As of June 30, Greentown China's total bank borrowings were 32.2 bln yuan. Photo: Greentown

In a warning sign reminiscent of the sub-prime loan crisis which battered Wall Street in 2008, a Chinese-language piece in Moneyweek takes a look at which banks are affected and how the developer managed to get so cozy with credit approvers.

It said the relationships formed between property firms and several Mainland lenders have been in many cases nothing short of “disastrous.”

Greentown China Holdings Ltd (HK: 3900) has been in the news lately for all the wrong reasons.

Top level management recently confirmed rumors circulating through the market the the Mainland China-based developer “was in a tight financial state from top to bottom.”

How did Greentown get so tight with its creditors and exactly which banks are overly exposed to the property sector?

PRC press said the relationships formed between property firms and several Mainland lenders has been in many cases nothing short of “disastrous.” Photo: Leong Chan Teik in Chengdu

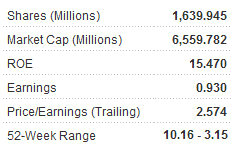

In its first half earnings statement, Greentown said that as of June 30, its total bank borrowings were 32.2 bln yuan, more than the total of 30.8 bln at the end of 2010.

“The relationship between property developers and the banking industry has become more and more lax. Three years ago, developers could typically borrow up to 60% of the value of a particular project. But now I am afraid that there are no such limits in place,” the Moneyweek report cited a high level official with Shanghai Pudong Development Bank (SHA: 600000) as saying.

Greentown’s situation is certainly not an exception within the industry.

Prior to 2008, Greentown’s financing was sourced almost entirely from banks.

In 2008, the developers’ primary providers of loans were Standard Chartered, Bank of China, Agricultural Bank of China, ICBC, CCB, BOCOM, and Shanghai Pudong Development Bank, during which total loans exceeded 10 bln yuan.

In 2009, Greentown added two significant lenders to the ranks of its major financing institutions: China Everbright Bank and Guangdong Development Bank.

That year, Greentown won credit lines of 60 bln yuan from Bank of China, Agricultural Bank of China, ICBC and CCB, while at the same time getting loans of 4 bln and 2 bln from China Everbright and Guangdong Development Bank, respectively.

And at the end of that year, Greentown’s total bank borrowing reached 21.7 bln yuan, with trust related financial instruments at 3.4 bln.

By the end of 2010, Greentown’s total bank borrowing had surpassed 30.8 bln yuan with trust related financial instruments at 250 mln.

Greentown recent price: 4.00 hkd

For the year, Greentown’s total major lenders rose to 10, with Bank of East Asia Ltd (HK: 23) added to the list.

Therefore, it should be no surprise that Greentown’s bank borrowings rose again this year. But the rate at which they grew by the end of the first half – to 32.2 bln yuan – is cause for alarm, the report said.

As for the comparison of loan sources over the past few years, the rise of trust companies has meant property developers generally derive a smaller percentage of their overall borrowings from traditional banks. But this has not resulted in banks losing their dominant positions as the ATMs to real estate firms.

But it should also be kept in mind that banks offer a broader range of services than trust firms, including clearing and settlement operations, business and wealth management, bank cards, financial consulting and mortgage services.

The report added that developers seem to be in no hurry to lessen their dependence on banks for most of their capital needs. However it is in both parties’ interests to assure shareholders in both property firms and banks that due diligence is still being practiced by all involved.

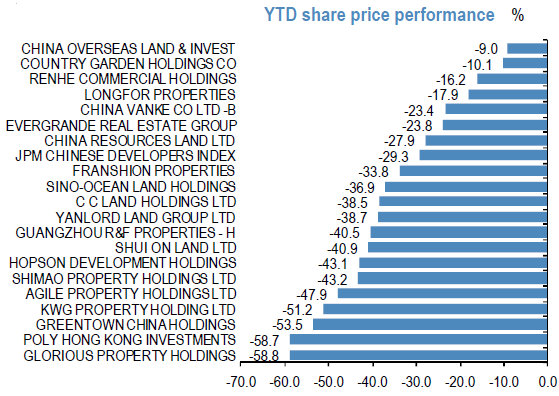

Greentown China along with other Chinese property developers have suffered sharp falls in their stock prices. Source: Bloomberg

See also:

VODONE'S Shares Afire On Tieup; TRINITY’S Margins Top 80%

CHINA’S ONLINE USERS Top 500 Mln, HEALTHCARE Rated 'Outperform'