XMH HOLDINGS, whose stock price has weakened despite an earnings-accretive acquisition, has been buying back its shares this month -- ahead of the release of its 2Q results which could be released in mid-Dec.

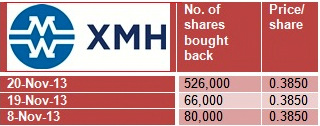

XMH HOLDINGS, whose stock price has weakened despite an earnings-accretive acquisition, has been buying back its shares this month -- ahead of the release of its 2Q results which could be released in mid-Dec.The company bought back 672,000 shares at 38.5 cents apiece, which is below the 41-cent level in Sept 2013 when it announced a deal to acquire Mech-Power Generator.

L-R: Cliff Loke, MD and co-owner of Mech-Power, with Elvin Tan, chairman of XMH, and Alphonsus Chia, deputy CEO of XMH.

L-R: Cliff Loke, MD and co-owner of Mech-Power, with Elvin Tan, chairman of XMH, and Alphonsus Chia, deputy CEO of XMH. NextInsight file photoThe acquisition is significant: It comes with a warranty from Mech-Power that its net profit shall not be less than $6.9 million over FY2014 and FY2015.

In other words, on average, it would be $3.45 million a year, which would be a sizeable contribution to XMH considering that the latter recorded $11.4 million profit in FY2013 (ended April).

It would also represent a sharp 100% jump over Mech-Power's net profit in FY13 of $1.7 million.

OSK-DMG has a buy call on the stock with SGD0.56 as the target price based on 14x FY14F EPS, saying the premium is justified by the company’s quality and highly visible catalysts.

Recent stories:

XMH: Unaffected by soft coal prices and rupiah slide

XMH acquires Mech-Power Generator for $17.4 m in earnings-accretive deal

GOLDEN AGRI-RESOURCES has been getting into the good books of JP Morgan and Deutsche Bank analysts of late.

In its report on 16 Nov on its stock picks for 2014, Deutsche Bank picked Golden Agri among its best 5 ideas.

It wrote: "One hundred per cent of Golden Agri’s earnings are derived from palm oil. We are bullish on palm oil demand in 2014 and 2015, due to our upbeat economic outlook, the continued rapid growth in key developing nations, and the positive influence of biodiesel taking off globally (Buy, TP of SGD0.75)."

Prior to the report, Deutsche had a sell call and a target price of 50 cents.

JP Morgan issued a report on 18 Nov with an "overweight" call on Golden Agri and target price of 70 cents.

"Besides a recovery from the tree stress due to dryness of weather this year, production kicker should also come from the c.16000 ha of mature area acquired in end-2012 experiencing yield improvement after it comes under the management of the Group. We also expect earnings of its China operations to improve as trading capabilities get boosted by earlier management team hires."

Well ahead of these two reports, a fund, Silchester International Investors LLP, has been accumulating the stock.

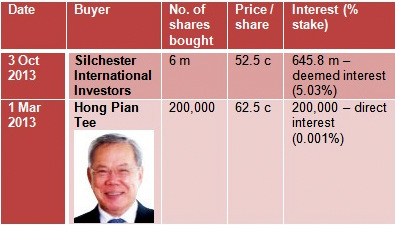

Well ahead of these two reports, a fund, Silchester International Investors LLP, has been accumulating the stock. Then on Oct 3, Silchester, which acts as a fully discretionary investment manager for a number of commingled funds emerged, as a substantial shareholder when it crossed the 5% level.

Much earlier, in March, independent director Hong Pian Tee bought 200,000 shares - his first foray into the stock.

The recent 3Q results of Golden Agri were dismal, though.

It reported net profit of USD30m, down 65% YoY and 33% QoQ.

It said the lower earnings were due mainly to a 19% YoY correction in the CPO price, an 18% increase in the cost of production, and lower yields.

OCBC Investment Research is among the houses which are bearish still on Golden Agri.

On Nov 20, OCBC maintained its sell call but upped its target price from 46.5 cents to 50 cents.

Recent stories: