At the 3Q results briefing at Carlton Hotel: Executive chairman & CEO Chen Qiu Hai (centre) with Kim Chew (finance manager) and Yang Lin (CFO). Photo by Leong Chan TeikWHAT ARE THE business possibilities that Yamada Green Resources might have with well-known Singapore entrepreneur Sam Goi?

At the 3Q results briefing at Carlton Hotel: Executive chairman & CEO Chen Qiu Hai (centre) with Kim Chew (finance manager) and Yang Lin (CFO). Photo by Leong Chan TeikWHAT ARE THE business possibilities that Yamada Green Resources might have with well-known Singapore entrepreneur Sam Goi?

That was one of the interesting questions that investors and analysts wanted to hear answers to during a results briefing by Yamada recently.

In February this year, Yamada had placed out 82.187 million new shares, representing 16.49% of the enlarged share capital of the company, to a special purpose vehicle of Sam Goi.

Just last week, on May 15, Mr Goi's son, Goi Kok Neng, 36, was appointed to the board as a non-executive director.

For its 3Q (Jan-March 2013), Yamada achieved revenue of RMB240.7 million, down 0.9% year on year.

Net profit fell 37.1% to RMB51.3 million.

Details of the financial performance are available from the company's press release here.

Below are some of the questions asked at the results briefing, with answers coming from Mr Chen Qiu Hai, the executive chairman and CEO, and Yang Lin, the CFO.

We highlight an interesting insight from Mr Chen into the direction of the company: "My style of management is unlike the typical Chinese firm, which goes for aggressive expansion. To me, long-term business growth is more important. After 3 years of listing (2010 IPO: 22cts @ 4-5X PE), the company is now ready to embark on its expansion phase. I hope FY2013 marks a historical low in earnings for Yamada."

>> Core business segment: Shiitake mushroom cultivation

Q: Why did revenue from self-cultivated shiitake mushrooms decrease year-on-year in 9M2013?

During 2Q2013, an unusually cold winter resulted lower production volume. ASP was unchanged from last year.

Q: What are your mushroom prices?

Ex-farm price is about Rmb 6.8 per kg. Supermarket retail price is about double of that.

Q: Have you ever considered direct sales?

We started appointing 12 exclusive direct sales distributors with exclusive retail outlets last year. So far, they have met our sales targets. We appointed them because we need to collaborate with local distributors in order to expand to regions such as Jiangsu, Zhejiang and Shanghai that are outside Fujian.

As mushrooms are perishable, refrigerated transportation is needed and it is often short in supply. By appointing specialized distributors, we ensure adequate supply to regions that are far away from Fujian.

Q: Do you wish to buy more land?

In China, agricultural land can only be rented, not purchased. Our business is not like other agricultural businesses because we use logs, not land. We have room to stack the logs and less land is needed.

Q: Have you considered using greenhouse plantation to lower weather risk?

Greenhouse or indoor cultivation is not suitable for mushrooms because of its cost structure. As mushrooms are cultivated only once a year, the relatively high costs associated with building maintenance and air-conditioning makes it commercially not viable.

>> New acquisition: bamboo plantation

Q: How much did you pay for your new bamboo plantation and how much do you expect it contribute to group revenue?

Additional revenue and cashflow: Bamboo trees can be harvested from July to December while the bamboo shoots from Jan to April.Our year-end is in June and we acquired the plantation in April 2013 for Rmb59 million (we have paid cash for two-thirds in Apr 2013 while the balance will be paid by year 2021). We will be able to start generating revenue in 1HFY2014.

Additional revenue and cashflow: Bamboo trees can be harvested from July to December while the bamboo shoots from Jan to April.Our year-end is in June and we acquired the plantation in April 2013 for Rmb59 million (we have paid cash for two-thirds in Apr 2013 while the balance will be paid by year 2021). We will be able to start generating revenue in 1HFY2014.

The revenue will be from mature bamboo trees, spring bamboo shoots and winter bamboo shoots. Initial estimates indicate revenue from these 3 products combined will be Rmb 20 million to Rmb 24 million.

Other than capex, costs of operation will include operating expenses, labor and transportation and logistics. Winter bamboo shoots command a good price and are normally sold to large cities like Shanghai. There are also logistics costs for the sale of mature bamboo trees, and daily cultivation and maintenance costs throughout the year.

Q: Why did you acquire the bamboo plantation?

Our mushroom business encompasses upstream, midstream and downstream processes of agricultural cultivation, processing and distribution. Instead of cultivating mushrooms on land, we use logs.

Early in my career, I worked with the Japanese in import-export trading and processing of bamboo shoots. When I started a factory in 1998, it was to process mushrooms. The supply chain of bamboo shoots in midstream processing and downstream distribution is already mature but the industry lacks bamboo plantations. That is why we went in.

Secondly, bamboo plantations are environmentally friendly and thus have government support. I expect increasing government regulation to promote environmentally friendly industries.

