'Greenrookie' recently posted the following article in Valuebuddies.com and on our NextInsight forum under the thread Lee Metal - nice & steady

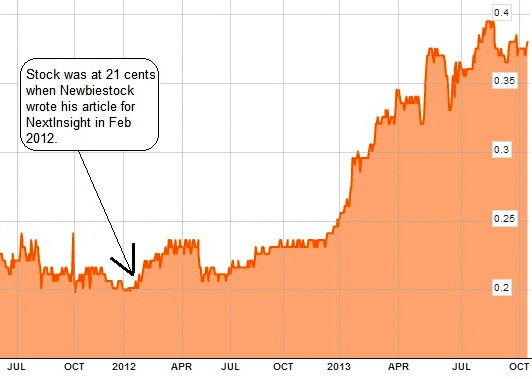

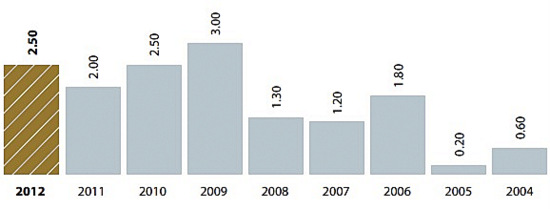

I WAS LOOKING at steel stockists when I came across Lee Metal. Reader "newbiestock" got it right when he recommended it at 21 cents in an article in NextInsight in Feb 2012. The stock has now touched 37.5 cents.

I believe the investment story is still intact.

The URL for Newbiestock's article on Lee Metal is given at the bottom of this page. Chart: Bloomberg

The URL for Newbiestock's article on Lee Metal is given at the bottom of this page. Chart: Bloomberg

Salient points:

1) It's a one-off bonanza from the Austville executive condominium project in 2014. Lee Metal Group has a 35% stake in the JV to develop the condo with United Engineers.

I WAS LOOKING at steel stockists when I came across Lee Metal. Reader "newbiestock" got it right when he recommended it at 21 cents in an article in NextInsight in Feb 2012. The stock has now touched 37.5 cents.

I believe the investment story is still intact.

The URL for Newbiestock's article on Lee Metal is given at the bottom of this page. Chart: Bloomberg

The URL for Newbiestock's article on Lee Metal is given at the bottom of this page. Chart: Bloomberg Salient points:

1) It's a one-off bonanza from the Austville executive condominium project in 2014. Lee Metal Group has a 35% stake in the JV to develop the condo with United Engineers.

The project is 100% sold and will TOP in 2014. Best of all, it will contribute 5.2 cents in earnings per share, which is almost the whole of 2012 earnings. Hopefully, there will be a special dividend!

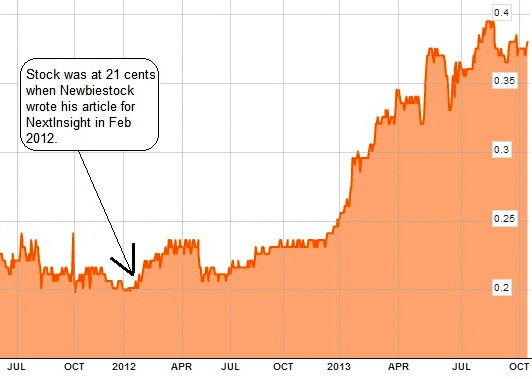

2) While the global steel market languishes, and Lee Metal's merchandising and trading arm continues to deteriorate with the general markets, its fabrication and manufacturing arm that supplies mainly to the construction sector of SIngapore is booming.

And it is offsetting the poor performance of its trading arm.

Revenue for the steel merchandising arm has dropped sharply over the years. But the fabrication and manufacturing arm has risen strongly.3) The fabrication and manufacturing arm had a record year in 2012 with $30,064,000 profit.

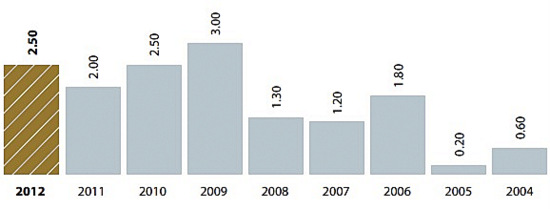

Revenue for the steel merchandising arm has dropped sharply over the years. But the fabrication and manufacturing arm has risen strongly.3) The fabrication and manufacturing arm had a record year in 2012 with $30,064,000 profit.In 2011, 2010, 2009, 2008, 2007, the profit was $19m, $22m, $27m, $22m, and $4m, respectively.

