Macquarie International Infrastructure Fund (MIIF), a private equity fund listed on the SGX main board, is due to hold a special general meeting (SGM) today (Wed December 5) to consider the appointment of three new directors nominated by two institutional shareholders owning more than 10 per cent in the Bermuda-incorporated fund.

I received a call late last week from MIIF's chairman, Heng Chiang Meng, a former MP, to support the present board of MIIF in rejecting the resolutions to appoint new directors. Mr Heng spoke at length about the achievements of the present board and management of MIIF and felt the SGM and its resolutions were unnecessary.

Earlier this week, I also received a called from MIIF's investor relations agency asking which way I stood on the resolutions to be voted on at the SGM.

I question the time, energy and money being spent by the board and management of MIIF in lobbying against the move by Metage Capital and Lim Advisors to appoint three new directors to the board of MIIF. To date, no less than two letters and a 20-page document have been sent to shareholders of MIIF to ask them to vote against the proposed appointment of new directors.

One letter from the board and one from the requisitioners of the SGM would have sufficed. Shareholders are intelligent enough to decide which way they want to vote, after weighing the arguments of both sides.

In MIIF's case, the four main points of the board against the requisitioners of the SGM do not hold water at all. I have been a shareholder of MIIF for many years, and my experience of the way the company is managed and how shareholders are treated has been very disappointing. For example, a number of issues relating to management fees, lack of action on their investments and low market price of the shares were raised by shareholders at the last AGM.

To our dismay, the minutes of the AGM did not report these issues at all; management appeared to have ignored them. Chairman Heng refused to incorporate the Q and A into the AGM minutes for dissemination to interested parties.

In his latest letter to shareholders, which were advertised in the newspapers at shareholders expense, Mr Heng, representing the Board of MIIF, claims the board has a track record of proactively identifying and implementing options that maximise shareholder value.

The truth is that minority (individual and institutional) shareholders have had a big role in nudging the MIIF management into action. Only on their repeated urgings and pleas, for instance, has the MIIF management shifted the focus of the fund to Asia, after a chequered performance elsewhere. The strategic review announced by the board in June this year was also partly at the behest of shareholders pushing for action to raise the value of their investment which has been languishing for some years.

Following the sale of some non-Asian assets two years ago, the expectation was that MIIF would pay a special, one time dividend. Instead, the board simply paid a higher regular dividend. A lot of the cash has been used to buy back the shares of MIIF, some 140 million units. The effect has been a higher market capitalisation for MIIF which has in turn allowed the managers to earn a higher fee.

I hope all shareholders will make an effort to attend and participate in the EGM at the Novotel Hotel today at 2pm. A change is seriously needed at MIIF and this event is a great opportunity to effect that. Three new independent directors with fresh thinking will certainly make for a more vibrant, shareholder-friendly MIIF.

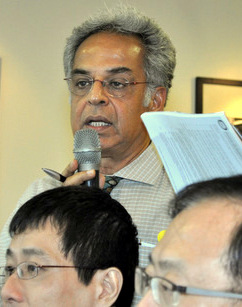

Visit Mano Sabnani's website: http://rafflesia-holdings.com/mano-sabnani.html

Recent article that Mano Sabnani appeared in: @ LION TECK CHIANG's AGM: Air of anticipation over Master Plan 2013