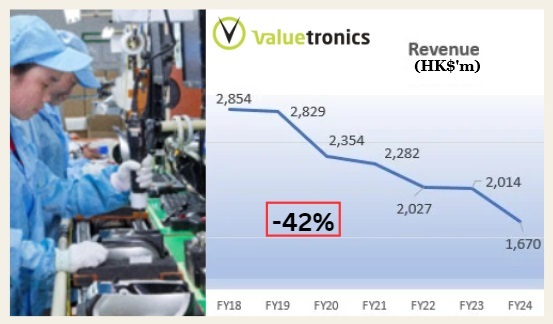

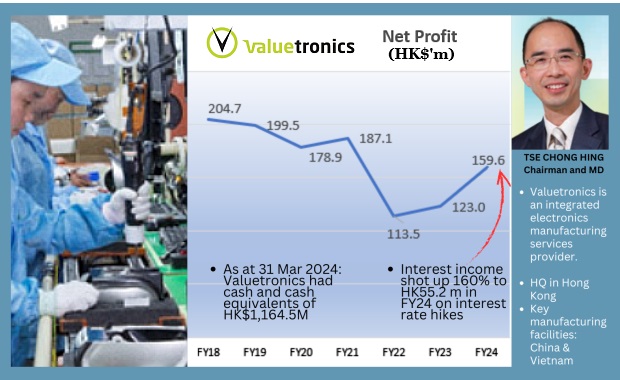

| • Valuetronics has just ended FY24 with another year of revenue decline, its sixth consecutive year (chart below). Not exactly a happy trend for its shareholders. • Reasons are myriad, including the loss of its electronics manufacturing services customers which shiftedout of China (where Valuetronics was concentrated) due to geopolitics and to avoid US tariffs.  • In the face of evolving trade flows, Valuetronics invested in a new factory in Vietnam which started mass production in early 2022. The good news is, it has attracted more customers seeking to diversify their supply chains while benefiting from lower labour costs. There's room for more customers as the Vietnam plant was operating at around 50% utilisation at end-FY24.  • While Valuetronics' revenue has been declining, its net profit actually grew in the past 2 years. Higher interest rates on its large cashpile contributed a not insignificant amount to FY24 (see chart). Accordingly, the company has upped its dividends. For more, read Phillip Securities' latest report below ... |

Excerpts from Phillip Securities report

Analyst: Paul Chew

Valuetronics Holdings Ltd

| Get paid as customer base is refreshed FY24 revenue was below our estimates at 89% of FY24e forecasts. PATMI was better than expected at 105% of our FY24e forecast. Lower depreciation, effective tax, and higher interest income were the reasons for the outperformance. Revenue was weaker than expected due to drag in legacy products such as consumer product printed circuit board assembly (PCBA) and auto entertainment modules. Customers have permanently switched their supply chains out of China. Contributions from new customers, namely networking products and theme park entertainment devices, are commencing. |

2H24 earnings growth of 19% YoY to HK$77mn was due to higher gross margins and a doubling of interest income.

| Valuetronics | |

| Share price: 62 c | Target: 76 c |

We kept our FY25e PATMI unchanged.

Our target price is raised from S$0.70 to S$0.76 as we roll over our valuations to FY25e earnings.

We peg our target price to the industry valuation at 11x PE.

We believe Valuetronics is turning around its operation with its new customers.

The pace of the turnaround will still be constrained by some remaining legacy products.

Meanwhile, valuations remain attractive with their cash pile of HKD1.16bn (or S$200mn).

Around 80% of the market capitalisation is net cash.

The company is also aggressively returning capital.

Dividends including special were raised by 25% to HKD0.25 (dividend yield of 7%) and an outstanding share buyback plan of HKD171mn (or ~46mn shares at current share price).

Company trading at EV/EBITDA of 1.7x FY25e.

The Positives

+Higher gross margins. Gross margins expanded by 3% points YoY to 15.6%, the highest in three years.

| "We also expect Valuetronics to add more new customers with their excess capacity in Vietnam." |

New products, weak renminbi, falling depreciation and less (spot) pricy electronic components are driving up margins.

Net margin was also boosted by the overprovision of taxes in 1H24, lower depreciation and interest income is not taxable.

+ Robust free cash flows and returning more to shareholders. Free cash in FY24 was HK$212mn (or S$36mn), an improvement over FY23’s HK$163mn (S$28mn).

Including special dividends, Valuetronics is paying 25 cents (or S$18mn), a 25% rise from FY23.

Capital expenditure will remain low at HK$20mn.

This after the massive capex spend of around HK$90mn p.a. for three years in FY20-22 on a new Vietnam factory.

The Negative

- Weakness in revenue. 2H24 revenue declined 19% YoY to HK$778mn.

The biggest drag to revenue was the 23% YoY fall in ICE (industrial and commercial electronics).

Two legacy products - household consumer and auto - are fading out due to the supply chain exiting from China to Indonesia and North America, respectively.

Another weak category is printers due to excess inventory post-pandemic.

Outlook

We expect revenue and margins to improve as new customer contributions increase.

For new customer ramps to be meaningful, they require at least two years.

Weak macro may delay the launch of some products (Figure 1) and cause customers to keep leaner inventory levels.

However, we also expect Valuetronics to add more new customers with their excess capacity in Vietnam.

Paul Chew, Head of ResearchMaintain BUY with a higher TP of S$0.76 (prev. S$0.70). Paul Chew, Head of ResearchMaintain BUY with a higher TP of S$0.76 (prev. S$0.70).Our target price is based on industry valuations of 11x PE 1-year forward earnings. Excluding cash, the company is trading at 3x historical PE and 1.7x EV/EBITDA FY25e. |

Full report here.