”The share placement will significantly increase our equity and lower our gearing, thereby improving our ability to negotiate for better credit terms when seeking bank financing,” said executive chairman Zhou Jun. Photo by Sim KihHAVING STRONG BACKERS with deep pockets certainly makes a difference in highly capital-intensive infrastructure businesses.

”The share placement will significantly increase our equity and lower our gearing, thereby improving our ability to negotiate for better credit terms when seeking bank financing,” said executive chairman Zhou Jun. Photo by Sim KihHAVING STRONG BACKERS with deep pockets certainly makes a difference in highly capital-intensive infrastructure businesses.SGX-listed water treatment player, SIIC Environment, recently announced that it is raising net proceeds of S$260.2 million by issuing 3.1 billion new shares by private placement to 5 institutions.

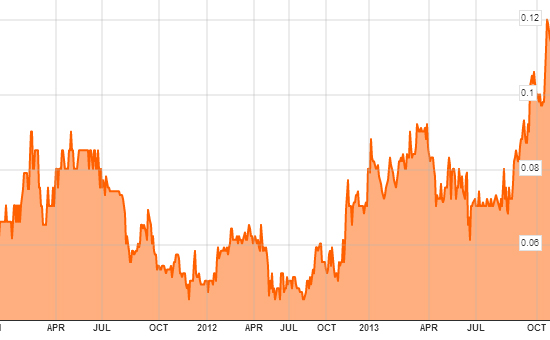

The shares were issued at at 8.5 cents each, a 13% discount to market price.

The market reacted positively to the news that PRC sovereign wealth fund China Investment Corp (CIC), is injecting S$56.1 million for a 7.68% stake in SIIC Environment’s enlarged capital.

Its stock price jumped to 11.2 cents on 16 October, 14% higher than its closing price before a trading halt was imposed for the placement announcement.

CIC manages part of China's foreign reserves, has assets under management of US$575.2 billion, and invests for commercial returns.

“Having an influential strategic shareholder such as CIC means a great deal to our operations in China,” said executive chairman Zhou Jun at an analyst briefing held at Pan Pacific Singapore on Wed.

Zhou Jun: "SIH is owned by Shanghai Industrial Investment (Holdings), which is to Shanghai what Temasek Holdings is to Singapore."Parent company, Shanghai Industrial Holdings (SIH, 363.HK), a venture capital arm of Shanghai’s municipal government, will inject S$136 million and hold interests of 50.79% post-placement.

Zhou Jun: "SIH is owned by Shanghai Industrial Investment (Holdings), which is to Shanghai what Temasek Holdings is to Singapore."Parent company, Shanghai Industrial Holdings (SIH, 363.HK), a venture capital arm of Shanghai’s municipal government, will inject S$136 million and hold interests of 50.79% post-placement.There were 3 other placees: private equity firms Dalvey Asset and CCBI Chengtou CleanTech, as well as Newyard, the personal investment vehicle of Yangzijiang Shipbuilding executive chairman Ren Yuanlin.

Issue proceeds will partially fund the upgrade of its existing portfolio of over 40 water and wastewater treatment facilities as well as acquisition of interests in the following new plants:

(1) 70% in a wastewater treatment plant (Shanghai Qingpu Second Waste Water Treatment Plant Co Ltd) for Rmb 126 million.

(2) 50% in a waste processing plant (Shanghai Pucheng Thermal Power Energy Co Ltd) for Rmb 530 million.

SIIC Environment has 41 water treatment projects and one waste incineration project located in developed parts of China.

SIIC Environment has 41 water treatment projects and one waste incineration project located in developed parts of China.Other than strong financial backing, Mr Zhou pointed out that SIIC Environment has strong deal flow from the municipal assets controlled by its key stakeholder, as well as the expertise in deal structure that is integral to the success of an infrastructure play.

Mr Zhou is a veteran dealmaker and is also Deputy CEO of SIH.

SIIC Environment has been growing fast under the SIH's management: Net profit attributable to shareholders in 1H2013 was up a whopping 80.1% year-on-year at Rmb 80.5 million.

FY2012 net profit attributable to shareholders of Rmb 131 million was 6 times what it was in FY2010, the year it took over Asia Water Technology.

To sustain the strong earnings growth, the company intends to expand its infrastructure portfolio beyond wastewater and water treatment, close one to two deals a year, as well as ramp up capacity.

Expertise at deal structure is important to the Group as it wants to avoid relying wholly on internal resources for its aggressive expansion plans.

“Being listed in Hong Kong and Singapore allows us to secure financing at a lower cost compared to even the SOEs running the municipal assets we hope to acquire. We hope to dual-list SIIC Environment in Hong Kong next year,” he said.

“We are currently adding waste incineration and thermal power generation projects to our portfolio. We hope to eventually include air purification and soil treatment projects,” he added.

On 30 Nov 2012, it changed its name from Asia Water Technology to SIIC Environment to reflect its ambitions to be a horizontally integrated environmental services infrastructure player.

"Going by SIH's track record with its ventures in pharmaceuticals, real estate and infrastructure businesses, we are confident we can achieve our goals for SIIC Environment quickly,” he said.

SIIC Environment's share price has doubled since it took over Asia Water Technology 3 years ago. Bloomberg data

SIIC Environment's share price has doubled since it took over Asia Water Technology 3 years ago. Bloomberg dataRecent story: SIIC (Fka Asia Water): Recovered From Crisis, Now Top Water Play On SGX