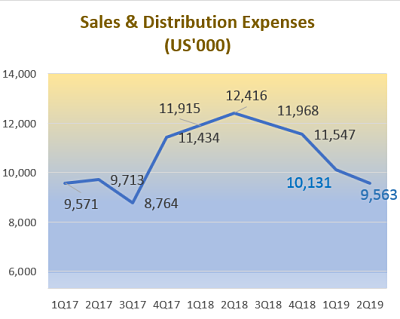

| Food Empire's net profit for 2Q19 jumped 140% y-o-y to US$5.6 million. That did not corelate with any revenue rise. In fact, revenue dipped 2.2% to US$67.8 million.  CEO Sudeep Nair with Chin Tze Ting, personal assistant to the Chairman. NextInsight file photo.What bumped up the bottomline was largely a cut in sales & distribution expenses -- from US$12.4 million to US$9.6 million. CEO Sudeep Nair with Chin Tze Ting, personal assistant to the Chairman. NextInsight file photo.What bumped up the bottomline was largely a cut in sales & distribution expenses -- from US$12.4 million to US$9.6 million. Essentially, Food Empire has changed its business model in, principally, Myanmar, a relatively new market where it has been investing to gain a foothold. As the chart below shows, Food Empire's group sales & distribution expenses have, in fact, declined every quarter since 2Q18.  The trajectory will continue: So, compared to 2H of 2018, sales & distribution expenses for 2H2019 are expected to be lower, as a continuation of the company's "rationalisation exercise," according to management. The trajectory will continue: So, compared to 2H of 2018, sales & distribution expenses for 2H2019 are expected to be lower, as a continuation of the company's "rationalisation exercise," according to management. With that, shareholders will be pleased to know Food Empire is on track to extend its 1H19 profit growth to the 2H of this year. Executive Chairman Tan Wang Cheow, in a press release, put it this way: "On a full financial year basis, we are committed to delivering profit growth." |

Food Empire has changed its business model in Myanmar to one which requires less of its own financial resources. That will pare down its losses while it continues to try to build market share.

Food Empire lost US$4 million in Myanmar last year, as disclosed by Mr Tan at the recent AGM. (See: @ FOOD EMPIRE'S AGM: Takeaways on prospects, selling expenses, etc)

For a few years already, Myanmar has proved to be highly challenging as its local currency depreciated sharply against the USD.

At the start of 2018, for example, 1,350 kyat could be exchanged for 1USD. At end-June 2019, it was 1,514 kyat.

The instant coffee market there is also competitive and coffee players have not raised their selling prices.

|

Stock price |

52 c |

|

52-week range |

49 - 62 c |

|

PE (ttm) |

12.7X |

|

Market cap |

S$278 m |

|

Shares outstanding |

534 m |

|

Dividend |

1.2% |

|

1-yr return |

-4.5% |

|

Source: Yahoo! |

|

Aside from Myanmar's kyat, Food Empire was faced with the ever present volatility of the Russian ruble.

In 1H2019, compared to 1H2018, the ruble weakened, and affected revenue recognised in USD from Russia, the Group’s largest market.

Thus, in 1H2019, sales in Russia increased in local currency terms but decreased by 5.4% y-o-y in USD terms to US$54.4 million.

The average exchange rate was 59.2 ruble per US dollar in 1H2018 as compared to 65.1 ruble per US dollar in 1H2019.

Fortunately, Russia's largely middle-income population has been resilient, which enables Food Empire to raise the selling prices of its MacCoffee and other products over the years.

It also has been introducing new products into its established distribution network.

Elsewhere, Food Empire enjoyed good sales growth of 15% y-o-y in Ukraine, Kazakhstan, and other Commonwealth of Independent States in 2Q19.

She has a BUY recommendation on Food Empire stock, raising her target price to SGD0.73 from SGD0.69. (See: FOOD EMPIRE: Better Margins Post Rationalisation; BUY) |

||||||

Executive Chairman Tan Wang Cheow with shareholders post-AGM. File photo: Company“The Group continues to perform well, with strength in our core business markets and key operating segments. As we seek to sustain this growth trajectory into the future, we will be looking at new product developments and strategic mergers & acquisitions to grow our business further. On a full financial year basis, we are committed to delivering profit growth.” Executive Chairman Tan Wang Cheow with shareholders post-AGM. File photo: Company“The Group continues to perform well, with strength in our core business markets and key operating segments. As we seek to sustain this growth trajectory into the future, we will be looking at new product developments and strategic mergers & acquisitions to grow our business further. On a full financial year basis, we are committed to delivering profit growth.” -- Tan Wang Cheow, Executive Chairman. |