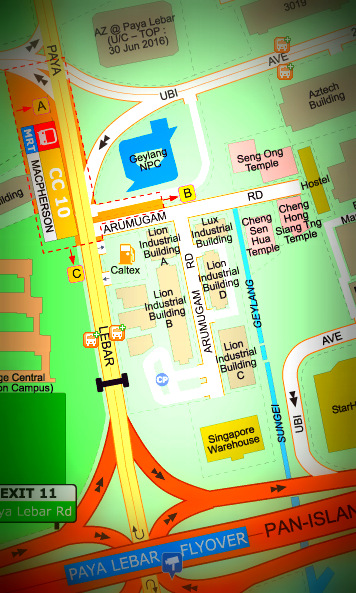

Venue: Lion Building, 10, Arumugam Road.

Time & date: 9.30 am, 25 October.

Map: Streetdirectory.com

WILL THE upcoming Master Plan 2013 for Singapore spell good news for shareholders of Lion Teck Chiang?

That could happen if the company's freehold land in Paya Lebar is rezoned from light industrial to commercial, raising its net asset value beyond the end-Sept 2012 figure of $1.296 per share.

The stock price of 62 cents recently is already at a substantial discount to the NAV.

Discussing the prospect of the re-zoning, shareholders wanted the management to lobby the authorities for the re-zoning to happen.

They contended that its location right next to the MacPherson MRT station would help make a strong case.

The management said that in practical terms, however, there is little the management or shareholders can do but wait for the release of the Master Plan which guides Singapore's physical development over the next 10 to 15 years.

Investment properties

A shareholder queried the valuation of S$101.9 million stated in the balance sheet for the company's 4 investment properties in Arumugam Road (in Paya Lebar).

He said that based on management's information that the aggregate land area is 131,000 sq ft, the per sq foot value pegged to it is just $300+, which is low compared to leasehold raw land in the vicinity which had recently been sold at around $500 psf.

The management replied that the valuer, Knight Frank, had taken into account the buildings had a rental yield of about 5% as well as the fact that these are investment properties and are not for sale.

Replying to queries, the management said the rental of the Lion buildings averages more than $2 psf.

Shareholders commented that the rate seemed relatively low when the MacPherson MRT station is at its doorstep and Paya Lebar is transforming into a business, office and industrial hub.

The management replied that rental income had gone up. And the company had actively sought tenants, including sourcing through real estate agents.

To a comment on selling the properties to realise their intrinsic value, MD Cheng Yong Liang said: "I forsee a lot of potential for this area. We can wait for the next Master Plan or the next 5 years. We are not in a hurry to sell this prized asset."

Dividend: 1 cent a share only?

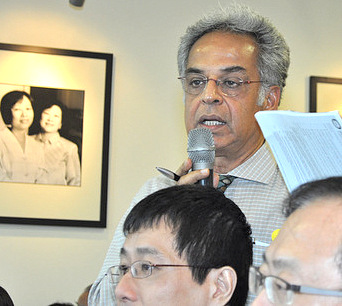

NextInsight file photo

Shareholder Mano Sabnani was none too pleased with the proposed dividend of 1 cent a share, which was unchanged from FY11.

"The correct amount should be 3.5 or 4 cents, which is about one third of your recurring earnings," he said. And that would translate into a yield of about 5-6%, which is what respectable Singapore companies are paying, he added.

Hoping the company would take up his suggestion, he said it could declare a special dividend in the near term.

The management's response: The company had decided on the 1-cent dividend after considering its future operating requirements and financial obligations.

Citing the steel division's turnover of S$150 million last year, Mr Cheng, said in comparison, it was less than $100 million just two years ago.

As a result, Lion Teck Chiang carried inventory of about $50 million in FY12. And its working capital needs include giving 2-3 months' credit line to its customers.

"Without enough working capital, we will have to cut down our revenue and slow down our business," he said.

There is another factor: In the last 15 years or so, the company had not spent much on capital expenditure for machinery.

The old machinery is operating on 2-3 shifts a day and has to be replaced for higher efficiency.

Mano pointed out that while the company's turnover went up, its cash and cash equivalent had doubled last year from $12.2 million to $22.5 million, or 14 cents per share.

In addition, the debt to equity is much lower than that of other steel trading companies, he said.

Responding, Mr Cheng reiterated that the company had committed to buy new machinery next year and steel demand would be boosted by mega infrastructure projects such as Thomson MRT Line and the North South Expressway.

The minority shareholders weren't persuaded and voted down by a show of hands the resolution on the 1-cent dividend.

Then the AGM chairman, Ong Teong Wan, called for a vote by poll, which led to Mano urging him to reconsider it in order to respect the views of minorities who had voted against the resolution --or it "would not leave a good taste in the mouth."

When the chairman did not change his mind, Mano and a number of shareholders started to walk out of the meeting.

Not surprisingly, the resolution was passed subsequently by poll -- and the 1-cent dividend will be paid on 22nd of this month.

Some BOD, when they see that the resolutions they want put forth are not supported, then demand a vote by poll as they know the major shareholders (which may include themselves) will surely push through the vote.

(posting at Valuebuddies.com)

besides walking out, they could have sold off their holdings and look for higher yield else-where..it is a free market anway.

(posting at Valuebuddies.com)