VODONE, FINLAND’S ANGRY BIRDS Ink Strategic Tieup

VODone said there has been a sharp increase in trading volume and share price of the firm's Hong Kong-listed shares due to news of a strategic tieup.

“We would like to confirm that recently VODone and unit CMGE have formed a strategic cooperation with ROVIO. ROVIO is an entertainment media company based in Finland, and the creator of the globally successful Angry Birds franchise,” Vodone said.

In a ROVIO partner event held in Shanghai on October 18, 2011, ROVIO announced its all-screen strategy where CMGE plays a key role as the partner company developing authorized Chinese feature phone game play for Angry Birds and Angry Birds Seasons with ROVIO.

VODone is also one of the selected distributors of these games on the feature phone market in China.

According to an Analysys Report in March, feature phones accounted for 86.2% of the total handsets in use/in inventory whereas smartphones accounted for 13.8% of the total handsets in use/in inventory in China.

“VODone’s board further notes that certain recent internet news reported the possible listing of our Mobile Game and Handset Design businesses. In relation to the possible spin-off and listing of our Mobile Game and Handset Design businesses, the board refers to the previous announcement VODone made on August 25, 2011 stating that VODone was considering the possibility of a separate listing of such businesses on an international stock exchange.

“The present position remains the same as stated in the aforesaid announcement. Further announcements will be made on any significant progress of such a possible separate listing,” VODone added.

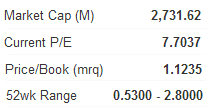

See also: VODONE: No.1 Mobile Gamer In China, Shares At 52-Wk Low... What Gives?

KINGSTON: TRINITY to expand in PRC thanks to increasing purchasing power

Kingston Securities said Trinity Group (HK: 891) is one of its top picks in the PRC's retail clothing sector.

"With its increasing purchasing power, Trinity intends to accelerate its shop number by having 50 new stores open by the end of the year. They are mainly located in first tier cities, as well as tier-2 and tier-3 cities," Kingston said.

Trinity had very strong recent earnings with the gross profit margin growing from 75.8% to 80.8%, reflecting the strengths of the firm’s brands.

"The higher-than-peers GPMs prove the group’s strong bargaining power under the cost inflation period. Trinity is well equipped with the condition of acquisitions by holding HK$330m at end June 2011.

"Meanwhile it states that it is searching for a high-end menswear brand, yet the details have not yet been confirmed."

Trinity has seven international luxury menswear brands under its retailing umbrella, of which Salvatore Ferragamo is under a JV, Kent & Curwen and Cerruti are self-owned brands and the rest are granted operational rights in the Greater China region.

In total, Trinity has more than 400 stores, of which 327 stores are located in Mainland China.

Kingston said its Buy-in Price for Trinity is HK$5.9, its Target Price is HK$7.4 and its Stop Loss is at HK$5.3.

See also: HK RETAIL: CHINA FOODS, TRINITY, INTIME, 361: What Analysts Now Say...