|

A consortium formed by 11 individuals, including Mr Teo Hong Lim, the Chairman and CEO of Roxy-Pacific Holdings, is making a bid to privatise Roxy-Pacific Holdings. |

NextInsight file photoThe offer price, which values the company at S$623.4 million, represents:

• a premium of approximately 19.8% over the closing price on 14 September 2021, being the last full trading day of the Company prior to the offer anouncement date

• a premium of 37.0% over the 12-month volume-weighted average price up to that date.

• exceeds all previous closing prices of the shares in the past three-year period and represents a 14.1% premium over the three-year highest closing price of S$0.425.

• a discount of 33.4% to the adjusted NAV of 72.87 cents (as at 30 June 2021).

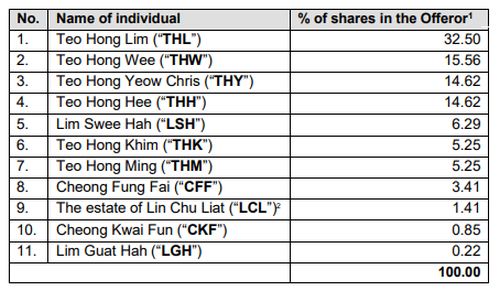

The offer price is final and will not be revised by the offeror, whose constituents are as follows:

The offeror says this is an attractive opportunity for shareholders to exit their entire investment in cash with price certainty and without incurring brokerage costs. This may otherwise be difficult due to the low trading liquidity of the shares and the challenging macro and operating environment faced by the Company amidst the COVID-19 pandemic.

"The construction of development projects continues to face prolonged challenges due to global supply chain disruption and labour crunch, leading to rising material and labour costs as well as higher tender prices for new projects. The Company may also face increasing risks of delays in project completion and potential penalties from late delivery exacerbated by the increasing risk of default by construction contractors. In addition, the COVID-19 pandemic continues to hinder the Company’s hotel operations, as countries around the world impose lockdowns and tightened border control measures. Continued weakness is expected in the hospitality industry as business travel and retail tourism remain lacklustre due to the surge in COVID-19 cases accelerated by the Delta variant."

The offeror believes that privatising the Company will provide the offeror with more flexibility to manage the business of the company and optimise the use of the company’s management and resources during this time of economic uncertainty.

The offeror has secured irrevocable undertakings for 76.44% of the shares, and the offer is the only offer capable of turning unconditional or succeeding.

|

The offer is subject to the receipt of all consents necessary under the Overseas Investment Act 2005 (NZ) -- this is the pre-condition to the offer being made formal. |

Should the offer fail to become or be declared unconditional, the offeror and its concert parties are not permitted under the Singapore Code on Take-overs and Mergers to make another general offer for 12 months following the lapse of the offer.

OCBC Bank is the sole financial adviser to the offeror in connection with the offer.