Photo: Longfor

Goldman Sachs: CHINA PROPERTY to See Further Price Upside

Goldman Sachs said Mainland China’s real estate has will see further upside potential driven by price increases.

“We think the strong sales so far this year will be maintained into the fourth quarter, and that the sequential sales decline in September does not indicate falling demand.

“Instead, we think the monthly fall in September is due to a high base of comparison and fading seasonality of sales in major cities,” Goldman Sachs said.

The research house said that overall, sales volumes have shown divergent trends, with tier-1 cities still at their lows since 2008 and most others at the mid-point at best.

“We expect such stable volume outlook to drive property price to recover from the 2Q trough level, but slowly.

“We believe developers are unlikely to regain strong pricing power in the coming quarters, given: “1) underlying demand, the main driver for volume recovery, is affordability sensitive; 2) we estimate it would take another 1-2 quarters for developers to repair balance sheets to a healthy level, partly due to still-high financing costs and a longer cash collection cycle now vs. previous years; 3) new sales launches could rise further in 2H12 given construction in the pipeline is sizable, not to mention units already launched but unsold are still at a historical high.”

Key drivers for 2013

On the reform front, property tax presents a near-term risk, but a long-term positive.

“We think property tax is a way to normalize tightening policies in the housing sector, i.e. replace home purchase restrictions.

As such, we think it should be positive in the longer run, but we cannot rule out the possibility that there could be a certain period when both the HPR and a property tax are in place, providing downside risk to our volume expectations,” Goldman Sachs said.

Cyclical drivers

“We believe our offshore coverage universe has largely priced in a strong volume recovery.

In our view, further upside would require sustainable property price appreciation, which we think is unlikely in the near term given the low visibility around further potential easing measures by the government.”

Goldman Sachs’ current earnings estimates are about 6%/11%/21% below consensus for 2012E-2014E.

Photos: Greentown

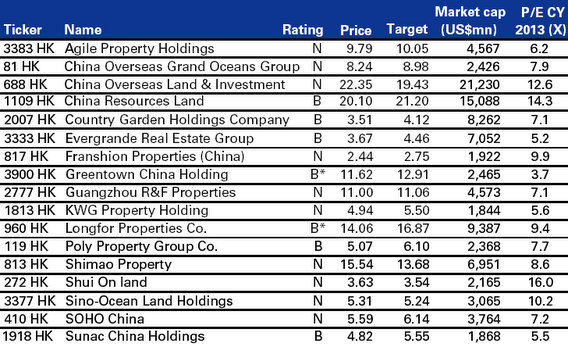

Stock recommendations:

Buy #1: Longfor (HK: 960)

“We expect Longfor to deliver stronger-than- peer contract sales growth in 2013 among our coverage universe on its opportune land banking since 2Q12, strong brand equity, and execution ability.

“With 16 new projects added YTD, we estimate the number of key projects selling in 2013E will increase by 28% to 59 from 46 in 2012E, representing the highest growth among our offshore coverage universe.

“Given ongoing uncertainty around government policies and the outlook for property prices, we think an expanded project pipeline is required to grow contract sales in 2013E and drive share price outperformance

Buy #2: Greentown (HK: 3900)

“We expect mean reversion of Greentown’s valuation on its earnings/margin normalization after the repair of its balance sheet.

We expect Greentown to continue its strong sales performance, which should serve as a positive catalyst for the stock. We now project presales in FY12 at 15% higher than the company’s target,” Goldman Sachs said.

Greentown shares have risen around 87% since the announcement of its strategic alliance with Wharf and the research house said it believes further re-rating will be realized, driven by better-than-expected earnings.

See also:

What Slowdown? CHINA NEW TOWN Lands 533 Mln Yuan Deal

CHINA NEW TOWN Inks Landmark Beijing Fund Deal

Moody’s: CHINA PROPERTY Upgraded to ‘Stable’

Moody’s Investors Service says that improving sales and access to funding for China’s listed property developers have convinced the ratings agency to upgrade the sector to ‘Stable’ from ‘Negative’.

The revised outlook reflects the ratings agency’s expectations for the fundamental business conditions in the industry over the next 12 to 18 months.

“Property sales to improve despite a decline in prices.

“The stable outlook for the industry reflects our expectation that property sales will grow in the single digits – in percent terms – year-on-year over the next 12 month,” Moody’s said.

The researcher added that solid underlying demand, continuing urbanization, easing mortgage financing for first-time home buyers, and the increasing development of mass-market housing should drive sales and transaction volumes for property developers.

“But, owing to the focus on mass-market housing rather than luxury homes, the average selling prices will likely decline mildly year-on-year.”

