Excerpts from analysts' reports

UOB KH maintains 'buy' call and 33-cent target price for Hafary

Analyst: Loke Chunying

UOB KH maintains 'buy' call and 33-cent target price for Hafary

Analyst: Loke Chunying

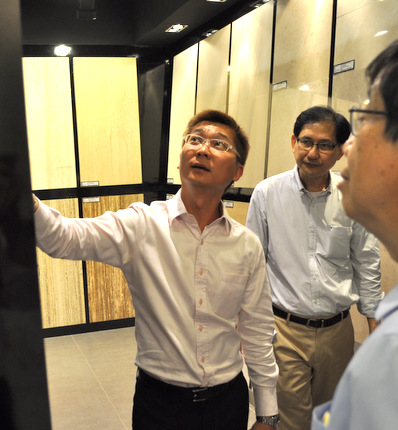

Hafary's financial controller Jackson Tay (left) showing investors some quality marble slabs in the Hafary showroom in Defu Ave 1. NextInsight file photo Recent price pullback offers buying opportunity as the company’s fundamentals remain intact and upbeat prospects support strong earnings growth. Hafary’s ability and willingness to pay out generous dividends payout make the stock compelling. We estimate a dividend payout of 32.3% - 65% for FY13F- FY15F.

Hafary's financial controller Jackson Tay (left) showing investors some quality marble slabs in the Hafary showroom in Defu Ave 1. NextInsight file photo Recent price pullback offers buying opportunity as the company’s fundamentals remain intact and upbeat prospects support strong earnings growth. Hafary’s ability and willingness to pay out generous dividends payout make the stock compelling. We estimate a dividend payout of 32.3% - 65% for FY13F- FY15F. Flushed with cash, more dividends to come? As at 1HFY13, Hafary received about S$37.8m from the sale of its Aljunied property. With the remaining proceeds of S$24m expected to be received by 2HFY13, we estimate Hafary to have a cash chest of S$31.8m (or S$0.074/share).

Although Hafary has already declared an interim dividend of 2.75 cents/share for FY13, given its generous payout history and an expected stellar performance in FY13 (1HFY13 adjusted net profit: +51.4% yoy), we believe there is room for more dividends. Hence, we raise our full-year dividend forecast to 4.25 cents/share, or a payout ratio of 32.3%.

Our View

Strong earnings growth momentum to continue. Hafary’s status as a major supplier of tiles in Singapore and its participation in HDB’s BTO and upgrading projects will continue to drive its earnings. We forecast a 3-year EPS CAGR of 21.3% for FY12-15. The successful establishment of International Furniture Park may also open the regional market to Hafary, providing a greater avenue of growth for the company.

Maintain BUY with a SOTP-based target price of S$0.33. Potential catalysts include strong earnings growth and special dividend payouts.

For full UOB KH report, click here.

Recent story: HAFARY: 10% dividend yield now but can it be sustained?

For full UOB KH report, click here.

Recent story: HAFARY: 10% dividend yield now but can it be sustained?

Deutsche says SPH 9M13 boosted by new accounting policy but operationally subdued

Analyst: Wei-Shi Wu

SPH's 9M13 was boosted by a S$111m gain as the company transitioned to fair value accounting for its investment properties (from cost model). This caused a 22% jump in 9M13 reported NPAT to S$358m.

Excluding the fair value gain, we estimate 9M13 underlying NPAT fell 16% YoY. We raise FY13e reported NPAT to reflect the accounting change but lower FY14-15e forecasts to reflect weakness in the core media business.

Near-term share price will likely be supported by anticipation for the special dividend, Hold.

Analyst: Wei-Shi Wu

SPH's 9M13 was boosted by a S$111m gain as the company transitioned to fair value accounting for its investment properties (from cost model). This caused a 22% jump in 9M13 reported NPAT to S$358m.

Excluding the fair value gain, we estimate 9M13 underlying NPAT fell 16% YoY. We raise FY13e reported NPAT to reflect the accounting change but lower FY14-15e forecasts to reflect weakness in the core media business.

Near-term share price will likely be supported by anticipation for the special dividend, Hold.

Underlying operational performance fairly weak: SPH’s 9M13 reflected sustained pressure in the core media business, with newspaper and magazine revenues falling 4.2% YoY to S$747m.

This was exacerbated by a 15.2% YoY reduction in other revenues due to weakness in the book publishing business and timing of exhibitions.

This was exacerbated by a 15.2% YoY reduction in other revenues due to weakness in the book publishing business and timing of exhibitions.

We hosted SPH at a post-results lunch with investors. Key areas of discussion

included the strategic direction of SPH's business, outlook for the core media

segment, the company's property strategy and dividends. An important takeaway from the meeting was management's comment that SPH would have the

capacity to sustain its current dividend yield post the REIT IPO. We believe the

proposed special dividend will provide near-term share price support, Hold on valuation.

SPH’s ability and intention to maintain dividend yield highlighted We hosted SPH’s CFO Mr Tony Mallek and Senior Vice President of Finance

Ms Babsy Young at a lunch with investors. Of key interest to investors was

SPH’s dividend outlook post the REIT IPO. In relation to this, management

reiterated SPH’s dividend policy and highlighted the company’s ability and

intention to maintain its dividend yield. Management also expressed its

commitment to re-invest the c.S$700m REIT IPO proceeds into four key areas

of growth: (1) property, (2) magazines, (3) exhibitions, and (4) digital.

Specifically for property, the company’s focus remains on retail assets, with

management citing potential acquisitions up to S$500-600m in size. On a 5-

year horizon, management sees SPH as remaining a media-focused business.