Ms. Yang Huiyan, 32, is both Country Garden's top shareholder and China's richest woman.

Ms. Yang Huiyan, 32, is both Country Garden's top shareholder and China's richest woman.

Photo: china.orgJP Morgan: COUNTRY GARDEN, SHIMAO ‘Top Picks’

JP Morgan said that Country Garden (HK: 2007) and Shimao (HK: 813) are its “Top Picks” among Hong Kong-listed property developers.

“They are our top picks in the sector on their strong growth in sales. Agile is a preferred name too on its cheap valuation.

“On the back of valuation and a delay in B-to-H conversion, we downgrade Vanke (B-shares) from ‘Overweight’ to ‘Neutral’,” the research house said.

In the first half, China’s property sector first outperformed MSCI China and then underperformed, and YTD it has just barely outperformed by +2.4%.

“Looking into 2H2013, we expect the policy environment to be broadly stable. ASP should also remain stable in 3Q and start falling slightly in 4Q, while sales volume should start to decrease due to credit tightening and worsening market sentiment,” JP Morgan said.

Shimao recently 16.18 hkdIt added that it thinks sector valuations could be under pressure from now until year-end and expects mid-caps to outperform large-caps.

Shimao recently 16.18 hkdIt added that it thinks sector valuations could be under pressure from now until year-end and expects mid-caps to outperform large-caps.

“We believe Country Garden and Shimao could surprise on better margins and Agile could surprise the market on more delivery.

“On the other hand, Sino Ocean Land, Shui On Land and Longfor could surprise the market with less delivery, and Longfor could surprise the market with higher gearing.”

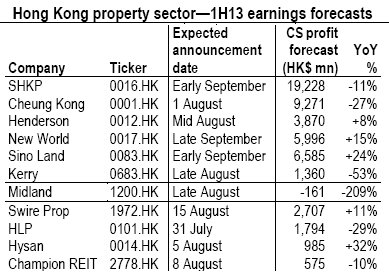

Source: Credit SuisseCredit Suisse: HK PROPERTY kept ‘Market Weight’

Source: Credit SuisseCredit Suisse: HK PROPERTY kept ‘Market Weight’

Credit Suisse said it is maintaining its “Market Weight” recommendation on Hong Kong-listed real estate developers.

“We expect rental growth reported by landlords should mitigate the market's concern on cap rates.

“We also expect the developers to report a decline in 1H13 profit from HK property sales, but that should provide them a low base for a strong turnaround in 2H13,” Credit Suisse said.

First half results/operations of Henderson Land (HK: 12), Midland (HK: 1200), Champion REIT (HK: 2778) and Hysan (HK 14) might surprise the market on the upside, and the Swiss research house expects a stronger rebound in earnings by developers in 2H13 and FY14.

“We expect strength in all business lines, including China property sale business which has been overlooked by the market.”

See also:

OSK Highlights Privatisation Possibilities In Property Sector