Moody’s said certain developers will see sales increases including China Overseas Land and Investments Ltd (Baa2 stable), Longfor Properties Company Ltd (Ba2 stable), Central China Real Estate Ltd (Ba3 stable), Country Garden Holdings Co Ltd (Ba3 stable), Shimao Property Hldgs Ltd (Ba3 stable) and Evergrande Real Estate Group Ltd (B1 stable) should benefit from their focus on the mass market and their well-established market position.

“The Chinese government is unlikely to impose further regulatory restrictions to tighten the property market, as the existing restrictions on home purchases have been effective in controlling speculation and reining in property prices.

“In addition, a further cut back in investment in the sector would weigh on an already slowing Chinese economy,” Moody’s added.

Developers that focus more on mass-market products and those with well-established market positions should see their contract sales increase over the next 12 months.

These companies include China Overseas Land and Investments Ltd (Baa2 stable), Longfor Properties Co Ltd (Ba2 stable), Central China Real Estate Ltd (Ba3 stable), Country Garden Holdings Co Ltd (Ba3 stable), Shimao Property Hldgs Ltd (Ba3 stable) and Evergrande Real Estate Group Ltd (B1 stable).

“By contrast, small companies that lack strong brands to promote the sale of luxury housing units or have less flexibility in transforming their business models to focus on the mass market will continue to face downward pressure on their sales.”

Moody’s said these companies include Zhong An Real Estate Ltd (B2 negative), Coastal Greenland Ltd (B3 negative), SPG Land (Hldgs) Ltd (B3 negative) and SRE Group Ltd (B3 negative).

See also:

SING HOLDINGS: Stock Price Is No Reason For Shareholders To Sing

HOUSE MONEY: Top 500 PRC Developers Assets Up 50% To 5 Trillion Yuan

JP Morgan: AGILE Best PRC Property Pick

JP Morgan said that Agile Property (HK: 3383) offers the most upside potential among Hong Kong-listed real estate firms.

The China property sector has rallied 56% YTD and has outperformed the MSCI China by 51%.

“After rolling over of PT timeframes and revising our PTs based on FY13E EPS, we suggest the sector is subject to 1% share price downside, and expect laggards to continue the valuation catch-up.

“We believe Agile offers most upside, followed by KWG (HK: 1813) and Evergrande (HK: 3333).

Earnings growth beyond FY13 is visible but placement risk exists.

“We believe big caps have fairly priced in the positive growth outlook and even margin expansion opportunities, while mid/small-caps have better share price upside potential.

“Among the mid/small-caps, we expect Agile to outperform in the near term as sales could improve significantly in the last two months with new project launches finally. We also believe KWG and Evergrande also offer greater upside potential given current low valuations.”

See also:

Hong Kong CONDOS, China CARS: Latest Happenings...

THE HOUSE OF TRUTH: China Property Unstoppable?

Credit Suisse: Staying ‘Underweight’ on PRC PROPERTY

Credit Suisse said it is maintaining its “Underweight” recommendation on Mainland China’s property sector.

“In the land market, 87 residential sites were sold over the past week with an average transacted premium to opening prices of 13%.

“Poly (HK: 119) bought three sites with GFA of 164,698 sqm at an average cost of Rmb10,455 /sqm, while Gemdale (SHA: 600383) bought land in Shanghai with GFA of 103,988 sqm at an average cost of Rmb5,578/sqm,” Credit Suisse said.

The China Index Academy just released the November 100 city housing index, with the average primary housing price up 0.26% MoM (vs +0.17% in Oct) but -0.46% YoY (vs -0.99% in Oct) to Rmb8,791/sqm.

Sixty of the 100 cities’ housing prices increased MoM in Nov (vs 56 cities in Oct).

“For the week of 26 Nov–2 Dec 2012, primary market volumes in the major cities Credit Suisse tracks dropped 1% WoW but increased 55% YoY.

Specifically, volumes were +9% WoW and +117% YoY in Beijing, -1% WoW but +45% YoY in Shanghai, -4% WoW but +86% YoY in Shenzhen, and +11% WoW and +106% YoY in Guangzhou.

Primary housing transaction volumes YTD increased 38% YoY.

In the land market over the past week, 87 residential sites were sold with an average transacted premium to opening prices of 13%.

Poly bought one site in Hangzhou (Zhejiang Province) with GFA of 101,796 sqm at an average cost of Rmb9,299/sqm and two sites in Guangzhou (Guangdong Province) with GFA of 62,902 sqm at an average cost of Rmb12,325 /sqm.

Gemdale bought land in Shanghai with GFA of 103,988 sqm at an average cost of Rmb5,578/sqm

See also:

THROUGH THE ROOF: China Housing Mkt Hits 17-Month High

JIM ROGERS Tips On China: Gold Or Homes?