At Uni-Asia Finance's 4Q briefing at its office in Shenton Way, Chief Operating Officer Michio Tanamoto (third from left) answers a question from Linus Loo, an analyst from Lim & Tan Securities. Also in the picture: Etsuko Nagata, Asst VP, Finance (second from left), and Lim Kai Ching, CFO (extreme right). Photo by Leong Chan Teik

At Uni-Asia Finance's 4Q briefing at its office in Shenton Way, Chief Operating Officer Michio Tanamoto (third from left) answers a question from Linus Loo, an analyst from Lim & Tan Securities. Also in the picture: Etsuko Nagata, Asst VP, Finance (second from left), and Lim Kai Ching, CFO (extreme right). Photo by Leong Chan Teik UNI-ASIA FINANCE CORPORATION is largely a play on a potential recovery in chartering income and asset values of cargo ships that have plummeted following the global financial crisis and the overbuilding of vessels.

The company made a net profit of US$3.25 million from its ship-owning and chartering business last year, up from US$1.1 million in 2011.

It owns 4 handysize bulkers, one of which operated for only half a year in 2012. A fifth handysize vessel will join the fleet in 2Q or 3Q this year -- and the profit for this business segment is likely to be higher year-on-year.

According to Uni-Asia Finance, the vessels were acquired from 2010, which is to say post-global financial crisis years, at "reasonable prices" -- some were at judicial auctions.

Its four handysize vessels (which can transport a variety of cargo such as grain, metal ores, phosphate, cement, and logs) accounted for the bulk of the US$3.6 million net profit made last year by the entire group, which has a number of other smaller businesses in various geographies.

In the next few years, Uni-Asia targets to increase its fleet size to 10 with each vessel hopefully earning US$800K-US$1 million net profit a year, said the CFO, Lim Kai Ching at the 4Q results briefing on Tuesday (March 19).

"Many ship brokers come to us, and we are always looking for opportunities. We hope to increase our fleet this year."

He added that the supply-demand equation is expected to achieve a better balance going forward, leading to prices of handysize bulkers to rise perhaps next year.

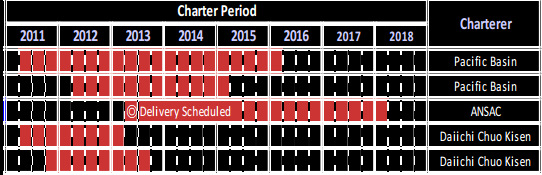

These are the charter periods of Uni-Asia Finance's 5 handysize bulkers. Two are on 2-year charters which are up for renewal this year. Their market charter rates are soft but not those for the 2 product tankers which Uni-Asia owns through a fund (see story below).

These are the charter periods of Uni-Asia Finance's 5 handysize bulkers. Two are on 2-year charters which are up for renewal this year. Their market charter rates are soft but not those for the 2 product tankers which Uni-Asia owns through a fund (see story below).Briefly, the other businesses of Uni-Asia Finance are property investment and development in HK, China and Japan, and hotel investment and operations in Japan.

These are small-scale projects and they delivered mixed results and, at least for this year, it is the ship side of the Group that is likely to continue to deliver most of the group's profit.

Aside from owning 5 vessels directly, Uni-Asia has further exposure to the ship business via:

* Ship investments: Uni-Asia Finance is also invested in 6 vessels through a ship investment fund (the Akebono Fund, set up in 2007, through which Uni-Asia Finance as the fund manager and the fund itself enjoy tax benefits in Singapore under the Maritime Finance Incentive). In addition, Uni-Asia has invested with other investors in 5 other vessels.

Uni-Asia recognised a fair value loss totalling US$4 million last year on some of the vessels as their market prices softened. (This fair value loss was nearly offset by fair value gains from its properties in HK and China).

* Fee income: Uni-Asia earns fees from services it renders to the Akebono Fund and is co-investments such as managing vessels, brokering buy-sell transactions, and arranging ship financing for third parties.

The latter is lucrative but it is non-recurring, so the earnings can be lumpy.

Taken together, the ship investments and fee income -- and asset management services of properties in HK and China and fair value adjustments -- come under a business segment known as "Non-consolidated Uni-Asia Finance".

This segment made a net profit of US$1.7 million last year, up from US$444,000 in 2011.

Consistent Dividends

Uni-Asia Finance stock trades at 0.54X book value and 22X historical earnings and 10.9 forecast current year earnings. Data & chart: BloombergUni-Asia has proposed a 0.5-cent dividend for FY12, its first payout since its listing on the Singapore Exchange in 2007 before the outbreak of the global financial crisis.

Uni-Asia Finance stock trades at 0.54X book value and 22X historical earnings and 10.9 forecast current year earnings. Data & chart: BloombergUni-Asia has proposed a 0.5-cent dividend for FY12, its first payout since its listing on the Singapore Exchange in 2007 before the outbreak of the global financial crisis.The 0.5 cent dividend translates into a 2.5% yield based on a recent stock price of 20 cents.

The company has not fixed a payout ratio and has to consider its need for cash to expand its vessel fleet.

"We would like to be able to consistently pay dividends to our shareholders," said Mr Lim. "If we make more profits, we hope to be able to pay more dividends."

Who is No.1 shareholder?

Yamasa Co held only 2.1% of Uni-Asia Finance prior to the latter's IPO in 2007 but bought placement shares during the IPO to raise its stake to 3.7%.

Today, Yamasa is the largest shareholder with a 33.46% stake which was boosted largely by its subscription of excess rights shares which amounted to 41.8% of the rights issue in 2011.

These excess rights had not been subscribed for by entitled shareholders and Yamasa had undertaken to subscribe for all of them. At that time it held 19.5% stake in Uni-Asia Finance.

Yamasa is a private Japanese manufacturer of amusement-related hardware and software, according to its website www.yamasa.co.jp

There is little you can find about Yamasa through a Google search but that is probably because it is a private company and the content is largely in Japanese.

So I asked Michio Tanamoto, Uni-Asia Finance's Chief Operating Officer and one of its 3 founders.

He said: "Yamasa is the largest ship and aircraft owner in Japan. It has over 100 aircraft and leases them to major airlines. And it owns over 20 vessels, leasing them to Evergreen and others.

"We started doing business with Yamasa over 10 years ago. We looked for investment opportunities for Yamasa -- it was making a lot of money."

Why did Yamasa increase its stake in Uni-Asia?

Mr Tanamoto: "It's a passive investment, and they view Uni-Asia as a good business partner. We have been able to come up with good investment opportunities for them."

The Powerpoint materials for the 4Q briefing can be accessed on the SGX website.

For more, read UNI-ASIA FINANCE: Confident of a sustainable turnaround

YANGZIJIANG, JES, COURAGE: Upside On Dry Bulk Bounce?