Excerpts from UOB KH report

• Global markets rallied in Nov 23 as encouraging economic data, cooling inflation and dovish comments from the US Fed raised hopes of an end to the rate-hike cycle.

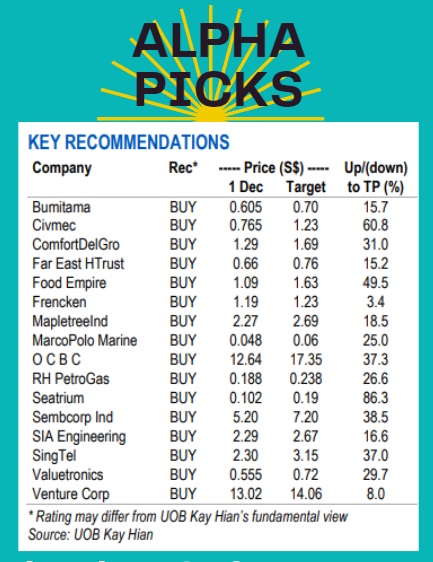

• For Dec 23, we add VALUE and VMS, while removing THBEV and CSE. |

For Dec 23, we add Valuetronics and Venture with the former expected to benefit from higher earnings from new customer acquisitions and share buybacks, while the latter’s valuation appears compelling, backed by its decent 6% dividend yield and potential share buybacks.

We remove Thai Beverage as we believe higher SG&A costs and stiff competition in key beer markets will likely stymie its share price performance, while CSE Global lacks near-term share price catalysts, in our view.

| Valuetronics – BUY (analyst: John Cheong) |

• Strong earnings beat in 1HFY24 results. Valuetronics’ (VALUE) 1HFY24 net profit of HK$82.1m (+42% yoy, +26.1% hoh) was above our expectations, making up 61% of our full-year estimate.

|

VALUETRONICS |

|

|

Share price: |

Target: |

Gross margin improved by 3.1ppt due to:

a) lower material costs from component shortage relief as the group’s supply chain visibility has improved, and

b) lower labour costs in China, stemming from stabilisation in the labour supply as well as depreciation of the Renminbi.

The surge in other income to HK$28.8m (+123% yoy), mainly from rising interest income as a result of the US Fed rate hikes, also led to net margin expansion to 9.2% (+3.7ppt yoy).

• Positive outlook with four new customers contributing. Upon VALUE’s newly-constructed Vietnam campus commencing operations, it has consolidated its facilities into one campus site since Jun 22 to optimise operations and costs.

VALUE has since acquired two new customers – a hardware provider customer for retail chain stores and a customer providing cooling solutions for high performance computing environments – and successfully commenced initial shipments at end-FY23.

Full-year contribution is expected from the two new customers in FY24.

More recently, VALUE has acquired another two new customers, including an electronic products supplier for a global entertainment conglomerate and a Canada-based customer providing network access solutions.

Management expects to have shipments scheduled in 2HFY24 and production ramp-up in FY25.

John Cheong, analyst. • Strong balance sheet, special dividend and share buybacks.As of 1HFY24, VALUE had net cash of HK$1.1b (accounting for around 80% of its current market cap). John Cheong, analyst. • Strong balance sheet, special dividend and share buybacks.As of 1HFY24, VALUE had net cash of HK$1.1b (accounting for around 80% of its current market cap). It has also doubled its interim dividend in 1HFY24 via a special dividend and has started aggressive share buybacks after its 1HFY24 results, where it has bought back 2.5m shares vs only 0.5m shares before its 1HFY24 results announcement. |

• Maintain BUY with PE-based target price of S$0.72, pegged to 10.6x PE for FY24.

This is based on 1SD above VALUE’s historical PE mean to account for potential strong demand from its four new customers.

VALUE is currently trading at only 2x FY24 ex-cash PE and offers an attractive FY24 dividend yield of around 7.5%.

Share Price Catalysts

• Events: a) Winning more customers, b) higher-than-expected contributions of new customers, c) higher-than-expected dividends and share buybacks.

• Timeline: 6-12 months.

Full report here