Excerpts from analyst reports....

SIAS Research maintains Roxy-Pacific's intrinsic value at 64 cents a share

Analyst: Liu Jinshu

We spoke to Roxy-Pacific Holdings Limited (Roxy), which left us with the impression that the five sites in its land bank are not adversely affected by the new URA measures announced on 4 September 2012.

The new measures still allow small units to be built, but limit their proportion of total units based on minimum average unit sizes.

The new measures are not totally unexpected as the URA has previously implemented similar measures in 2011.

Furthermore, URA had back in 2011 identified the Kovan and Joo Chiat / Jalan Eunos estates as potentially areas that may be subject to the “100 sqm” rule.

Fortunately for Roxy, it has been avoiding potentially at risk areas and the plans for its newer acquisitions Westvale Condominium and Jade Towers had a lower proportion (>40%) of small units versus the 50% to 80% at some developments as highlighted by the URA.

The results we see today are evidence of good risk management and foresight in Roxy’s acquisition and planning process.

1) Two of the sites (Sophia Mansions and Wilkie Terrace) in its land bank are in the Central Area, while the remaining three sites were already under the “2011 70 sqm” rule and were acquired under such consideration.

It seems that Roxy has been avoiding locations at risk of being subject to the “100 sqm” rule.

2) The three sites (Jade Towers, Westvale Condominium and Harbour View Gardens) outside of the Central Area have been designed with fewer compact units and two of them have already obtained Provisional Permission for redevelopment.

The third site, we expect, should likewise be approved.

3) Existing developments Natura@Hillview and Nottinghill Suites, which are characterized by small units, are already close to 90% sold. The Mkz is already 100% sold.

> OCBC Investment Research report on 6 Aug.

Analysts: Eli Lee & Kevin Tan

We continue to like ROXY for its ability to seek accretive land acquisitions, quick turnaround time and efficient sales conversion at projects launched.

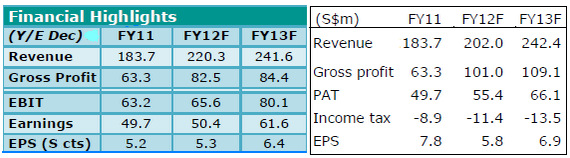

Maintain BUY with an increased fair value estimate of S$0.50 (30% RNAV disc.), versus S$0.45 previously, due to accretion from land acquisitions.

Recent stories:

ROXY-PACIFIC: Why its stock is up 94% in year to date

ROXY-PACIFIC: Scrubbing hard to raise $ for less fortunate children