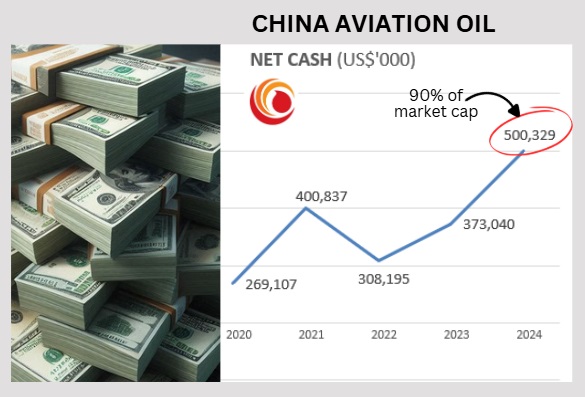

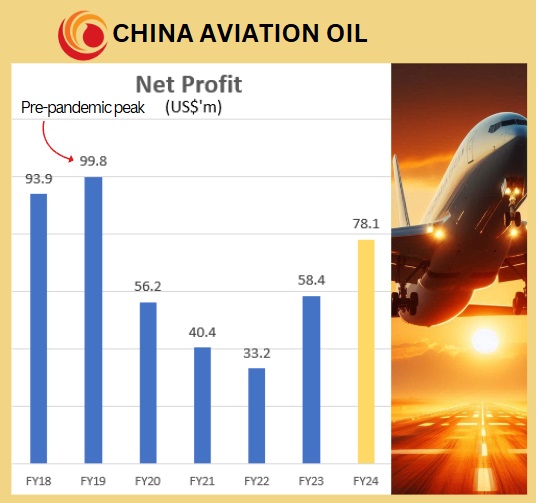

• Singapore-listed China Aviation Oil (CAO) delivered US$78.1 million earnings for 2024 which was 33.8% higher than the year before. Phillip Securities Research is expects CAO's profit to come in at US$82 million this year and US$83 million next year. • Jet fuel supply is a core business of CAO via its 33% stake in fuel supplier SPIA (Shanghai Pudong International Airport Aviation Fuel Supply Company). As SPIA is responsible for refueling all planes departing from that airport, CAO has been benefitting from the growth of domestic and international air travel in China.  CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou. CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou.• A striking thing is CAO has amassed a cashpile of US$500 million by end-2024, up from US$373 million a year earlier. • When you look at the company's current market value of S$723 million (US$560 million, stock price 84 SGD cents) and subtract all that cash, the actual business is valued at only US$60 million. For a company pulling in ~US$80 million in profit, that's dirt cheap -- with ex-cash PE of less than 1.  • Wait, there's a downside risk -- CAO's trading of oil products is high volume and thin margin. CAO reported losses for its 2H24 "other oil products" trading segment. • Bottomline: SPIA's contribution is on an uptrend with Chinese aviation growth, while oil trading risks pose uncertainty for CAO. • For more, read what Phillip Securities Research says below ... |

Excerpts from Phillips Securities Research report

Analyst: Liu Miaomiao

|

The Positives + |

+ Increasing trading volume with a higher margin. Trading volumes on the Asia-North America route have improved in 1H25, with CAO resuming two vessels/month.

|

CHINA AVIATION OIL |

|

|

Share price: |

Target: |

The increase was driven by rising jet fuel demand, which aligns with the 4.9% YoY growth in international demand in March 25, as reported by IATA.

SAF (sustainable aviation fuel) trading volume also surged, though its absolute trading volume remains <1%.

The growth was supported by the EU mandate requiring aviation fuel suppliers to include SAF in all outbound flights, starting with a 2% blend in 2025 and rising to 70% by 2050.

SAF prices average c.3–5x higher than conventional jet fuel.

As CAO obtained EU certification in 2022 and SAF remains undersupplied, we expect group-level trading margins to improve with rising SAF demand.

China National Aviation Fuel Group (“CNAF”) is the controlling shareholder of CAO with its 51.31% stake. A state-owned enterprise, CNAF is the largest aviation transportation logistics services provider in the PRC, providing refuelling services at over 200 airports in China. CAO is CNAF's key overseas subsidiary and platform for international aviation fuel trading and procurement to support China's civil aviation industry. Photo: CAO.Upgrade to ACCUMULATE with a higher TP of S$0.90 (prev: S$0.85) China National Aviation Fuel Group (“CNAF”) is the controlling shareholder of CAO with its 51.31% stake. A state-owned enterprise, CNAF is the largest aviation transportation logistics services provider in the PRC, providing refuelling services at over 200 airports in China. CAO is CNAF's key overseas subsidiary and platform for international aviation fuel trading and procurement to support China's civil aviation industry. Photo: CAO.Upgrade to ACCUMULATE with a higher TP of S$0.90 (prev: S$0.85) We upgrade our rating on CAO from NEUTRAL to ACCUMULATE with an increased DCF-TP of S$0.90 (prev: S$0.85), supported by recent share price performance and improving fundamentals. Our FY26e/27e PATMI forecasts remain unchanged at US$82mn/83mn, but we project at least high single-digit YoY growth in 1H25. CAO holds US$500mn in cash, accounting for over 90% of its market cap. |

The Phillip Securities report is here.