Translated by Andrew Vanburen from: 魏橋紡織為高息低PE之選

(中文翻譯,請看下面)

WEIQIAO TEXTILE Co Ltd (HK: 2698), an 8 bln hkd producer of cotton yarn, grey fabric and denim for the PRC garment factory juggernaut, has a tantalizingly low sub-4x P/E, and its dividend yield is nearly 8%.

And with cotton prices coming back down to earth, this counter is definitely worth watching.

The surge in cotton prices last year was a major body blow for textile firms. But the recent tapering off in prices for the commodity has allowed margins the liberty of a breather.

And thanks to the sky-high prices last year, many mainland Chinese farmers overplanted in a mad rush to cash in on the boom, leaving the potential for an oversupply environment going forward.

Since early March this year, the ability of textile and clothing makers to shift costs downstream has also been enhanced in the generally inflationary period in the PRC.

But textile stocks in general are lagging behind the benchmark Hang Seng Index, and there are several counters in the sector with price-to-earnings ratios in the 4-7 times range, with many certainly being bargains.

According to forecasts by the International Cotton Advisory Committee, due to last year’s rapid rise in cotton prices to historic levels in both the US and Mainland China – two major producers – an upward spike in cotton field acreage was witnessed to ride the commodity boom.

Global acreage devoted to cotton cultivation is expected to hit 17-year highs this year.

The US Cotton Industry Association says higher prices last year will result in cotton acreage in the country increasing 14% this year, with a total expected harvest of 19.2 mln bags.

And with corresponding increases in cotton acreage in the PRC, prices are likely to continue trending downward this year.

Industry giant Weiqiao Textile is the world's largest producer of cotton textiles, and primarily focuses on cotton yarn, grey fabric and denim products for sale to clothing manufacturers in Mainland China, but also enjoys considerable orders from Hong Kong, Japan and South Korea.

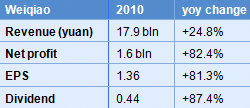

The Hong Kong-listed firm saw 2010 net profit leap 82.4% year-on-year to 1.63 bln yuan, with 1.1 bln of this flooding in during the second half alone – a y-o-y increase of 110%.

Weiqiao’s top line last year rose a healthy 24.8% to 17.89 bln yuan, much less robust than the net profit growth due to higher average selling prices and higher margin products.

The final end-year dividend was 0.4376 yuan, a startling 87% year-on-year jump.

By region, revenue from Mainland China and Hong Kong constituted 61.7% and 11.7%, respectively.

Broken down by product, cotton yarn and cloth production increased by 11.1% and 10.2%, respectively, contributing 94% to total income.

It is clear why cotton prices hold such a sway over Weiqiao’s fortunes.

Raw material costs were the biggest area of concern for this counter in 2010, and this year is no different.

But judging by the recent financial performance of clothing and garment manufacturers, textile suppliers have been able to pass on the higher cotton costs downstream.

Weiqiao last year made strategic adjustments in the selling prices of its core products, especially after cotton prices soared 50% in the second half.

It lifted cotton gauze prices by 40%, a key product that comprised 45% of revenue last year.

The fact that gross profit margins last year improved to 16.1% from 8.7% in 2009 is further testimony to the ability of Weiqiao to pass higher input costs downstream without too much resistance.

And for cotton yarn alone, gross margins over the same period leapt from 8% to 21.3%.

Weiqiao management says that orders in the just-finished first quarter stayed on pace with fourth quarter 2010 performance, and gross margins stayed at levels seen in the second half of last year.

Group capital expenditure should total 200 mln usd this year, mainly for upgrading production capacity at four existing facilities.

Weiqiao says it is committed to further expanding its market share going forward and will continue to explore new markets, both of which will help maintain healthy revenue growth.

In addition, the Group reduced its orders receivable days from customer accounts to 11 days from 22 days, which is in large part a function of clients hoping to meet their financial obligations before any additional cotton price hikes.

This helped Weiqiao execute more stable inventory management.

