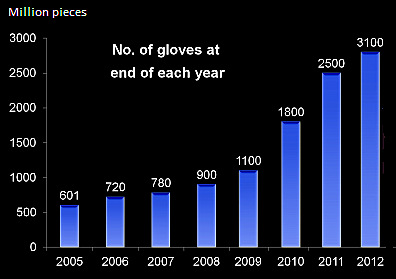

Riverstone Holdings has expanded its annual production capacity to 3.1 billion gloves as at end-2012. The actual output last year was 2 billion gloves as the 600-million expansion was completed only in 4Q. Above: Screenshot from corporate video

Riverstone Holdings has expanded its annual production capacity to 3.1 billion gloves as at end-2012. The actual output last year was 2 billion gloves as the 600-million expansion was completed only in 4Q. Above: Screenshot from corporate video

UNTIL I met the CEO and CFO of Riverstone Holdings recently, I thought the business of glove manufacturing presents low barriers to entry to newcomers and lots of competition to incumbents.

I was partially right -- and partially wrong.

"We are quite innovative and our business model is different from other glove manufacturers," said Wong Teek Son, the CEO, who trained as a chemist and has a MBA from Monash University.

In fact, Riverstone has developed a new type of glove for manufacturers of tablets and flat panels. The product has gained sales momentum, accounting for 20% of its sales of cleanroom gloves in the 4Q of last year. More on this later. L-R: CFO Lim Sing Poew and CEO Wong Teek Son.

L-R: CFO Lim Sing Poew and CEO Wong Teek Son.

Photo by Sim KihSingapore-listed Malaysian-headquartered Riverstone supplies gloves for use in the cleanrooms of high-tech electronics manufacturers.

The company doesn't worry too much about competitors snatching its customers away. I will share the reasons (as given by Mr Wong) shortly.

Where I was right was in the healthcare glove segment -- competition is rife and the players have been aggressively expanding production capacity, which is bad news for everyone.

But Riverstone thrives in niches where it is sheltered to some extent from competition.

Cleanroom gloves: Sole supplier to Seagate for 18 years

When it comes to gloves for cleanrooms, Riverstone has a commanding 60% market share globally.

That stems from it being the sole supplier, or main supplier, to the big players in the hard disk drive and semiconductor industries -- Seagate, Western Digital, Hitachi, Toshiba, TDK.

Interestingly, Riverstone sells directly to its customers.

This is not a recent happening: Seagate, for example, has been buying solely from Riverstone for the last 18 years.

Now, that seems a dangerous departure from the risk-management principle of not relying on a single supplier for anything.

This is mitigated as Wong Teek Son, the CEO of Riverstone, explained, by Riverstone having factories in Malaysia, Thailand and China.

In this glove business, while gloves cost very little relative to the customer's total cost of production, any contamination originating from the supplier can wreak costly havoc. For this reason, customers prefer to source from only a supplier so that any issues can be easily traced to the supplier.

In some cases, a strong relationship developed over the years between customer and client has enabled Riverstone to hold on to its customers.

As an example, Seagate trains Riverstone engineers in Six Sigma and lean manufacturing. Riverstone engineers -- not just its sales people -- visit clients to better understand their needs and problems.

"We are always catching up with changes in technology. Our cleanroom gloves of 10 years ago and today are very different," said Mr Wong.

The production of cleanroom gloves is far more stringent and complex than for medical gloves -- a reason why the barrier to entry is higher.

While glove demand from HDD customers is flat, Riverstone is tapping into customers which manufacture tablets and flat panels. Riverstone has come up with a new type of glove to better meet special cleanroom requirements of these customers.

Showing great promise, this glove type accounted for 20% of Riverstone's cleanroom glove sales in the 4Q of last year.

Branded as Aclean and Cleancare, it looks likely to be a hit product for Riverstone in 2013 with gross profit margins comparable to its high-end gloves for HDD customers.

Medical gloves: Strong competition

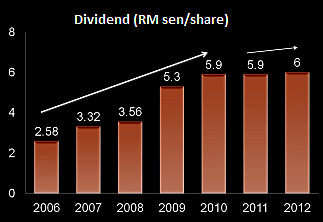

Riverstone's steadily rising dividends. At 6 RM sen, the FY12 dividend yield is 5.4%.At 155 billion pieces, the global market for healthcare gloves is much bigger than for cleanroom gloves.

Riverstone's steadily rising dividends. At 6 RM sen, the FY12 dividend yield is 5.4%.At 155 billion pieces, the global market for healthcare gloves is much bigger than for cleanroom gloves.

Riverstone started producing healthcare gloves in 2009, selling them to distributors in Europe and the US.

It eschewed contract manufacturing high-volume standard products for brand names like Kimberly Clark because of the thin profit margins.

Said Mr Wong: "We develop gloves with our distributors. They visit clients such as hospitals, and tell us if there are requirements for different finishing, and we customise our products. There are small differentiating features."

Increasing capacity Riverstone has consistently expanded its production capacity, and plans to continue to do so at 25% a year. Of the cleanroom and medical gloves, Riverstone produces them in 40-60 proportion by volume.

Riverstone has consistently expanded its production capacity, and plans to continue to do so at 25% a year. Of the cleanroom and medical gloves, Riverstone produces them in 40-60 proportion by volume.

The revenue contribution is 60-40, reflecting the higher value of the cleanroom gloves.

By end-2012, Riverstone had increased its production capacity from 2.5 billion a year earlier to 3.1 billion gloves

The actual output was 2 billion gloves, of which Riverstone sold 1.2 billion medical gloves with the remaining 40% being cleanroom gloves.

With a new 600-million glove capacity coming onstream only in the 4Q2012, this year will see significant volume growth: Riverstone is targeting 2.8 billion gloves.

The company is in the midst of negotiating for land to continue its capacity expansion, targeting a capacity expansion rate of about 25% per annum.

This will shift the product mix increasingly towards medical gloves and, likely, lower gross profit margin at the group level.

The higher production capacity is expected to raise revenue and gross profit and divdend over time, as has been demonstrated by the company's track record.

Unlike many a manufacturing business, Riverstone has zero debt and has enjoyed positive free cashflow since its listing in 2006.

As at end-2012, it had cash of RM64 million (up from RM44 million two years ago), which can be used to fund its expansion. And about S$12.4 million will come this year from the exercise of the outstanding 40.25 million warrants before they expire on 4 Aug 2013.

Investment merits & risks

Riverstone has not only consistently paid dividends, it has raised them steadily over the years. At 50 cents, the stock trades at nearly 10X earnings and 1.6X book value.

Riverstone said it would face increasing wage and utilities costs (it has 2,000 employees), volatility in the USD-Ringgit exchange rates and raw material prices.

For insights into the personal side of Wong Teek Son, read a Sunday Times article on him.

For details of its FY2012 performance, click here for its Powerpoint materials.

For more insights into Riverstone's business, watch the 2 corporate videos here:

Recent story: RIVERSTONE: Steady dividends, rising production capacity