| Heard of Morph Investments? Maybe not. It's a fund that we have not seen interviewed in the media at all or cited for whatever reason, unlike local names like Asdew Acquisitions, Pheim Asset Management, etc. However, we took notice that it is a shareholder of SuperBowl and Hiap Hoe after this was mentioned in a NextInsight forum post. |

With SuperBowl the subject of a current takeover offer by Hiap Hoe, the prices of these 2 stocks have jumped and increasingly their intrinsic value is being recognised.

With that, Morph's investments in these two companies has been proven to be astute.

The folks behind Morph are likely to be deep-value investors who patiently bid their time to achieve higher prices for their stocks.

We did some Googling and found a few old mentions of Morph in another forum. With that, we went to the SGX website and downloaded annual reports of a number of companies which Morph was said to be invested in.

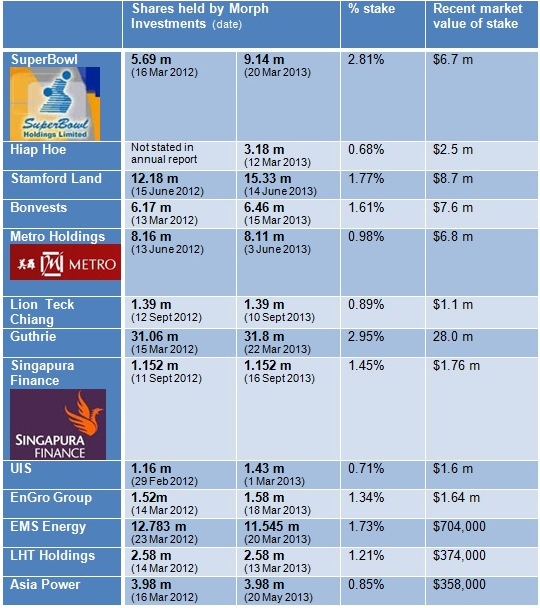

These are our findings: Compiled by NextInsight.

Compiled by NextInsight.

Based on the list, Morph has investments worth about S$68 million, most of which are in property-related companies.

The few exceptions, such as EMS Energy and Asia Power, are relatively small holdings.

There isn't anything on the Web that we could find about its investment approach. It doesn't even have a website of its own.

Given the not-insignificant size of its investments in Singapore-listed companies, we presume it is a local fund.

If you know anything about Morph, feel free to post below.

In this article, we are not delving into the fundamentals of the stocks held by Morph. But you can view the discussion of some of them in threads in our forum for SuperBowl, Hiap Hoe, Lion Teck Chiang, and Bonvests.

Previous stories:

@ LION TECK CHIANG's AGM: Air of anticipation over Master Plan 2013

Morph is one of the best minds in value investing when it comes to S'pore listed companies. Many of these stocks that they held had been delisted (or going to be delisted) throughout the years like Haw Par Healthcare, Pan Pacific Hotels Group, Guthrie GTS, Superior Multi-packaging etc.

They also owned stocks like UOI, Straits Trading, SHC Asia, Lasseters, Haw Par, Khong Guan Flour Milling etc before but dropped out of the list.

Some of the other stocks that they still own besides your list include United Engineers, Isetan, Intraco, Sing Investment and Finance, Hotel Royal, Koyo International, Jacks International, Fung Choi, Keppel T&T, K1 Ventures etc.

I had been following them for the past few years and so far, most of their investments are spot on. However, one must be prepared to hold for very long term for value to be unlocked in these companies.