Excerpts from UOB KH report

Analysts: John Cheong & Clement Ho

| Food Empire Holdings (FEH SP) 1H21: Below Expectations Due To Costs; Price Increase Should Improve Earnings FEH’s 1H21 net profit of US$11.5m (-13.2% yoy) is below expectation, forming 37% of our full-year estimate. Margins came under pressure due to high commodity prices and record-high ocean freight rates.

All markets recorded sales growth, with double-digit growth in its two largest markets, Russia and Southeast Asia. This continues to reflect FEH’s strong brand power. Maintain BUY and target price of S$1.30. |

||||

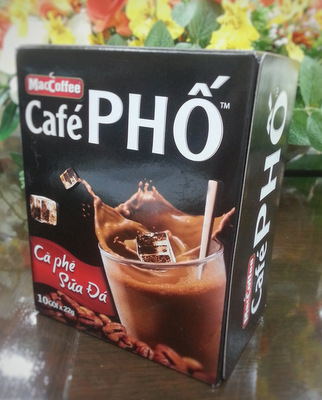

Cafe Pho is Food Empire's best-seller in Vietnam.RESULTS

Cafe Pho is Food Empire's best-seller in Vietnam.RESULTS

• Results below expectations due to higher costs which led to margin pressure. Food Empire Holdings’ (FEH) 1H21 net profit of US$11.5m (-13.2% yoy) is below expectation, accounting for 37% of our full-year estimates. The miss was mainly due to lower margin as a result of:

a) higher commodity prices,

b) record-high ocean freight rates,

c) a shortage of shipping container slots which resulted in supply chain delays, and

d) higher depreciation expenses arising from commencement of the group’s new freeze-dry coffee plant in India.

Gross margin fell 7.7ppt to 32.2%.

• Revenue growth across all markets, especially the two largest ones. Revenue for 1H21 grew 12.5% yoy as most markets recovered from a harsh lockdown last year. FEH’s two largest markets reported encouraging double-digit sales growth in 1H21 - Russia (+12.8%) and Southeast Asia (+13.2%). The third largest market, which consists Ukraine, Kazakhstan and CIS, also recorded 4.3% yoy revenue growth.

• Expect cost pressures to be overcome by price increases and normalisation of costs. Given its strong brand power and market-leading position, FEH will be able to pass on the increased costs of raw materials and logistics gradually via price hikes. In addition, we believe the spike in raw material and logistics costs will ease as COVID-19 disruptions reduce with higher vaccination rates across the world.

STOCK IMPACT

• Growing revenue. With the gradual reopening of economies on the back of global efforts to increase vaccine adoption rate, our forecast incorporates a 9.4% increase in revenue for 2021.

Furthermore, FEH’s increasing scale in Vietnam, efforts to streamline its operations, exit from its loss-making Myanmar business, and ability to raise ASP during core market currency weakness have improved its overall margins over the years while maintaining stable revenue. We expect stable net margin going forward after 2021.

• Resilient product offerings and strong brand equity. Despite challenges in 2020 including currency devaluation in core markets and national lockdowns, the group has managed to generate record level of profits.

We believe this is a testament to its strong brand equity and experience in navigating volatile currencies. Furthermore, given the low price point and consumer staple nature of its products, its products are relatively price inelastic. As such, sales volumes more sheltered from an economic slowdown, in our view.

• Compelling valuation; potential takeover target. FEH trades at 10x 2022F PE vs peers’ average of 18x. In view of its resilient core earnings amid a challenging environment, leading position in its core markets in Eastern Europe and growing presence in its second largest market, Vietnam, we believe the valuation gap with its peers will narrow.

Furthermore, given the depressed valuation, we do not rule out a possibility of a takeover offer or privatisation. Besides, in the past, SGX-listed peers including Super Group and Viz Branz were acquired and privatised at significantly higher valuations of 30.0x and 16.4x respectively.

| EARNINGS REVISION/RISK • We reduce our 2021 earnings forecast by 20% as we reduce our gross margin forecast by 2.2ppt to 36.1%. This is to account for the higher raw material and logistics costs as a result of COVID-19 disruption. However, we believe this situation is temporary in nature. Hence, we only reduce our 2022 and 2023 earnings estimates by 6% after reducing our gross margin assumption by around 1ppt to 38%. VALUATION/RECOMMENDATION • Maintain BUY with an unchanged PE-based target price of S$1.30, based on 16.6x 2022F PE, or 1SD above its long-term historical average (excluding outliers). We have rolled over our valuation base year to 2022. |

Full report here.