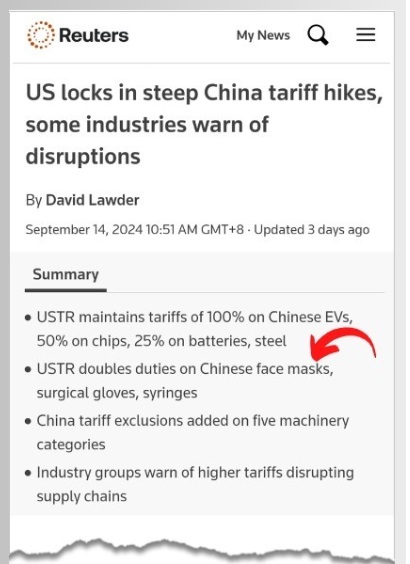

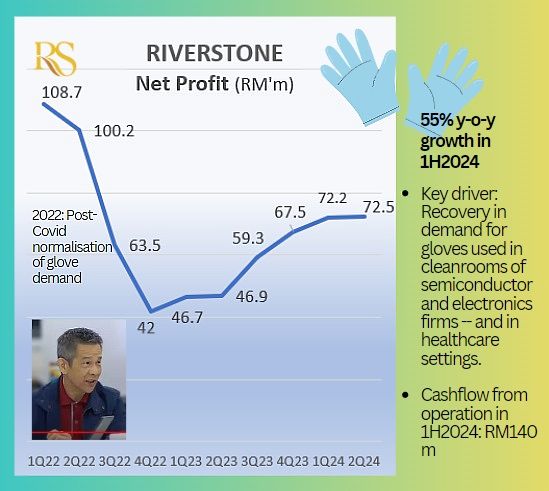

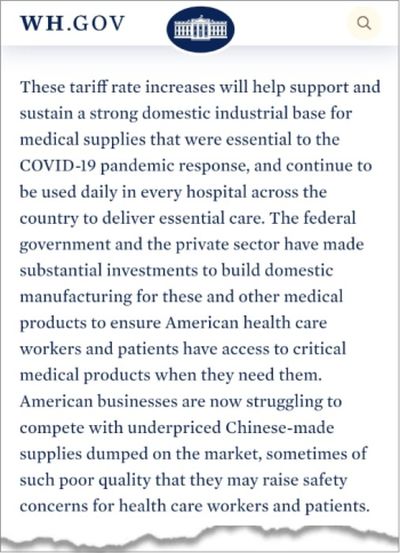

• News of US tariffs on medical gloves from China over the weekend has lifted stocks of glove producers on Monday and Tuesday: Riverstone Holdings (+6.6%, inclusive of 1.21 cent interim dividend), and Top Glove (+21%), both listed on the Singapore Exchange. The stock of their peers listed on Bursa Malaysia had a good uplift too from the news (see screenshot below).  The full Office of the US Trade Representative document (187 pages!) can be read here. • During the Covid pandemic, many new glove manufacturers sprung up in China to ride on the huge demand for healthcare gloves. The new competition and excess production capacity led to a surplus of inventory post-pandemic and, of course, a plunge in selling prices. • Profits then eluded many regional players, mostly those based in Malaysia. The exception was Singapore-listed Riverstone Holdings (market cap: S$1.4 billion), which has an established business producing gloves for use in electronics cleanrooms as well. • That's why its stock has been an outperformer among its peers.  Inset: CEO Wong Teek Son Inset: CEO Wong Teek SonThe rationale for the US tariffs on China's glovess, to be implemented from 2025, is captured in the following extract:  Source: White House press release Source: White House press releaseThe Office of the US Trade Representative initially proposed to increase the tariffs on medical and surgical gloves to 25% in 2026. However, this proposal was revised, and the tariffs will now increase to 50% in 2025 and further to 100% in 2026. Read below excerpts of a report by UOB Kay Hian's Malaysia-based analyst on the impact on Bursa Malaysia-listed glove producers .... |

Excerpts from UOB KH report

Analyst: Jack Goh

A further precipitous tariff hike and earlier implementation timeline announced by the US authority on China’s medical-grade gloves are poised to revitalise investors’ sentiment on the Malaysian glove sector. With the sector’s post-pandemic recovery eclipsing earnings amid demand moderation, domestic glovemakers should progressively reclaim market share from China, sustaining concrete ASP trajectories and margin upticks. Maintain OVERWEIGHT. |

WHAT’S NEW

• US imposed higher tariff and earlier timeline on China medical-grade gloves in modifications of statutory review. Last Friday, the Office of the United States Trade Representative (USTR) locked in steep tariff increases on an array of Chinese imports under Section 301 of the Trade Act of 1974.

This is a further modification on the earlier tariff hike introduced in May 24 after taking into consideration public comments and the advice of the Section 301 committee.

The modified tariff action includes higher tariff of 50% in 2025 and 100% in 2026 (from current 7.5%; initially proposed 25% in 2026) on China’s rubber medical and surgical gloves’ exports into the US beginning next year.

• Structural change likely altering nitrile gloves’ demand landscapes. Since the COVID-19 pandemic, China glovemakers ramped up capacity at a considerably aggressive pace and leveraged on their lower production costs to seize market shares.

To note, China had significantly raised its global market share from around 11% in 2019 to >30% in 2023.

While China players predominantly produce PVC vinyl and nitrile gloves (>85% of total sales in 2023), we assess meaningful nitrile gloves demand flowing back to Malaysian manufacturers after the tariff hike is imposed.

| • Who is potentially the biggest winner in Malaysia? Capacity matters. While rising tides lift all boats, we view Top Glove and Hartalega (Harta) which have overall larger production capacity and better presence in the US market as the major domestic beneficiaries of this potential structural change in demand. In terms of production capacity: a) Top Glove remains as the largest local glove manufacturer at around 60b; b) Harta’s current capacity is at 32b (43b if including NGC 1.5 plant); c) Kossan’s capacity is about 24b; and d) Supermax’s capacity is about 21b. In terms of US market exposure: a) Harta leads with >50% of total sales, b) Kossan at about 40%, c) Top Glove at about 20%, and d) Supermax at about 29%. |

Full report here