Excerpts from analyst's report KGI Fraser analyst: Renfred Tay (left)

KGI Fraser analyst: Renfred Tay (left)

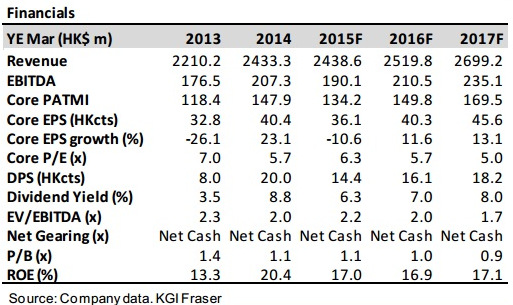

Results in‐line. VALUE’s 9M15 revenue formed 76% of our estimate for FY15F, while net profit formed 81% of our full year projection. This set of results is in line with our expectations given that fourth quarters tend to be the weakest quarter due to the CNY break.

Gross margin of 14% for 3Q15 was also the highest ever in its recent history.

Investment thesis intact. Our investment thesis for VALUE was anchored on the view that strong growth in the ICE (industrial and commercial electronics) segment, which commands more than double the CE (consumer electronics) segment’s gross margin, should over time, increase VALUE’s profitability, perpetuate growth and reduce its concentration risk from CE.

CE revenue for 3Q15 was only down 6.4% yoy, a smaller decline than expected while ICE revenue was up 24% yoy; a clear and positive signal that VALUE is still on the right course.

Three new HK warehouses bought. During the quarter, VALUE acquired three new warehouses (c.3,000 sq. ft. in total) for HKD14.8m. These units are located on the same floor as their existing HK office and current warehouse (they own the office but are currently leasing the warehouse).

Current warehouse floor space is about 2,000 sq ft and its lease will expire within 2015. VALUE’s warehouses in HK are used as a transitory storage space to receive procured raw materials before re‐sending them to China. All three new warehouses are now being rented out on short‐term leases for the time being at yields of 3‐4%.

VALUE could possibly stop leasing its current warehouse space and use their newly acquired ones eventually. This would imply a net increase of 1000 sq. ft. of space, possibly catered for their anticipated growth. There could be other scenarios but we see this as a highly likely one.

|

|

Previous story: VALUETRONICS: "Stock is extremely attractive," says AmFraser