SINO GRANDNESS stock has astonishingly doubled in price in the last four months as it delivered sharp earnings growth for FY2012 and took strides towards spinning off its subsidiary, Garden Fresh, at possibly lofty valuations of around 20x PER in Hong Kong.

SINO GRANDNESS stock has astonishingly doubled in price in the last four months as it delivered sharp earnings growth for FY2012 and took strides towards spinning off its subsidiary, Garden Fresh, at possibly lofty valuations of around 20x PER in Hong Kong.The stock price gain likely was a key factor for some major changes in the shareholding structure.

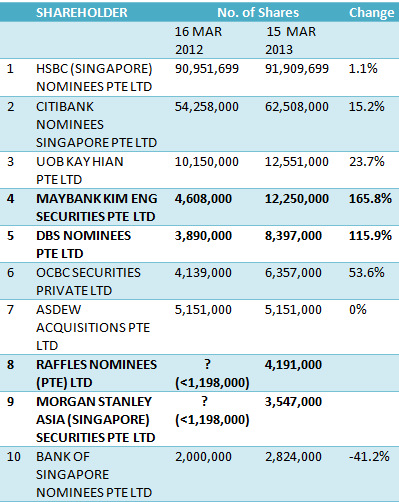

We compared Sino Grandness' shareholder lists from its 2011 and 2012 annual reports.

According to the 2012 annual report, as of 15 March 2013, the shareholding of many top holders has increased, with the stark exceptions of Phillip Securities and a related entity of it.

These top shareholders are stock brokers and nominee accounts held by stock brokers, as our table shows.

Item No. 7 above: Not reflected in the 2012 annual report is Asdew Acquisitions' subsequent sharp increase in shareholding -- from 5.15 million shares to 18.8 million via open market purchases of 5.65 m shares and placement of 8 million shares in March 2013.> In percentage terms, Maybank Kim Eng Securities Pte Ltd leads the pack with a 166% jump in shareholding (see details in item No. 4 in the table).

Item No. 7 above: Not reflected in the 2012 annual report is Asdew Acquisitions' subsequent sharp increase in shareholding -- from 5.15 million shares to 18.8 million via open market purchases of 5.65 m shares and placement of 8 million shares in March 2013.> In percentage terms, Maybank Kim Eng Securities Pte Ltd leads the pack with a 166% jump in shareholding (see details in item No. 4 in the table). Maybank Kim Eng Securities held almost as much as UOB Kay Hian -- these are the top 2 stockbrokers in terms of shareholding.

The rise could be due to investors holding their stock under the stockbrokers' accounts.

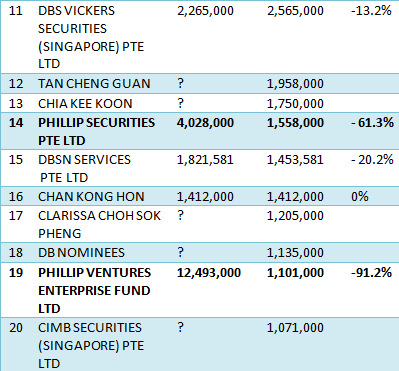

> In sharp contrast, Phillip Securities sold down its holding by 61% (see item No. 14) while Phillip Ventures Enterprise Fund (PVEF) slashed its holding by 91%

PVEF is a private equity investment fund managed by Phillip Private Equity Pte Ltd on a full discretionary basis.

The shareholders of PVEF comprise mainly institutional investors and high net worth individuals.

PVEF is a private equity investment fund managed by Phillip Private Equity Pte Ltd on a full discretionary basis.

The shareholders of PVEF comprise mainly institutional investors and high net worth individuals.

A pre-IPO investor of Sino Grandness, PVEF sold 7.9 m vendor shares during the IPO and continued to hold 18.3 million post-IPO -- but is now left with a meagre 1.1 million shares.

Jack Huang, CEO of Sino Grandness. NextInsight file photo.> Morgan Stanley and Raffles Nominees appear in the 2012 annual report but not in the 2011 report.

Jack Huang, CEO of Sino Grandness. NextInsight file photo.> Morgan Stanley and Raffles Nominees appear in the 2012 annual report but not in the 2011 report. They may have held shares previously but the number would be below 1.198 million, which was the figure for the No.20 shareholder at the bottom of the 2011 list. (see items 8 and 9 in the table above).

> Based on the annual reports 2011 and 2012, the number of shareholders has shrunk dramatically by 31% from 1,258 to 864.

It could be that the retail investors had taken profit, selling to investors who park their stock with stock brokers and to other investors who hold their shares in nominee accounts.

The No.1 shareholder remains Sino Grandness CEO Jack Huang who owns 117,748,280 shares, unchanged from a year earlier.

His stake of 44.40% as at 15 March 2013 was held under various accounts -- either stockbroker accounts or nominee accounts -- as his name does not appear in the list and no single stockbroking firm or nominee account holds this entire 117.8-m share stake.

_____________________________________________________________________________

Recent stories:

SINO GRANDNESS, FORTUNE REIT: What analysts now say

8 STOCKS that inspire investor optimism for 2Q