Spring bamboo shoots are raw ingredients for our processed food. Mature bamboo trees can be sold for manufacturing building materials, textiles, paper & pulp, etc. The bamboo industry is a mature market, with major hubs in Fujian, Zhejiang and Jiangxi. Prices for bamboo are stable. We expect gross margins of about 30% or more for this segment.

The sales peaks of our various segments are staggered over the different months in a year, and this will smooth out our quarterly revenue and cashflow. I hope to expand our convenience food segment next year.

I hope Yamada's share price can double or triple.

Q: Do you need to build your own bamboo product sales network?

The villagers whom we leased the bamboo plantations from are not aggressive entrepreneurs who build their own sales channels. We will work with the farmers and build our sales network.

Q: What license is needed for harvesting of bamboo plantations?

We need to apply for licenses for harvesting the recently acquired plantations.

Unlike eucalyptus trees that take an entire year to grow a few meters, bamboo trees in the ground can reach 5-10 meters in as little as one month. We have leased a mature bamboo plantation. We estimate that every year, we can harvest approximately one third of the bamboo plantation.

We intend to use spring bamboo shoots as feedstock for our factory processing division. We cost our bamboo shoots based on market price. If we expand our plantation resources, we may sell bamboo shoots.

>> Sam Goi as a shareholder - and business partner?

Q: Why did you sell the placement shares to Mr Goi at such a low price (11.9 cents / 10% discount to market price)?

Yamada shares trade at a PE of about 10X based on the past 4 quarters of earnings. The market cap is S$112 million. Chart: BloombergHis strategic interest will improve investor perception of our market value as well as help our group expansion.

Yamada shares trade at a PE of about 10X based on the past 4 quarters of earnings. The market cap is S$112 million. Chart: BloombergHis strategic interest will improve investor perception of our market value as well as help our group expansion.

Q: How much interest does Mr Chen have in Yamada currently and how does the shareholding structure change after your recent placement?

Sam Goi holds 16.49% of Yamada's enlarged share capital while Chen Qiu Hai holds about 50%.

Q: How does the placement benefit the company?

Firstly, there is a boost from the funds injection. No concrete collaboration plans have been made, but Mr Goi's representatives have visited our factory and met our sales network. He is in the chilled food business while we are in food processing. I envision that we can supply fresh produce such as mushroom and bamboo shoots to him as he has a factory in China. He has a dumpling product for which we can supply ingredients for its fillings.

Q: Has Mr Goi seen your plantations?

No, he has not seen them as they are way out in rural far-flung locations, but his representatives have seen our factory.

Q: What are the business possibilities of collaboration with Sam Goi?

We hope to collaborate in the future. Many investors are inquiring about this and we take your feedback seriously. We want to invest for the long haul.

Q: Can you give us a summary of your fund raising activities to-date for IPO, placement and use of proceeds?

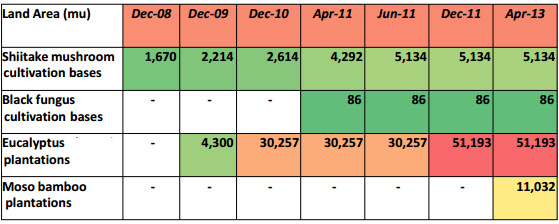

IPO net proceeds S$13.8 million. Our placement to Sam Goi: S$9.4m. We have net cash of RMB 40 million as at end-March 2013 and no bank borrowings.  Agricultural assets of Yamada: 1 football field is equivalent to 10.5 mu.

Agricultural assets of Yamada: 1 football field is equivalent to 10.5 mu.

>> General -- dividends, financials, etc

Q: Are there any plans to pay dividends this year?

Yes, we are considering a dividend payment. Whether that materializes will depend on our Group’s operating results, financial conditions, cash requirements including capital expenditure and other factors deemed relevant by our Directors.

Q: Do you think it is easier to run an agricultural business or manage a food brand?

The agricultural aspect is the foundation of food business. Managing food brands are for the long-term when a business has matured. The wholesome approach is to integrate agricultural production with brand management.

Q: Does Yamada have its own brands?

Yes, we have brands for convenience food products such as Konjac instant noodle, Konjac drinks and dessert, and processed foods such as dried mushroom, water boiled bamboo shoots and dried black fungus.

Konjac is a second product we have that has huge growth potential. Its market is very mature in Japan and Taiwan. It is more developed at China's east coast regions. It has room for growth in inland Chinese cities. This product has health and slimming benefits through the activation of the detoxification process in our digestive system. We are distributing this product currently, and plan to go upstream in this segment, if necessary.

Q: Do you think zero gearing is a good position?

It is very easy for us to get bank loans because of our strong cash position, but I do not wish to use debt financing because it will lower our risk appetite. We are taking some loan facilities to maintain a long-term relationship with banks. Our bankers have advised that we need a good loan repayment track record should we really need a huge loan in the future.

Q: Why did you list in Singapore in 2010 when the stock market was so depressed?

In life, sometimes providence plays a part. Singapore has many professionals while China has a mixture of entrepreneurs and professionals.

Recent story: YAMADA GREEN RESOURCES harvests its own eucalyptus trees for sawdust