised gloves for the healthcare sector.

Riverstone has a resilient business producing high-margin cleanroom gloves as well as customised gloves for the healthcare sector.

Excerpts from UOB Kay Hian report

Analyst: John Cheong & Heidi Mo

Riverstone’s 1H24 earnings were in line with expectations, lifted by higher ASPs and demand recovery for cleanroom and healthcare gloves.

Healthcare gloves continued to see strong order flow, while cleanroom gloves have enjoyed improving qoq demand since end-23. |

|||||

RESULTS

| Strong 2Q24 performance; higher 1H24 dividend |

Riverstone Holdings (Riverstone) reported robust growth in 1H24 revenue (+7% yoy, +10% hoh) and net profit (+55% yoy, +11% hoh), largely in line with expectations as sustained demand recovery for both cleanroom and healthcare gloves mirrors the improving demand in the global semiconductor market.

For 2Q24, revenue (+10% yoy, -1% qoq) was flat qoq due to shipping delays from port congestions deferring roughly RM40m in revenue, excluding which would have led to a 15% qoq revenue growth.

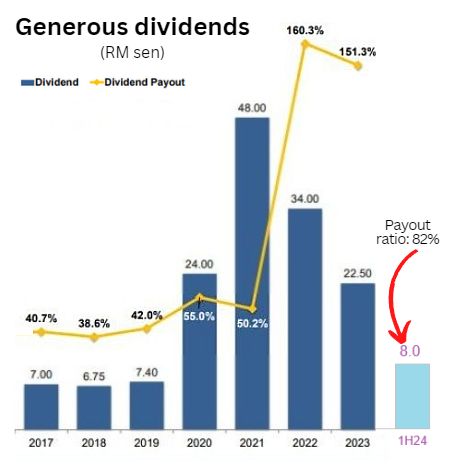

Management declared a second interim dividend of 4.0 sen, bringing total 1H24 dividend to 8.0 sen (vs 1H23: 5.0 sen).

Riverstone has declared a 2Q interim dividend of 4 sen in addition to the 1Q dividend of 4 sen.

Riverstone has declared a 2Q interim dividend of 4 sen in addition to the 1Q dividend of 4 sen.

• Cleanroom segment sees higher demand. There was a 5% increase in sales volume of higher margin cleanroom gloves in 2Q24 (10% ytd), which we believe is attributable to higher demand from the technology component-manufacturing sector.

Coupled with lower raw material costs, 1H24 gross margin expanded 12ppt yoy and 2ppt hoh.

We expect continued pickup in demand in 2H24 as the global semiconductor manufacturing industry recovers.

• ASP of healthcare gloves remains competitive. While the ASP of cleanroom gloves remained largely unchanged, the healthcare glove segment remained competitive and registered a 3-5% qoq decrease in ASP in 2Q24 due to a higher mix of standard products.

STOCK IMPACT

| Boosting production capacity with firm demand |

Management highlighted that its capacity expansion is on track with 12 production lines to be built over the next two years.

Six production lines are for cleanroom gloves and expected to be commissioned by end-24, while the other six are for customised healthcare gloves, three of which are expected to be commissioned by end-24 and the rest by 2025.

This will boost the total capacity from 10.5b to 11.9b (+13%) gloves by 2025. As the new lines are for higher-margin gloves, there is likely room for gross margin expansion.

| Riverstone’s 2025F PE of 16x is at a >100% discount vs peers’ average of 38x and it offers a way more attractive dividend yield of 7.7% vs peers’ average of 0.5%. |

• Potential downside to currency translation. Exchange rate volatility may pressure profits, with a 2Q24 loss of RM3.4m vs a RM16.9m gain in 2Q23 as the RM/US$ rate weakened from RM4.74 on 1 Apr 24 to RM4.49 on 1 Aug 24.

• Riverstone offers the most attractive valuation in the glove industry with a >100% discount in terms of PE multiple and 8x higher dividend yield vs peers.

Riverstone’s 2025F PE of 16x is at a >100% discount vs peers’ average of 38x and it offers a way more attractive dividend yield of 7.7% vs peers’ average of 0.5%.

We think Riverstone is a good proxy to the recovery in the healthcare glove industry while offering downside protection given its dominant position in the cleanroom glove sector.

| Strong balance sheet supports higher payout ratio |

Backed by its healthy 1H24 cash balance of RM761.2m (about 15% of market cap) and strong operating cash flow of RM139.8m (vs 1H23: RM97.8m), we expect 2024-26 payout ratio to exceed 100% to reward shareholders (2023: 151%; 2022: 116%).

This translates to an attractive dividend yield of 7.7% for 2024.

|

VALUATION/RECOMMENDATION |

Full report here.

Read also: RIVERSTONE: While peers continue to bleed, it makes lots of profit -- & pays dividends