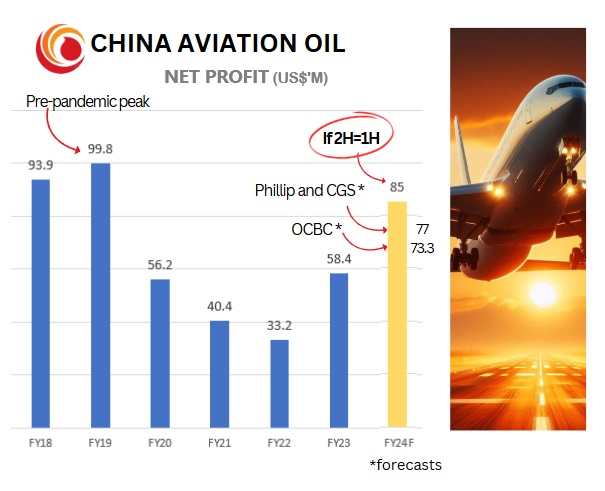

| Back in September and October 2024, analysts were pretty optimistic about China Aviation Oil's (CAO) stock after its strong 1H results. Their forecast earnings for the full year were: US$77 million (Phillip Securities and CGS-International) and US$73.3 million (OCBC Securities).  Since then, they did not make any change to those numbers, perhaps because CAO did not update the market on its 3Q performance. Since then, they did not make any change to those numbers, perhaps because CAO did not update the market on its 3Q performance. But here’s the kicker: new industry data suggests those analyst estimates might have been too conservative. The company could actually blow past those numbers! The industry data is publicly-available information on the volume of flights handled by Shanghai Pudong International Airport, one of China’s busiest travel hubs. The airport's exclusive fuel supplier is a major contributor to CAO's bottomline. |

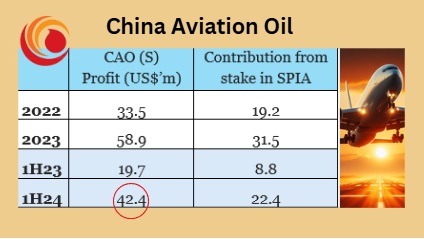

CAO owns 33% of Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA). SPIA is responsible for refueling all planes departing from that airport.

SPIA is responsible for refueling all planes departing from that airport.

SPIA's contribution to CAO can be seen in the table, amounting to approximately 50%.

In 2024, Shanghai Pudong International Airport saw a 22% jump in total flights compared to the previous year, with international flights skyrocketing by 69%!

As shared by a CAO shareholder, the data in the 2 tables below can be gleaned from filings submitted to the Shanghai Stock Exchange (e.g., monthly data by Shanghai International Airport Co., Ltd.).

|

All flights |

1H |

2H |

2024 |

|

2023 |

187,685 |

246,178 |

433,863 |

|

2024 |

257,724 |

270,349 |

528,073 |

|

Change |

37% |

10% |

22% |

International flights jumped even higher from a low base in 2023 when China emerged from its zero-Covid policy.

International flights typically consume more jet fuel than domestic ones.

|

Intl. flights |

1H |

2H |

2024 |

|

2023 |

39,799 |

68,489 |

108,288 |

|

2024 |

85,134 |

97,124 |

182,258 |

|

Change |

114% |

42% |

69% |

|

Why this maters:

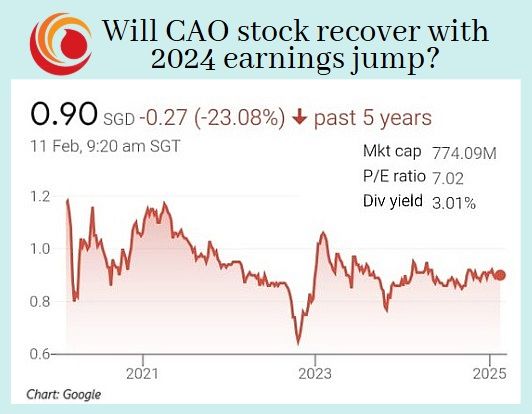

At these profit levels, the stock looks seriously undervalued.

The implied price-to-earnings (PE) ratio would be just 6.7x—or an even lower 2.5x if you exclude cash holdings (the company had US$353.4 million in cash and zero debt as of 1H 2024).

There is thus scope for analysts to increase their stock target prices, which currently are: $1.20 (CGS), $1.05 (Phillip Securities) and $1.10 (OCBC Investment Research).

The risks to the business include oil price volatility, and China economic slowdown.

| "We leave our forecasts intact ahead of CAO’s FY24 results. This is due to be released on 27 Feb 2025, and we are expecting healthy earnings growth with potential dividend upside. We reiterate our FV estimate of SGD1.10 and BUY rating on the counter." -- OCBC Investment Research analyst Ada Lim (10 Feb 2025) |