• A certain resilience in Food Empire's instant coffee sales came through strongly during the Covid years. It showed up in its strong sales and profits.

• The 1H2023 results continued to be fine, with revenue up and core profit (ex-forex effects) too, on a year-on-year basis. With US$26.6 million in net profit in 1H23, Food Empire is forecast by Maybank and UOB KH to hit US$50 million for the full year.

• Food Empire had raised its selling prices during the pandemic when supply chain disruptions led to higher operating costs. (Hit by Western sanctions and a fall in its export revenues, the Russian economy is taking a hit, and the ruble is down to a 17-month low against the US dollar this week). • The two covering analysts for this stock have the same target prices after the release of 1H2023 results:

|

|||||||||||||||||||||||||||||||||||||

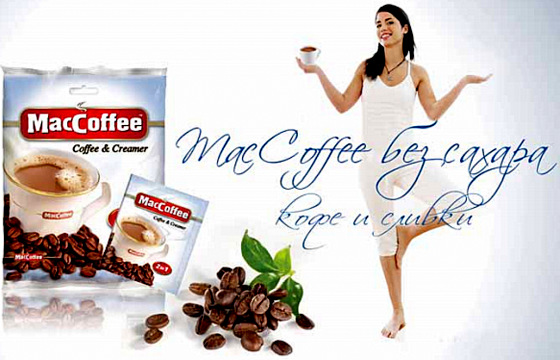

MacCoffee is one of the best-selling brands of Food Empire, especially in Russia.

MacCoffee is one of the best-selling brands of Food Empire, especially in Russia.

Excerpts from Maybank KE report

Analyst: Jarick Seet

Food Empire Holdings (FEH SP) -- Robust demand to continue

| Maintain BUY with higher TP of SGD1.36 |

FEH reported a strong 1H23 with PATMI declining 1.6% to USD26.6m and forming 55% of our FY23 forecast.

|

FOOD EMPIRE |

|

|

Share price: |

Target: |

This exceeded both MIBG/consensus estimates and came despite a forex YoY difference of –USD8m.

We expect strong demand to continue in core markets and we think Vietnam has also turned the corner and is now experiencing double-digit revenue growth.

Management plans to raise prices in its core markets by 7-15% from next month in two tranches due to the depreciation of the ruble in recent months.

As a result, we raise our FY23/24 PATMI estimates by 5% and increase our TP to SGD1.36 (+5%), pegged to 11x FY23E P/E.

| Strong performance in core markets to persist |

As of 1H23, FEH reported strong revenue growth of 11.8% YoY to USD198.2m due to strong demand from its core markets.

| Management plans to raise prices in its core markets by 7-15% from next month in two tranches due to the depreciation of the ruble in recent months. |

Revenue from Russia, Ukraine and other CIS regions grew 23.6% and 20% YoY, respectively.

Demand from Vietnam has also reversed a decline and increased YoY due to the group’s marketing efforts.

Gross margins have also improved from 29.3% to 35.1%. Operating profit surged 67.7% YoY to USD34.6m.

PATMI declined 1.6% YoY mainly due to a FX difference of USD8m.

| Prices hikes to combat depreciating ruble |

Management will likely be raising prices from next month by 7-15% and this will be done in two tranches, mainly to combat the impact of a weaker ruble which has depreciated significantly in the past few months.

We expect softness in revenue and gross profit in 3Q23E as these price increases typically take about 3-6 months to fully take effect but performance should pick up in 4Q23E.

|