Chemical Industries' stock recently traded at 51 cents, a substantial discount to its NAV of $1.27. Chart: Bloomberg.

Chemical Industries' stock recently traded at 51 cents, a substantial discount to its NAV of $1.27. Chart: Bloomberg.

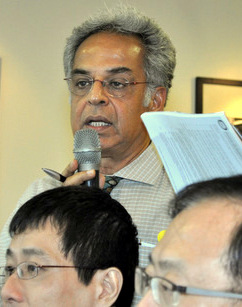

Mano SabnaniCHEMICAL Industries (Far East) is one of the "lost" stocks on the Singapore Exchange (SGX) mainboard. It has a reasonably good core business in industrial chemicals and a few valuable properties. But the company and its management do not seem to know how to maximise value for shareholders.

Mano SabnaniCHEMICAL Industries (Far East) is one of the "lost" stocks on the Singapore Exchange (SGX) mainboard. It has a reasonably good core business in industrial chemicals and a few valuable properties. But the company and its management do not seem to know how to maximise value for shareholders.

I have been a shareholder of the company for many years and have known it since the days I was a reporter in The Business Times and covered listed companies. The company has been undervalued all this time, so much so that one could say it is a value trap. That means good value trapped in an endless time warp. There are a few pressing issues the board of directors would be wise to take a good look at and act on or impose upon management to work on.

- The group's latest results to March 2015 do not make for good reading. Revenue declined further to under S$87 million from about S$100 million previously, no thanks to the loss of a key customer. The company recently said another key customer is set to be lost, but surprisingly went on to say the impact on operating results would not be significant even though this customer accounts for 10 per cent of revenue! How could that be, unless margins are set to improve? If so, that should be said clearly.

- Group profit after tax and minorities declined to S$8.1 million from over S$10 million previously. Segment results show the chlor-alkali business saw a good improvement in profits in the second half year. That is heartening, but the continued loss of customers is worrying. Why is management not shifting operations to where the customers are ? Are they letting the business die a slow death?

- Another issue is the payment of dividends. Earnings per share declined from 13.62 Singapore cents previously to 10.67 Singapore cents for the year ended March. The balance sheet is relatively ungeared and cash held at year-end stood at S$27.3 million. That being the case, it is hard to understand why the dividend proposed remains a paltry 1.5 Singapore cents. Chemical Industries is capable of paying about five Singapore cents per year (50 per cent payout ratio) and shareholders deserve that.

- The company has been holding a few properties for many years. They were valued at about S$41 million at last count. The question is what the management plans to do with these assets other than sitting pretty and collecting rent of a few million dollars a year. Is there potential for asset enhancement or redevelopment? Who is looking at these opportunities?

- So far as I know Chemical Industries, it has always been Lim Soo Peng who has driven the company. He has been there for over 30 years and is now probably in his 80s and earning up to S$2 million a year from the company. There seems to be no successor in sight. How could the independent directors in charge of the Nominating Committee and Remuneration Committee allow this? Mr Lim is the executive chairman and managing director and so he leads both the board and management. It is ALL in his hands. What if he is incapacitated?

|

I intend to attend the forthcoming AGM and raise the above issues. It would be good if more shareholders could attend and ask these and other questions they may have. Chemical Industries needs to be awakened from its long slumber and there is no better occasion than the annual meeting of stakeholders. The company should provide a good venue and adequate time for the AGM.

Mano Sabnani is the Chairman and CEO of Rafflesia Holdings, a company he founded in 2008 to pursue opportunities in the media and financial sectors. He was the Chief Editor of Singapore’s Business Times from 1986 to 1992. From May 1992 to the close of 1995, he was the Managing Editor of The Straits Times. From January 1996 to August 1997, Mano was the Director of Research at DBS Securities. He then moved on to be the MD for Investments at Individual Banking, DBS. Mano also served as the MD for Equity Capital Markets, DBS Bank from July 2000 to June 2001 when he left to join Corporate Brokers International as Executive Director. He was CEO and Editor-in-Chief of daily newspaper TODAY from April 2003. He had developed the paper into the second most read in Singapore by the time he left in Nov 2006.

1. The free cash flow is striking --> The company enjoyed positive net operating cashflow of $15 million a year in fy 14 and fy15. Capex was minimal but... there was debt to pare down.

As a result, cash level increased by around $7 m a year. Now stands at about $27 million. The debt stands at about $30m, so the company is not exactly in a net cash position.

2. The company owns two properties in Upper Circular Rd & Carpenter Rd -- these were revalued at $41 million. (They delivered rental income of about $1.3 million a year. )

These assets already more than cover the market cap of the company. So. the rest of the business which generates $15 million a year in operating cashflow is free!