Photo: Chow Sang Sang

Credit Suisse: CONSUMER Stocks Tops in Hong Kong

Credit Suisse said in its China Market Strategy that it has the biggest “Overweight” recommendation on consumer sector stocks listed in Hong Kong, and expects the H-share index to rise this year.

“In early 2012, we had expected the market to experience a mild rebound (which happened) and less ‘flight to quality (which did not happen). Again, in 2013, we expect the market to rise, and set our H-share index target at 14,000.

“We believe that two consecutive years of positive share price performance will finally reduce the ‘flight-to-quality’ phenomenon that we have seen in the past two years. As in 2010, we expect the ratio of outperforming stocks to reduce to the 50% range,” Credit Suisse said.

The research house said it was most bullish on consumer shares listed in Hong Kong.

“The Hong Kong-listed consumer discretionary sector has underperformed in four of the past five years. We also like banks which have underperformed in the past three years.”

Despite the underperformance of the capital goods sector in the past five years, Credit Suisse said it is still having difficulty in bottom-up stock picking in this sector.

“In our January 2012 report, ‘China Market Strategy: Reversal to mean?,’ we highlighted two things: (1) the market would experience a rebound in 2012 -- we set 2012 index targets for MSCI China, H-share and Shanghai A-share at 65, 11,500 and 2,900, respectively; and (2) given the market rebound, the ‘flight-to-quality’ phenomenon would change and more laggards would start to outperform.”

With the exception of A shares, Credit Suisse’s index targets for 2012 materialised -- MSCI China and H-share indices were at 11,436 and 63 as of end-2012, respectively.

“However, we changed our H-share index targets a few times last year -- so we should not claim too much credit for the earlier call last year.”

Consumer discretionary and materials are two other poorly performing sectors which have underperformed in four of the past five years.

“Indeed, we have the biggest ‘Overweight’ on consumer discretionary, expecting that the investment-led macroeconomic stabilization will filter through to discretionary consumption,” Credit Suisse added.

See also:

CHINA's REAL ESTATE & RETAIL: Latest Happenings...

XTEP ‘One Of Two Survivors’; China Property Boosting White Goods

HSBC Upgrades XTEP; UNI-PRESIDENT Started ‘BUY’

Bocom: CONSUMER STOCKS See Strong November Rebound

Bocom International said that Hong Kong-listed consumer/retail stocks saw a “strong rebound” in November.

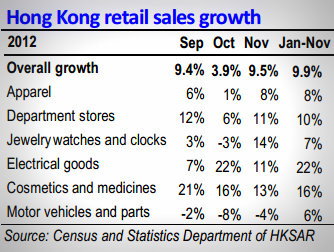

Hong Kong retail sales growth (in value) saw a strong rebound to 9.5% in Nov from 3.9% in Oct, much better than the consensus estimate of 4.2%. For Jan-Nov 12, the average retail sales growth was 9.9%.

The key improved segments were jewelry & watches (to +14% vs. -3% in Oct), followed by apparel (to +8% vs. +1% in Oct) and department stores (to +11% vs. +6% in Oct).

On the other hand, electrical goods reported sales slowdown (to +11% vs. +22% in Oct), followed by cosmetics (to +13% vs. +16% in Oct).

“We believe the rebound was mainly due to the normalization of Chinese tourist arrivals, with arrival growth recovering to 30% in Nov (Jan-Nov +24%), from 21% in Oct which was affected by the adverse impact of China’s Golden Week holiday,” Bocom said.

While the research house expects the growth momentum to carry into Dec (the peak season of the year), the continuing cautious consumer climate and the sustained high base last year (retail sales +23.5% in Dec 11 vs. +23.4% in Nov 11) will cap the sector’s improvement, Bocom added.

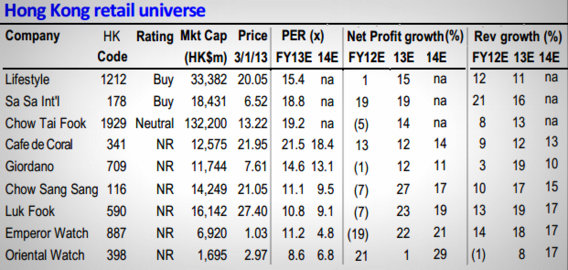

“In our Hong Kong retail universe, Sa Sa (HK: 178, ‘Buy’) and Lifestyle (HK: 1212, ‘Buy’) remain our key picks.”

See also:

China Retail Rundown; XTEP ‘Buy’; ANTA Mixed

XTEP ‘Buy’; Bocom Downbeat; MAGIC Shines; PAX Impresses