Site of Riverstone's new factory: Land cost was RM12.4 million while the area is 30 acres, which is equivalent to 30 soccer fields.Photos and video by Leong Chan Teik

Site of Riverstone's new factory: Land cost was RM12.4 million while the area is 30 acres, which is equivalent to 30 soccer fields.Photos and video by Leong Chan TeikIN LESS THAN a year from now, this site (picture) in Taiping, Malaysia will be transformed into a highly-automated sprawling factory producing gloves chiefly for workers in the healthcare industry globally.

Singapore-listed Riverstone Holdings will unveil in due course details of the production capacity increases and the various phases.

Analysts having a discussion with Riverstone's CEO Wong Teek Son and CFO Lim Sing Poew.Certainly, the capacity increase will be massive as can be deduced from the fact that the new site is of 30 acres while Riverstone's existing factories cover 22 acres.

Analysts having a discussion with Riverstone's CEO Wong Teek Son and CFO Lim Sing Poew.Certainly, the capacity increase will be massive as can be deduced from the fact that the new site is of 30 acres while Riverstone's existing factories cover 22 acres.Last Wednesday (Sept 18), six analysts (from DBS Vickers, OCBC, OSK-DMG, Phillips, CIMB and UOB Kay Hian) and NextInsight visited the Taiping site -- as well as an existing factory of Riverstone a few kilometres away.

Riverstone also has factories in Kuala Lumpur, Thailand and China.

Currently, the company has a production capacity of 3.1 billion gloves a year -- a level which was achieved by end-2012 and a long way up from the 720 million-capacity it had in 2006, the year of its IPO.

The rate of utilisation in 2Q of this year was about 85%.

About 60% of Riverstone's production was for healthcare gloves and 40%, cleanroom gloves. The latter are used in cleanrooms of hard disk drive and semiconductor industries.

Riverstone is estimated to have a market share of 60% of the world's cleanroom glove market, as it is the main supplier to the big boys -- Seagate, Western Digital, Hitachi, Toshiba, and TDK.

L-R: CEO Wong Teek Son with CFO Lim Sing Poew.

L-R: CEO Wong Teek Son with CFO Lim Sing Poew. NextInsight file photoHere are some highlights of the Q&A session between analysts and Riverstone chairman Wong Teek Son and CFO Lim Sing Peow.

Q: What gives you the confidence that you can use up the new production capacity?

Mr Wong: Firstly, for cleanroom gloves, we have decided to compete in the lower-end of the market also. Secondly, for healthcare gloves, a few customers have come to us requiring very big supplies but we can only produce part of their requirements. One customer wanted 800 million gloves a year, another asked if we can supply 70% of their requirements.

They are comfortable with us after auditing our factories. Thirdly, there is greater demand arising from a trend of users moving away from gloves made from latex to gloves made from nitrile which we focus on.

Q: You mentioned going into the low-end of the cleanroom gloves segment. What's the outlook for the high end?

Mr Wong: We have been taking market share but the market itself is not growing much because the HDD and wafer manufacturing sectors are not growing.

Q: You see more growth in the low-end cleanroom gloves segment -- what are these industries?

Mr Wong: Flat panel, touchscreen and mobile. The profit margins are almost the same as the other cleanroom gloves but the selling prices are lower. The margins are higher than for healthcare gloves and we can't ignore this market as it is growing.

For glimpses of the tour of the existing factory, click on the NextInsight video below.

Q: For your new factory, do you forsee problems getting workers?

Mr Wong: We will depend on workers from Nepal and Myanmar to do the lower-level work but the new lines are more automated than existing ones. We can get local workers for the packing work which doesn't involve night shifts.

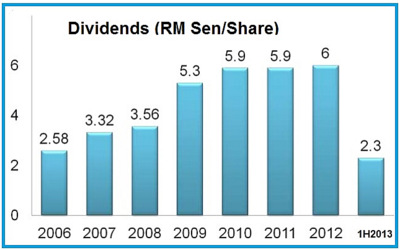

Q: Do you have a formal dividend policy?

Mr Wong: It's not formal but we have been paying 40-50% of earnings.

CFO Lim: And this will not be affected by the capex for the new factory as we have reserves from the exercise of warrants and we are looking for other financing. Phase 1 will cost RM70-80 million but Phase 2 will be less.

Mr Wong: For phases 1 and 2, no problem. For 3 and 4, if we don't have enough internal resources, we will get from the bank. We already have bank approvals.

Can you please give a breakdown of the COGS (cost of goods sold)?

Mr Wong: Raw material 25-30%, labour 15%, fuel 10-15%, chemical 7%, utility 7-10%, and the rest would be depreciation, maintenance and packaging.

> Unlike many a manufacturing business, Riverstone has zero debt and has enjoyed positive free cashflow since its listing in 2006.

> Unlike many a manufacturing business, Riverstone has zero debt and has enjoyed positive free cashflow since its listing in 2006. > The one-year return of Riverstone stock is 76%.

> Trailing dividend yield is 3.6%.

> Market cap is S$252 million (based on a recent stock price of 68 cents).

For PowerPoint presentation, click here.

Recent stories: