| Yes, Food Empire did deliver robust 1Q2023 earnings as forecast by analysts. And by all accounts, there's more resilience and growth ahead given its established instant coffee brands in markets such as Vietnam, Russia, Ukraine and the Commonwealth of Independent States (CIS) countries which include Kazakhstan and Armenia.  CEO Sudeep NairFood Empire continues to busy itself with organic growth. CEO Sudeep NairFood Empire continues to busy itself with organic growth. It has a large cashpile of US$123.3 million as at end-March 2023 and no major capex on the horizon, which are factors that motivate it to scour for potential acquisitions. In the process, it has its eyes opened to the relatively high valuations of peers in Asean, and those of delisted peers. (see UOB KH report in March 2023 FOOD EMPIRE: Trading at 40-50% discount to peers). Indicative asking prices / valuations of potential targets are relatively high too. "You look at them and you say, oh my God, it's better to buy Food Empire actually," as CEO Sudeep Nair quipped at a results briefing last week.  Even after a 100% surge in stock price over the past year, Food Empire recently traded at a modest 7X PE. Chart: Yahoo! Even after a 100% surge in stock price over the past year, Food Empire recently traded at a modest 7X PE. Chart: Yahoo!With its $1.10 stock trading at a PE of 7X, it would not be surprising to see the company resume its share buy-back now that it has released its 1Q23 results. In addition, maybe, just maybe, it would start paying an interim dividend too. That would be its first interim dividend in over 20 years. Well, at least Maybank Kim Eng has raised that tantalising possibility. |

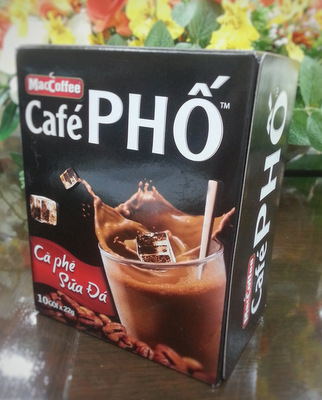

Food Empire's instant coffee brand selling well in markets including Russia is MacCoffee.

Food Empire's instant coffee brand selling well in markets including Russia is MacCoffee.

| Following are excerpts from UOB KH report: |

Analysts: John Cheong & Heidi Mo

• Sustained consumer demand across segments. Despite rising inflationary pressures and ASPs, FEH does not see major changes in consumption patterns. Given the consumer staple nature of FEH’s products, demand is relatively price inelastic.

|

Buying shares |

|

|

For instance, the group’s products in the coffee segment continue to be affordable enough for mass appeal, leading to sustainable or even stronger demand as proven by FEH’s consistent results.

Hence, we see that sales volumes are more sheltered from the market volatilities. With supply chain disruptions easing in some markets, we forecast higher earnings moving forward.

• Positive brand equity built. Despite challenges continuing into 2023, including geopolitical uncertainties in its core markets and rising inflation, the group has managed to generate improved profits.

Additionally, the group was once again recognised as the Top 100 “Most Valuable Singaporean Brands” by Brand Finance for the twelfth consecutive year, with its estimated brand value increasing 17% yoy to US$101m. We believe this is a testament to its strong brand equity.

• Top-line growth to lift earnings. With the strong levels of demand sustained amid inflationary pressures and currency volatility from geopolitical uncertainties, our forecast incorporates a 5% increase in revenue.

Furthermore, management expects higher revenues from: a) Vietnam, with increased marketing efforts and the new capacity expansion of its non-dairy creamer facility expected to contribute from 4Q23, and b) India, as its spray dry and new freeze dry coffee plants continue to see demand exceeding supply which may push prices upward.

• Frequent share buybacks to date reflects confidence. In Apr 23, FEH has bought back close to 1m shares at S$0.99-1.01. This is close to the 52-week high share price of S$1.10, showing management’s confidence in the future growth outlook.

EARNINGS REVISION/RISK

• We raise our 2023/24/25 earnings estimates by 4%/4%/4% to S$50m/S$54m/S$58m, up from S$48m/S$52/S$55m to reflect the better-than-expected earnings moving forward.

VALUATION/RECOMMENDATION

• Maintain BUY with a 4% higher PE-based target price of S$1.33 (S$1.28 previously), pegged to 10.5x 2023F EPS, or its long-term historical mean.

| • Full UOB KH report here. • Full Maybank Kim Eng report here. |