SHARES OF Roxy-Pacific Holdings have done really well with an 86% rise from 25 cents to 46.5 cents in the year to date.

Add in the 2-cent final dividend for FY2011 paid in April 2012, and the gain climbs to 94%.

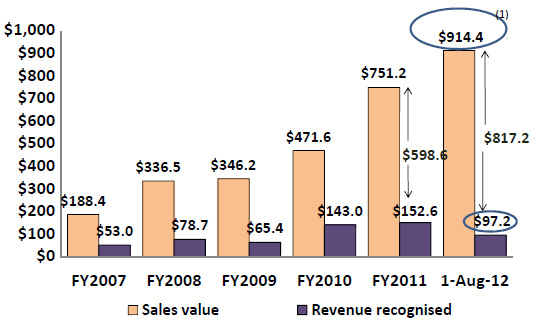

Underpinning the stock rise are strengthening business fundamentals --- Roxy-Pacific has chalked up rising sales in the past three years from its property development projects.

See the chart above.

Consider the revenue -- also known as "progress billings -- which will be recognised in the near future according to milestones as the properties are constructed.

From $598.6 million outstanding as at Feb 2012, the figure has jumped to $817.2 million as of 1 Aug 2012.

This revenue will be recognised from the current 3Q until 2016.

To appreciate the magnitude, the $817.2 million is 6 times the property development revenue that Roxy-Pacific booked in FY11 alone.

To put it another way, even if Roxy-Pacific doesn’t sell another property unit from today, its annual revenue from property development over the next six years would, on average, be similar to last year’s.

First-ever interim dividend

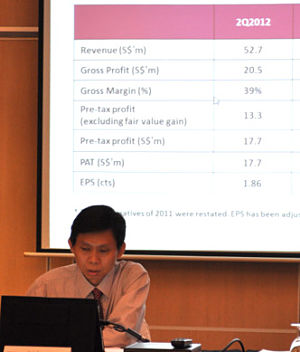

Even as the future profits from its property development division look promising, Roxy-Pacific's sole hotel continues to deliver steady income to the Group.

The Grand Mercure Roxy Hotel contributed $25.5 million revenue in 1H2012 and $6.9 million in pre-tax profit (as compared to $17.2 million from property development).

In announcing last week a $26.8 million net profit for 1H2012, Roxy-Pacific declared its first ever interim dividend (0.67 cent a share) since its IPO in 2008.

This comes hot on the heels of a bonus issue of 1 share for every 2 shares in May 2012.

The interim payout is not expected to be a flash in the pan.

While Roxy-Pacific does not have a declared dividend policy, it would surely have considered its growing cashflow and profitability over the coming years, and recognised that it can sustain an interim dividend.

It is premature for it to decide on its final dividend for FY12 but it would have weighed the likelihood that shareholders would be disappointed if the total dividends for FY12 is less than FY11's.

For now, the interim dividend bolsters Roxy-Pacific's dividend track record.

Every year after its IPO, it has paid dividends that exceeded the previous year's.

Another metric that has risen over the years is its adjusted Net Asset Value, which stood at 60.18 cents a share as of end-June 2012.

Thus, the stock at a recent 46.5 cents traded at a 23% discount to the adjusted NAV.

Highlights from Q&A session between Roxy-Pacific management and analysts last Friday

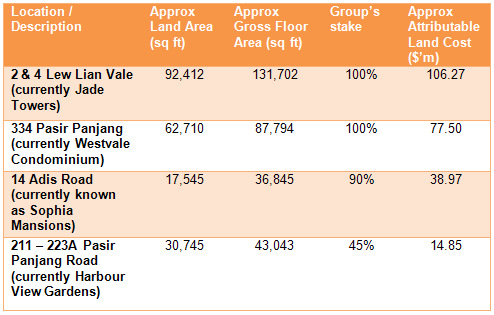

Q: For the four sites you acquired recently, what is the expected gross profit margin?

Teo Hong Lim (executive chairman & CEO): Typically, our target is 15-20%. All these years, this has been our internal requirement. In past years when the market moved up, our margin was 20-30%.

Q: Last year, you did quite a few commercial projects but your current landbank is 100% residential. Why?

Teo Hong Lim: We like to spot trends and manage our risks. When we did the commercial projects, the acquisition cost was quite low. Of late, residential-commercial mixed developments have gone up substantially. When something is too popular, supply will emerge -- and the government could also come up with new rules. As for the residential market, this is still the biggest market and the authorities have already implemented a lot of rules there.

Q: You seem to prefer en-bloc to GLS (government land sales)....

Teo Hong Lim: We are a bit concerned that the GLS are concerntrated in certain locations such as Pasir Ris and Punggol, and are for a large number of units: 500, 700, 800 units.

It's a lot easier for us to sell our smaller developments than GLS projects.

Our 4 purchases are freehold en-bloc projects -- there have been few such sales in the last few years. One year later, there will not be a lot of freehold launches. There will be a lot of 99-year property launches in locations where buyers will have a lot of choices.

But the supply of freehold projects will be low in Pasir Panjang and Sophia Road -- we may be the only launches in these locations next year. In Serangoon, there are not many en-bloc sales either.

Q: How about your hotel business? Previously, you said you were scouting for new sites?

Chris Teo (Managing Director): We are still looking. We look at greenfield and conversions but we prefer greenfeld as we have the advantages from being also in property development.

In the meantime, we have decided to go ahead with upgrading our existing hotel. It will be completed within about five months. The hotel occupancy rate may dip a bit but we are pushing for higher RevPar.

Q: Your landbank may be profitable but there is a lot of supply coming.....

Teo Hong Lim: We have to manage risks by going to locations where there are not many sales in recent years and where there won't be many new launches. The location and supply have to be analysed rather than taking Singapore as a whole.

Which is why I don't want to go to the major GLS locations. Let's say, you can make $200 psf in Punggol with the same land cost as your competitor. If he decides to launch and make a profit of $150 psf, your sales won't be able to move. This execution risk is real and is happening to some developers.

Q: Your 1H2012 profit level is the same as last year but now you are giving an interim dividend. What's your thinking behind this?

Koh Seng Geok (CFO): Profit is one factor we look at but there are others -- especially cashflow. Last year, we had 4 projects which obtained T.O.P. This year, another 3-4 projects will obtain T.O.P.. That's when the cash really comes in, and we are comfortable to declare the interim dividend.

Teo Hong Lim: Of course, we hope to continue it. Once we start something, we won't pull out for no reason.

For more information, check out Roxy-Pacific's powerpoint presentation here.

Recent stories:

HI-P, BIOSENSORS, ROXY-PACIFIC: What analysts now say.....

1H2012 Top Gainers: INTERRA, ASPIAL, SARIN, ROXY, SUPER