Excerpts from DBS Vickers' 14-page report on Singapore Strategy dated 17 Aug 2012.....

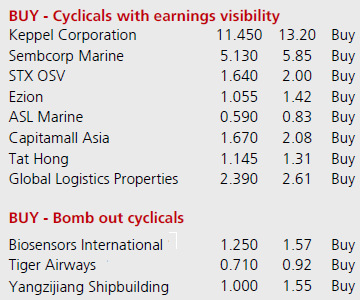

DBS Vickers recommends cyclicals such as ....

Analysts: Janice CHUA, LING Lee Keng & the Singapore Research Team

Top slice selected REITS and Telcos.

We advocated investing in yield plays since March 2012. Our yield picks – primarily REITs and telecoms stocks have outperformed on a 3 to 6 month basis.

Yield gap for REITs has compressed from 6% in March 2012 to the current 4.5%.

We prefer to be selective on yield plays and will top slice REITs where we see limited potential in yield compression – CapitaMall Trust, Capita Commercial Trust, Cache Logistics, CDL

Hospitality and Ascendas India Trust.

Switch to cyclical stocks with earnings visibility…

We believe it is still early to add cyclicals in the transport and commodities related sectors which are vulnerable to the weak global economy.

We prefer to add positions in cyclicals with earnings visibility, which are found mainly in oil and gas proxies.

These are companies backed by strong order books for projects - Keppel Corp, SembCorp Marine, ASL Marine, STX OSV, Ezion - or high level of steady income - CMA, GLP - while Tat Hong is riding high on the upturn in the regional construction industry.

…or bombed out cyclicals.

We reiterate our buy calls for Tiger, a turnaround play with its operations in Australia in full swing by October 2012.

Biosensors remains a steal for a company with 30% earnings growth and strong competitive advantage.

Yangzijiang is a well managed shipyard, trading at undemanding PE of 5x and backed by dividend yield of 6.4%.

Recent stories:

@ BIOSENSORS AGM: "Company in high growth, no plan for dividends"

Nomura has 'buy' on commodity stocks, AmFraser on YANGZIJIANG

Lock in gains of REITS, etc.....too early to turn positive on SAKARI

EPS down due more new shares, and nil dividend is not a plus for Institutions.