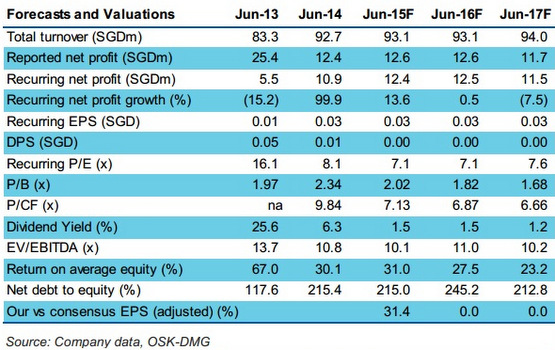

Excerpts from analyst's report

OSK-DMG starts coverage of Hafary Holdings with 35-c target

Analysts: Sarah Wong & Terence Wong, CFA

♦ Market leader in tile supply in Singapore, with 34 years of track record. Hafary supplies a wide array of tile and flooring products for home renovation, private property development and public sector refurbishment needs. Founded in 1980, Hafary has demonstrated a strong track record in identifying interior decorative trends and managing working capital and inventory. Its tile supply business typically yields 8-12% net margins and we forecast stable revenue and earnings trends from FY15-17F.

OSK-DMG starts coverage of Hafary Holdings with 35-c target

Analysts: Sarah Wong & Terence Wong, CFA

|

We initiate coverage on Hafary Holdings “Hafary” with a BUY rating and a SOP-derived TP of SGD0.35, representing an upside of 67%. Hafary is a market leader in tile supply in Singapore, offering a wide range of tile and related products for home renovation, private property development and public sector projects. Hafary also owns a portfolio of six property assets with a potential valuation surplus of c.SGD58.1m. |

♦ Market leader in tile supply in Singapore, with 34 years of track record. Hafary supplies a wide array of tile and flooring products for home renovation, private property development and public sector refurbishment needs. Founded in 1980, Hafary has demonstrated a strong track record in identifying interior decorative trends and managing working capital and inventory. Its tile supply business typically yields 8-12% net margins and we forecast stable revenue and earnings trends from FY15-17F.

Hafary CFO Jackson Tay shows off some expensive tiles in Hafary's showroom. NextInsight file photo.♦ An undervalued portfolio of six property assets. Hafary has accumulated five properties in Singapore and one in China over the past four years, mainly for warehousing purposes.

Hafary CFO Jackson Tay shows off some expensive tiles in Hafary's showroom. NextInsight file photo.♦ An undervalued portfolio of six property assets. Hafary has accumulated five properties in Singapore and one in China over the past four years, mainly for warehousing purposes.The portfolio of properties has a book value of SGD61.3m, with a valuation surplus of another SGD58.1m. Most of the valuation surplus would pertain to two properties: 105 Eunos Ave 3 and 18 Sungei Kadut Street 2 (which will undergo redevelopment).

♦ Initiate BUY with SOP-derived TP of SGD0.35. We value Hafary using SOP, valuing its tile supply business and property development assets separately. We peg its tile supply business to 10x FY15F P/E, deriving a FV of SGD71.6m. We then add on the book value and valuation surplus of the properties, minus the debt pertaining to property. We derive a FV of SGD152.2m or TP of SGD0.35 per share on Hafary.

♦ Risks include susceptibility to a slowdown in construction and renovation activities in the local market, credit risks and default in payments by customers, as well as inventory obsolescence risks.

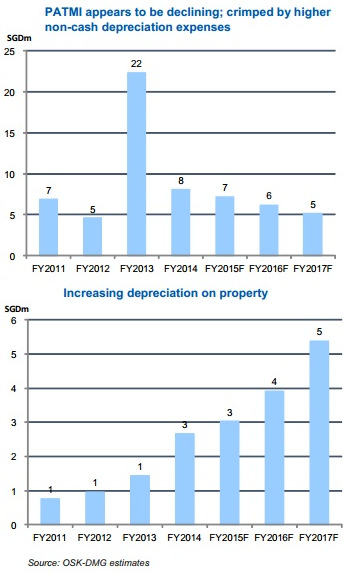

Net earnings may be crimped by a higher depreciation on the properties. On the other hand, PATMI may appear to be declining even though gross profits are likely to remain stable at c.38.4% gross margins.

This is due to a higher depreciation cost, which is non-cash in nature, on its expanding portfolio of properties.

We forecast gross profits to be c.SGD36m per annum over FY15-17F.

Our PATMI forecasts are c. SGD7.2m/6.2m/5.2m for FY15/16/17F, on higher depreciation numbers.

Net earnings may be crimped by a higher depreciation on the properties. On the other hand, PATMI may appear to be declining even though gross profits are likely to remain stable at c.38.4% gross margins.

This is due to a higher depreciation cost, which is non-cash in nature, on its expanding portfolio of properties.

We forecast gross profits to be c.SGD36m per annum over FY15-17F.

Our PATMI forecasts are c. SGD7.2m/6.2m/5.2m for FY15/16/17F, on higher depreciation numbers.

Full report here.

Recent story: HAFARY: "It stood out due to its considerable dividends"

the second set of tables (PATMI & depreciation) are the ones that are most relevant, and they clearly point to a declining Profit After Tax. However, how did the analyst come up with a rising depreciation trend? Based on assets yet to be purchased but presumed to be ?