Daiwa: New HK Administration Seen as Property Friendly

Daiwa Capital Markets says the new administration in place in Hong Kong may not be targeting property prices.

“Policy risk concern on HK developers could lessen, and there is room for improvement in developers' valuations.

"We expect the new administration’s housing policy to unfold gradually in the coming months,” Daiwa said.

The research house said it believes while concerns that the new administration will crack down on property prices are widespread, Daiwa has not yet found evidence suggesting that this will be the ultimate orientation.

“While we expect it to address the issue of younger people or lower income groups not being able to buy property, we do not think this necessarily means the new administration will have such a policy orientation.

“Indeed administration chief C.Y. Leung has publicly noted that he does not think it is necessary to bring down property prices to make them affordable for the ordinary person. Nor does he plan to increase the supply of land to exert downward pressure on property prices.”

These are all positives for Hong Kong’s developers.

Is Hong Kong on its way to being a property market resembling London and New York City?

“In our view, the very high prices achieved by some units in Hong Kong may be the market’s way of saying that the current stock of prime residential units in Hong Kong is just too small relative to the number of wealthy persons who want to own units in Hong Kong.

“As such, a notable increase in larger units in the New Territories could resemble a “soft landing scenario” for the Hong Kong residential property. Our read is that in London or New York City, many local people live further away from the centre for a better living environment, and accept commuting to work for one hour or more,” Daiwa said.

It added that it thinks this may be the direction Hong Kong is headed, and this could well be reinforced by the new administration’s housing policy.

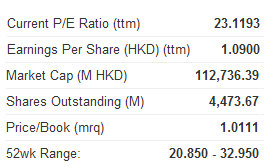

“The policy risk concerns have resulted in Hong Kong developers trading currently at valuations seen in past crises. We expect the discount on Hong Kong developers to narrow, and we think now is a good time to buy developers such as Sino Land (HK: 83, ‘Buy’), Cheung Kong (HK: 1, ‘Buy’) and Henderson Land (HK: 12 HK, ‘Buy’).

“We differ from most peers in that we believe that the market’s concern over policy risk is overdone.”

See also:

THE HOUSE OF TRUTH: China Property Unstoppable?

Jefferies: Value Emerging in HK PROPERTY vs. Near-Term Headwinds

Jefferies said it believes near-term market volatility will still drive sector sentiment, but it sees support on solid industry backdrop.

“Policy overhang could hinder developer performance despite value emerging at current levels. We advise investors to overweight developers, when we see: 1) policy clarity, 2) improving transactions and 3) distressed valuation (down 10-15%).

“Our top picks are now Hang Lung Properties (‘Buy’) and Kerry Properties (‘Buy’) since valuation is attractive and their businesses are on a sound track.”

Developers' valuation testing trough

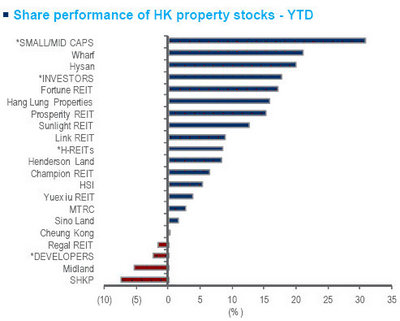

Hong Kong developers are now trading at low levels, with average NAV discount at ~40%, and 0.7x PB, close to a previous trough in 2008.

“We believe developers have discounted the risks investors are concerned about. In the same context, landlords/REITs are trading at a richer valuation than developers.

“Their outperformance over developers may be sustained, supported by higher income visibility and minimal policy impact,” Jefferies said.

But the research house said this situation may reverse when it sees more clarity on policy outlook.

Liquidity Still Key

“We believe fund flows will continue to be the leading indicator, signaling interest in allocations into assets,” Jefferies said.

Amid the abundant liquidity in Hong Kong, home prices in 2H11 only corrected 5-7% versus 17-23% in 2H08.

Given that 60% of Hong Kong homeowners have no mortgage or loan, the strong market liquidity in Hong Kong would support home prices despite increasing supply, the research house said.

“We are still cautious on developers but prefer those with China commercial exposure,” Jefferies said.

Despite the valuation mismatch, the research house said it remains cautious on Hong Kong developers mainly due to the policy overhang and volatile sentiment.

“We expect to see developers’ outperformance when the policy overhang is removed. Now, we see an attractive entry point for Hong Kong developers with China commercial exposure.”

See also:

THROUGH THE ROOF: China Housing Mkt Hits 17-Month High

Bocom: Staying ‘Market Perform’ on China Property

Bocom International said it is maintaining its “Market Perform” recommendation on China’s real estate sector.

Most the developers recorded robust m-o-m growth in contracted sales revenue in May, which rose 15% m-o-m, or 26% y-o-y, on average during the period.

Contracted ASP increased by 2% m-o-m, but dropped 1% y-o-y, in May.

Excluding the outliers, ASP dropped 3% m-o-m. Also, 13 out of 25 developers recorded m-o-m decline in ASP, and year-to-date sales progress is back on track.

Meanwhile, January-May sales revenue rose 4.2% y-o-y, the first time showing y-o-y growth this year.

The developers achieved a lock-in ratio of 37%, which was similar to the 38% achieved in Jan-May 2011.

“Looking forward, we expect the sales momentum to sustain in June, despite a possible slowdown in m-o-m growth rate. It is mainly attributable to both the sentiment boost and large sellable volume,” Bocom said.

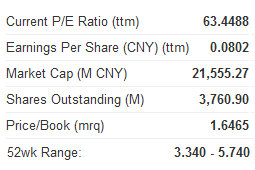

The sector is currently trading at an average 46% discount to 2012E NAV, which was above the average of the discount range of 40-63% during 2010-11.

“We think the strong contracted sales have been somewhat priced in. We see limited opportunity of policy relaxation within this year and a breakthrough in valuation,” the research house added.

See also:

HOT PROPERTY: PRC Real Estate Shares Up 20% This Year

Yuanta: Chongqing Auto Subsidies to Stay Local

Yuanta Research said that the PRC city of Chongqing’s offer for trade-in subsidies will only benefit local area automakers and investors in plants elsewhere should not get their hopes up for similar measures.

The Chongqing City Government has announced an ‘Old for New’ trade-in subsidy on new vehicle purchases. The subsidy will be 6% of the selling price of a qualifying vehicle up to a maximum of 3,000 yuan,” Yuanta said.

Qualifying vehicles include smaller commercial vehicles with engine displacements below 1.6L made in Chongqing, with the subsidy program set to expire in February 2013.

“In addition, A-share listed Chongqing Chang'an Auto (SZA: 000625) will give an additional 4% subsidy for its branded vehicles sold.”

The fact that Chongqing -- a municipality directly reporting to Beijing -- initiated its own subsidy program suggests that the central government may not necessarily be initiating a countrywide subsidy program in the short term, contrary to general expectations,” the research house added.

“To us, the subsidies seem more like an attempt by the Chongqing government to help Chongqing Chang’an, a local area SOE that has been losing significant market share over the past year. We do not expect other cities to follow Chongqing’s lead for now.”

See also:

CHINA AUTO SECTOR ‘Market Perform