Weiqiao has been one of the favorite targets for major funds of late, with its top three strategic shareholders being Brandes Investment Partners, L.P. (13.55% stake), The Bank of New York Mellon Corp. (12.94% stake) and Mellon Financial Corp. (9.93% stake).

Weiqiao Textile’s earnings prospects remain rosy, thanks to gross margin stability and ongoing capacity upgrade plans.

And with such a low P/E and a relatively generous dividend yield, Weiqiao is worth watching, with 6.6 hkd a good entry point.

See also:

PRC HYPERMARKETS, TEXTILES: What Analysts Now Say...

CHINA GAOXIAN, FORELAND, CHINA FIBRETECH, TAISAN: What CIMB Found Out...

魏橋紡織為高息低PE之選

(文: 何慧韻, 股票分析师)

去年棉花價格急升,令紡織業大受影響,不過,近期商品價格已有回落跡象,加上高棉價下已吸引農民增產令供應上升。

自從今年3月初起,國際棉花價格向下,加上紡織成衣股轉嫁成本的能力較預期為高,且大幅落後大巿,現時一眾紡織股市盈率約在4倍至7倍的水平,值得留意。

據「國際棉花諮詢委員會」預測,由於棉價去年大幅飆升,創有紀錄以來高位,包括美國、中國在內的主要產棉國,將大幅增加棉花種植面積,今年全球植棉面積預計增至近17年最高水平。美國棉業組織估計,美國農戶因棉價飆升而增加14%土地種植棉花,料今年秋季收成將增加至1920萬包。隨供應增加,加上內地著力維持壓抑物價上漲,棉價走勢有機會穩定下來。

行業龍頭魏橋紡織(2698)是全球最大棉紡生產商,主要產銷棉紗、坯布同牛仔布等,市場包括中港、日本及韓國等地。截至2010年底,全年盈利16.27億元人民幣,按年增82.4%,其中下半年純利更達11億元人民幣,按年急增1.1倍。全年營業額178.87億元人民幣,升24.8%。派末期息0.4376元,增加87%。按地區收入劃分,內地及香港分別佔61.7%及11.7%。產品方面,棉紗和坯布產量分別上升11.1%及10.2%,共佔收入比例94%。

原材料飆升為該板塊最為人關注的地方,但觀乎各成衣商公布的業績顯示,上游紡織商可藉加價,轉嫁成本壓力。魏橋紡織去年已調升主要產品價格,如去年下半年雖然棉價急升達50%,其紗布普遍已提價,而佔魏橋收入45%的棉紗,價格升幅高達40%。由於紗布價格漲幅,高於原材料價格漲幅,令整體毛利率由2009年的8.7%倍增至去年的16.1%,棉紗毛利率更由2009年的8%升至21.3%,反映集團有能力將成本轉嫁。

據集團管理層透露,今年第一季的訂單維持去年第四季的水平,而毛利率亦維持去年下半年的水平。今年集團資本開支為2億美元,主要用作提升現有4個生產基地的產能。未來集團將進一步擴大市場份額,開拓更多新興市場,有助維持收入增長速度。另外,集團從客戶方面收取的賬期由22天縮減至11天, 顯示客戶於去年肯提早付款以控制價格上升及保證存貨量。

魏橋一直為基金愛股,現時最大的三個策略股東,包括Brandes Investment Partners, L.P.持有權益13.55%,The Bank of New York Mellon Corp.持有12.94%,而Mellon Financial Corp.則持有9.93%,合共已達36.42%,另有為數不少的權益低於5%的大小基金。

集團毛利率穩定,產能有提升空間,其盈利前景仍然樂觀。現時的市盈率僅4.28倍,加上除稅後的股息率逾6厘,於現今巿況,更顯其投資價值。該股貨源集中,建議6.6元買入,中線目標為年高位9.06元,失守250天線6.4元止蝕。

請看:

PRC HYPERMARKETS, TEXTILES: What Analysts Now Say...

CHINA GAOXIAN, FORELAND, CHINA FIBRETECH, TAISAN: What CIMB Found Out...