Deutsche: CHINA PROPERTY fundamentals best since 2010

Deutsche Bank is upbeat on China’s Hong Kong-listed property developers with its top buys being COLI (HK: 0688), China Overseas Grand Oceans (HK: 81), China Resources Land (HK: 1109), Country Garden Hldgs (HK: 2007) and Guangzhou R&F Properties (HK: 2777).

“Sector fundamentals are the best since 2010,” Deutsche said.

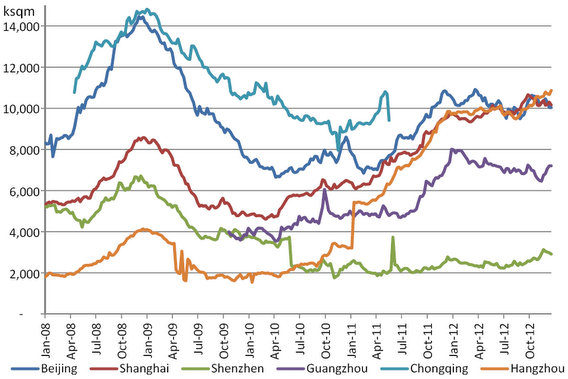

In 2H09-10, new supply in the commodity residential market fell due to tight financing for Chinese developers.

“We expect this falling supply scenario to recur in 2013 as a result of 1) lower inventory levels; 2) falling new construction starts in 2012; and 3) continually declining land sales (in top 300 cities) in 2011 and 2012.”

The German research house said that with a likely fall in new supply, it expects pricing power to return for developers and property prices to rise by 5-10% in 2013.

“In this scenario, we believe overlooked quality mid- and small-cap developers should see stronger valuation re-ratings ahead. We see a more favorable supply picture in 2013.”

Deutsche recommends selling Sino Ocean and Yanlord.

Key risks include widespread financial distress and a sharp deterioration in the economy.

“For the 23 key cities we monitor, the average number of months required to clear the available-for-sale supply has continued to decrease from a peak of 21.5 months in February 2012 to 10.4 months in November 2012, and is reaching the eight-month level from 2009 and 2010,” Deutsche added.

See also:

XTEP ‘One Of Two Survivors’; China Property Boosting White Goods

HSBC Upgrades XTEP; UNI-PRESIDENT Started ‘BUY’

Yuanta: SUNAC started with ‘Buy’ call

Yuanta Research said it is initiating coverage of property developer Sunac China Holdings (HK: 1918) with a “Buy” recommendation and a target price of 6.53 hkd (recent share price 5.83 hkd).

“We like Sunac for its solid earnings record, contract sales performance and counter-cyclical acquisitions.

“At the same time, its product quality, as well as respected partners, suggest better than average execution ability and a strong growth outlook,” Yuanta said.

Gearing concerns overdone

Sunac has 139% cash to short-term debt coverage, and a 0.9x contract sales over interest-bearing debt ratio, which is above the sector average of 110% and 0.62x respectively.

“In addition we believe that Sunac has no near-term repayment burden due to prudent cash flow management. We expect Sunac’s net gearing ratio to return to under 100% by the end of 2012,” Yuanta said.

Sunac has an “ambitious” 40 billion yuan contract sales target for 2013.

“We expect the company to achieve its contract sales target by the end of 2013 thanks to its strong execution capabilities. We estimate revenue/net profit growth of 53.1%/31.0% for 2013,” the research house said.

See also:

China Retail Rundown; XTEP ‘Buy’; ANTA Mixed

XTEP ‘Buy’; Bocom Downbeat; MAGIC Shines; PAX Impresses

ABCI: BELLE, INTIME top retail picks, sector ‘Overweight’

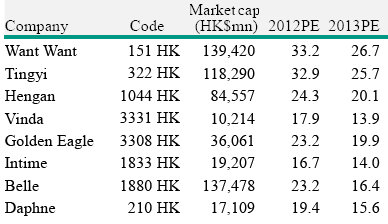

ABC International said its top picks in China’s Hong Kong-listed retail space are Belle (HK: 1880) and Intime (HK: 1883), and it gives an “Overweight” recommendation for the sector.

“We prefer market leaders with brilliant growth. As China’s macro environment continues to exhibit healthy growth, we expect retail sector starts to enter the recovery phase,” ABCI said.

Consumer staples are well-positioned to maintain growth momentum and the research house said it prefers leading names such as Hengan (HK: 1044) and Vinda (HK: 3331).

“Discretionary names will enjoy gradual rebound with stronger recovery of SSSG next year. We like Belle and Intime.”

China retail sales grew by CAGR of 19.4% from 2007 to 2011, higher than the disposable income growth of 12.2%.

During the recently concluded National Congress, the central leadership targets to double disposable income for urban and rural residents by 2020 from 2010, representing a CAGR of 6.5%.

“We estimate a net increase of 198 mln urban population in 2020, which will account for 60% of the total population in 2020.

“The continued urbanization and surging disposable income will be the key drivers of retail sales growth,” ABCI added.

The consumer index underperformed benchmark Hang Seng Index on year-to-date return.

“As the economy bottomed in 3Q12, we turn positive on the consumer/retail sector in 2013.”

See also:

XMAS Celebration And Shopping Take Off In China