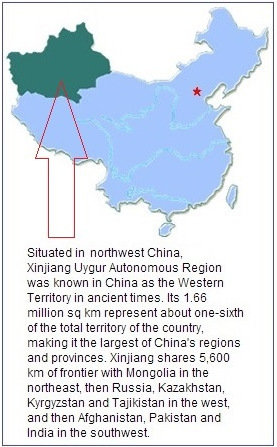

Jin Xin, chairman of JES (centre), treats analysts and fund managers to a meal. NextInsight file photoJES International Holdings is massively diversifying from being a major private shipbuilding group based in the PRC to investing in mines in the Xinjiang Uygur autonomous region of China.

Jin Xin, chairman of JES (centre), treats analysts and fund managers to a meal. NextInsight file photoJES International Holdings is massively diversifying from being a major private shipbuilding group based in the PRC to investing in mines in the Xinjiang Uygur autonomous region of China.JES has entered into a conditional investment agreement with Mineriver Pte Ltd for the acquisition of up to a 30% stake in Mineriver for S$127.0 million.

Mineriver is a special purpose vehicle incorporated in Singapore to acquire the entire issued share capital of a Xinjiang company which holds mineral exploration rights in Xinjiang Uygur. The rights are with respect to metals and minerals, which includes magnesium and nickel.

Patrick Kan, CFO of JES. NextInsight file photo.Mineriver is expected to obtain the relevant mining rights (in Tuoli District, Tacheng City) and operate production lines to manufacture magnesium products.

Patrick Kan, CFO of JES. NextInsight file photo.Mineriver is expected to obtain the relevant mining rights (in Tuoli District, Tacheng City) and operate production lines to manufacture magnesium products. The Xinjiang company, Xinjiang Feng Li De Yuan Trading Co, had a net value of 381,000 yuan (S$77,590) as at July 31, according to an independent valuation report dated Oct 22 by Xinjiang Tiannuo Zhengxin Assets Appraisal Ltd Co.

The valuation does not include the magnesium and nickel assets of the firm, which are believed to be worth at least S$60 billion.

As no proper valuation exercise of the assets has been carried out, the S$60 billion was based on internal consensus, JES chief financial officer Patrick Kan told The Business Times.

"This is just a yardstick which the owner of the mine and the introducer is confident of reaching," he said. "Based on this S$60 billion, compared to the amount we are going to invest, it is very good value."

The acquisition will be carried out in three tranches:

The acquisition will be carried out in three tranches:> The Group shall obtain 5% in the share capital of Mineriver in tranche 1 for S$7.0 million cash of which S$2 m is a loan to Mineriver.

> Under tranche 2, JES will acquire 15.0% Mineriver’s share capital from vendors for an aggregate sum of S$60.0 million.

> In tranche 3, JES shall be granted a call option for an additional 10% stake at about S$60.0 million.

The aggregate consideration of S$127.0 million shall be satisfied by cash and issuance of new shares.

“The signing of the investment agreement is an important step towards the realisation of our overall Group strategy, which is to increase our earnings stream that is independent of the cyclical effect in the shipbuilding industry.

"Although the investment is still in its preliminary stages, we are excited at the opportunity to be involved early in the project due to the higher potential returns," said Mr. Jin Xin, Chairman and CEO of JES.

It is proposed that Mineriver will in due course apply for a listing on a stock exchange.

JES will be calling for an EGM for shareholders to vote on the proposed acquisition.

Recent story: OTTO MARINE & JES INTERNATIONAL: Strong order wins

"Although the investment is still in its preliminary stages, we are excited at the opportunity to be involved early in the project due to the higher potential returns," said Mr. Jin Xin, Chairman and CEO of JES.

It is proposed that Mineriver will in due course apply for a listing on a stock exchange.

JES said the proposed acquisition is an investment and will not constitute an expansion of its business as JES will not be directly involved in the management of Mineriver’s business.

JES stock recently traded at 13.3 cents, or down 7% over the past 12 months.

If JES decides to pay part cash for its second and third tranches of the proposed acquisition, it has financing to call upon. On Aug 30, JES announced it had secured up to US$40 million in financing from a US fund for its working capital and for mergers & acquisitions.

The number of shares to be issued by JES for the proposed acquisition will be 84.15% of the current issued share capital of JES of 1.166 billion shares.

This assumes that the second and third tranches are satisfied in full by the issue of shares at S$0.1223. Using the same assumptions, existing JES shareholders will see their JES shareholding diluted from 100% currently to 53.77%.

It will hold 36.19%, overtaking JES chairman Jin Xin's diluted interest of 28.36%. However, it has undertaken not to exercise control of the business of JES.

For details, see JES announcement.

The new No.1 shareholder of JES will then be the Xinjiang company vendor, Thumb New Energy Co., Ltd. (Beijing) (大拇指 (北京)能源投资有限公司).

It will hold 36.19%, overtaking JES chairman Jin Xin's diluted interest of 28.36%. However, it has undertaken not to exercise control of the business of JES.

For details, see JES announcement.

JES stock recently traded at 13.3 cents, or down 7% over the past 12 months.

If JES decides to pay part cash for its second and third tranches of the proposed acquisition, it has financing to call upon. On Aug 30, JES announced it had secured up to US$40 million in financing from a US fund for its working capital and for mergers & acquisitions.

JES will be calling for an EGM for shareholders to vote on the proposed acquisition.

Recent story: OTTO MARINE & JES INTERNATIONAL: Strong order wins