UBS: XTEP ‘One of two expected survivors’

UBS Investment Research reiterated its “Buy” recommendation on China’s top fashion sportswear play, Xtep International (HK: 1368).

“Xtep is one of two expected survivors (the other being Anta) amid more evidence of weaker operators leaving the industry,” UBS said.

UBS has a 4.00 hkd target price on Xtep (recent price 3.23 hkd).

“Our colleagues who have travelled in different parts of China recently witnessed more store closures of weaker domestic sportswear brands.

“In our earlier report, we highlighted that most non-listed sportswear operators (which we estimate had a market share of more than 30% before 2010) have either exited or scaled back their operations materially in the past two years.”

Inventory eased, new products gain traction

The Swiss research house said its proprietary checks indicated inventories in the channel have reached an inflection point—the inventory build-up situation has incrementally eased over the past two quarters, although the overall inventory level in the channel remains high.

“Our checks show the sector has done well in October and November as new products gain traction.

“Xtep management shared more confidence in products to be showcased in the upcoming Q312 trade fair in January.”

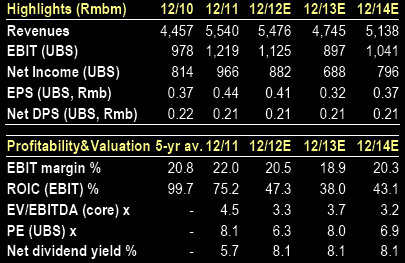

UBS is lowering its 2012/13 earnings estimates on Xtep by 5%/3% to reflect a slight increase in 2012/13 A&P/sales ratio assumptions to 12.5%/13.0% (from 11.5%/12.5%).

Its 2014 earnings estimate remains unchanged.

“We highlighted in our 27 September report our belief that the sportswear sector might have bottomed. We expect Xtep and Anta to be survivors with high dividend yield,” UBS said.

Xtep was founded as a sportswear OEM manufacturer in 1999. The company developed its owned Xtep sportswear brand in 2002 and began selling branded products to direct-sales customers. In 2006, Xtep began to phase out its OEM business segment and adopt wholesale distribution to increase market share and expedite store rollout. To enhance product offering and place more focus on fashion sportswear, Xtep launched two new brands, Disney Sport (licensed brand) and Koling (owned brand) in 2007. Xtep listed on the Hong Kong Stock Exchange on 3 June 2008.

See also:

HSBC Upgrades XTEP; UNI-PRESIDENT Started ‘BUY’

China Retail Rundown; XTEP ‘Buy’; ANTA Mixed

XTEP ‘Buy’; Bocom Downbeat; MAGIC Shines; PAX Impresses

XTEP Kicking Things Up A Notch; CHOW SANG SANG Target Hiked

UBS: China Property Growth Fuelling WHITE GOODS

UBS Investment Research said that economic fundamentals in China are recovering, and a boost from property sales may help with the sustainability of the country’s Hong Kong-listed white goods manufacturers.

“Production and sales of white goods both recently increased. Air-conditioner production rose 4.3% YoY in November and continued to expand MoM, indicating gradually recovering confidence,” UBS said.

Monthly sales rose 11.1% YoY, while MoM growth recovered considerably over last month (2%), and absolute sales increased MoM (against the seasonal trend), implying a substantial recovery in demand adjusted for the low base.

The Swiss research house said that a boost to domestic sales from strong property sales is now visible.

“The 2nd round of ‘Home Appliances Go Rural’ ended after November, but domestic sales of air-conditioners still posted 6.2% YoY growth, with the policy exit having a limited impact on the market.

“The boost to air-conditioner demand from strong property sales, which tends to lag behind, has begun to appear, and we believe it will be sustainable until Q113 at least,” UBS said.

Air-conditioner exports surged 20% YoY in November, above market expectations, which could be attributed to sound home sales in the US and a bottoming-out of exports to Europe.

Better industry trend drives leaders’ performance

Driven by strong property sales, domestic and overseas air-conditioner sales have both recovered, while there has been a limited impact from the end of the ‘Home Appliance Go Rural’ programme and an increasing boost from urbanization.

“Our pick in this space is Gree Electric Appliances (SZA: 000651) thanks to its strong competitive edge and gradually increasing market share.

“We believe the reduction in the stake of Gree’s second largest shareholder does not indicate a lack of confidence in Gree’s operation, while short-term share price volatility makes its valuation look more attractive,” UBS added.

Gree will be officially added to the FTSE A50 China Index next week, and the positional switch in related index funds may become a short-term catalyst for Gree.

Gree’s market share hits new high

Gree’s sales increased 30% YoY in November, accounting for a 46% market share (a historical high).

Domestic sales rose 24% YoY, higher than the industry average, leading the runner-up by a wider margin; exports rose 58% YoY, running parallel with Guangdong Midea Electric Appliances (SZA: 000527).

“Midea’s sales increased 2.4% YoY, posting the first positive growth YTD, which we believe may help the company achieve flattish revenue growth in Q4,” UBS said.

Downside risks to China’s white goods sector include: a larger-than-expected impact from the end of the ‘Home Appliance Go Rural’ program, reducing sales volumes and investors’ enthusiasm for the sector; changes to the market growth strategy of any individual manufacturer intensifying competition and eroding the sector’s profitability; rapid growth in raw material costs reducing gross margins; government rolling out harsher real estate market tightening policies.

See also:

An Honest Look At Chinese Share Prices

BIG BROTHER? China Firms Dominating Blockbuster HK IPOs

What The Big Boys Are Buying In China

PARTY TIME: Top Five PRC Earners