Click on the above 58-second video for an idea of the where and who of Uni-Asia Finance's lunch event for analysts, fund managers and the media on Nov 21.

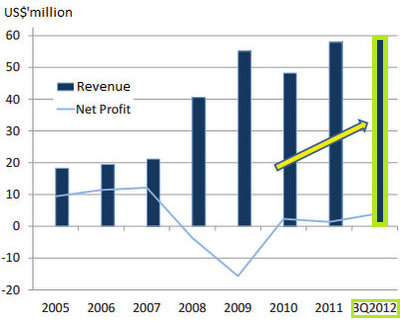

The profitability of Uni-Asia Finance Corporation ranged between US$7.9-10.4 million prior to the 2008 outbreak of the Global Financial Crisis.

Then the Singapore-listed company fell into a loss in 2008 and 2009 before ekeing out a recovery (see chart).

This year, profit growth has returned, and the management is confident of sustaining the momentum into 2013.

In an October 17 un-rated report, AmFraser Research said: "We believe the worst may be behind Uni‐Asia as it turns the corner with a 1HFY12 profit of USD1.7mil. It also marked the third consecutive quarter of profits."

Make that four consecutive quarters of profit.

Even then, the stock hasn't really reacted yet. At 17.9 cents recently, it trades at a price-to-book of 0.5 and a trailing PE of 10. The company has a market cap of S$84 million.

The stock is way below the 55-cent price it listed at on the Singapore Exchange in August 2007. And you have to take into account the fact that there has been some share dilution since then, as Uni-Asia has had a rights issue as well as placed out new shares.

A challenge Uni-Asia faces is educating investors on its business model, which comprises four business segments spanning several geographies and industries. It's not exactly your regular manufacturing nor F&B nor service business.

Uni-Asia has its roots in the corporate loan syndication and structured finance industry in Japan which its chairman and its COO have over 25 years of experience of.

Reflecting the nature of its business, Uni-Asia's major shareholders are Yamasa Co (33.46%), a Japanese asset owner; Evergreen International (9.98%), a well-known Taiwanese shipping company; and Uni-Asia's 3 executive directors (5.31%).

1. Ship and property investment and management, and structured finance:

> The business: Uni-Asia arranges ship financing for clients, and collects a fee for the service. Business is adhoc but it can be a significant contributor to the bottomline, says CFO Lim Kai Ching.

Currently, Uni-Asia also invests in 11 vessels through a ship investment fund and joint investments.

In HK, Uni-Asia has a 10.2 % interest in an office building redevelopment project which was fully sold by 4 Sept 2012. The building is scheduled to be completed and handed over to the buyers by end-Nov 2013.

> 9M2012 result: Net profit jumped to US$2.8 milliion from US$138,000.

> Growth drivers:

• Combination of structured finance fees and recurring services fee income

• Expand vessel fleet under vessel co-investments

• Invest in small residential property development projects in Japan

• Invest in commercial development projects in Hong Kong

2. Ship owning and chartering:

> The business: Purchased five handysize vessels, of which four have been delivered and are contributing to the Group’s profit with recurrent charter hire income..

> 9M2012 result: Net profit jumped to US$1.7 million from US$153,000.

> Growth driver: Acquisition of more handysize bulk carriers to boost the Group’s fleet of vessels to generate charter income. The target is 10 vessels, which could generate US$8-10 million net profit a year, said CFO Lim Kai Ching.

3. Investment/management of properties in Japan:

> The business: Develop residential properties in Tokyo of 4-5 storeys with 10 -15 units of studio apartments. Exit strategy is either to sell the property en bloc to an investor or to hold and lease to tenants.

Uni-Asia has three projects, one of which (ALERO Shimo Meguro) was completed in September 2012 and sold in October 2012. The remaining two projects will be completed in 1Q and 2Q next year.

> 9M2012 result: Net loss shrunk to US$59,000 from US$803,000.

> Growth driver: Deals are in the pipeline.

4. Hotel operation and services in Japan:

> The business: Currently operates 11 hotels.

> 9M2012 result: Net loss shrunk to US$603,000 from US$1.6 million.

> Growth driver: Increasing the number of hotels under management. Target is about 3,000 rooms, compared to about 1,900 currently.

Given its investments in assets such as ships, Uni-Asia has debt of US$109 million. Its cash pile is US$61.6 million, and net debt is US$47 million.

Below is a slideshow of the lunch event on Nov 21.