Its track record appears checkered, and margins ranged from 8% to 11%.

Jurong Town Council approval is expected by 30 Oct for Lee Metal's purchases of 1 Tuas Ave 8 and 3 Tuas Ave 8, the 2 buildings beside their existing facility, to expand their manufacturing arm.

The acquisitions speak volumes about the outlook of the business.

Also 1H turnover for the segment is already $192.6m while it was $361.6 m for the whole of 2012. In other words, demand is still strong, and growing.

4) HDB will taper off its supply of new flats to 15k from 2016 onwards, and the MRT lines will keep the industry busy till 2020.

The Ministry of National Development plans to add 700,000 homes till 2030 to accommodate a population of 6.9 million. Granted it is just a guideline, but the construction sector does not seem likely to sharply correct anytime soon.

5) Trading arm is in the doldrums, but the lower it is, the less chances for this segment to spring nasty surprises.

This segment is of low margin, so any growth or deterioration will not significantly affect the group's bottom line.

However, China has talked about consolidating the production of steel mills, but iron ore restocking and import are still at record highs.

The US housing sector is showing signs of recovery, and Europe is stabilizing.

All this crystal glass gazing might be meaningless but given that steel is a commodity indispensable in urbanization, the better the economic climate, the higher the demand for steel.

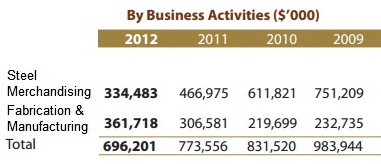

6) Lee Metal has an unbroken record of dividends and profitability since listing in 2001. Payout ratio has been 30-50%, except in 2005, where payout was only 10%.

Dividends paid by Lee Metal Group through the years.

Dividends paid by Lee Metal Group through the years.

Valuation:

6) Lee Metal has an unbroken record of dividends and profitability since listing in 2001. Payout ratio has been 30-50%, except in 2005, where payout was only 10%.

Dividends paid by Lee Metal Group through the years.

Dividends paid by Lee Metal Group through the years.Valuation:

At current prices, you are paying a premium above NAV of 30.05 cents (as at June 2013).

You are paying a forecast PE 6x 2013 and 3-4 times 2014 earnings.

Projected dividend yield of at least 7% in 2013 and 2014.

Risks

1) High gearing, which is expected to continue to increase. Gross gearing is 1.5X of equity due to its high inventory

2) Inventory level is higher than equity (175 million compared to equity of 148 million)

As with the case of HG Metal, when crisis hits, heavy inventory writedown + high gearing are a recipe for disaster.

I am comfortable with the risk I am taking, since steel prices are some 30% off the peak, and the company is generating free cash flow in most years. Net gearing with its fixed deposit included will be about 0.5.

If you are interested, you can read my brief comparison of Lee Metal with other steel companies at my blog.

There is a detailed write-up by "newbiestock" on Nextinsight in early 2012: LEE METAL: "12% dividend yield, low PE of 4...."

Risks

1) High gearing, which is expected to continue to increase. Gross gearing is 1.5X of equity due to its high inventory

2) Inventory level is higher than equity (175 million compared to equity of 148 million)

As with the case of HG Metal, when crisis hits, heavy inventory writedown + high gearing are a recipe for disaster.

I am comfortable with the risk I am taking, since steel prices are some 30% off the peak, and the company is generating free cash flow in most years. Net gearing with its fixed deposit included will be about 0.5.

If you are interested, you can read my brief comparison of Lee Metal with other steel companies at my blog.

There is a detailed write-up by "newbiestock" on Nextinsight in early 2012: LEE METAL: "12% dividend yield, low PE of 4...."

Lee Metal is a good stock. I hv taken all my profits for Lee Metal a few mths ago around 34-35 cents. No regret vesting on it

It has reached a decent capital gains i need so i decided to exit.. I would reconsider vest it in again if it ever trades below 30 c.

The business should still remain stable for the next few years, judging from the strong construction demand in Singapore.

And what other stocks are you cleverly positioned in? I know Eratat - you are the No.1 champion of Eratat. mmmm maybe I should be more optimistic about that one!