Excerpts from latest analyst reports…..

CIMB reiterates BUY call and 43-c target price for Ziwo after strong 3Q

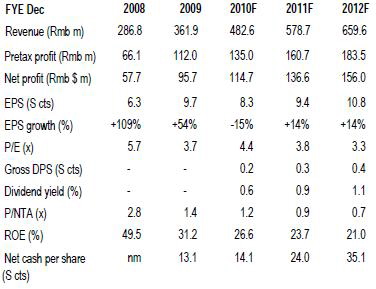

• Reiterating our BUY call on the stock, with the positive showing in 3Q10 re-affirming the improvement in its prospects. The stock trades at 3.3x CY12 P/E, which remains undemanding in our view, considering the improvement seen in its performance since 2Q10.

Moreover, approximately 39% of its market capitalization is backed by its net cash per share of 13.9 scts (no gearing).

We have adjusted our net profit forecasts for FY10-12 by 5.5% - 8.5% to incorporate higher gross and operating margins expectations. Our target price is hence lifted to S$0.43, still pegged at 4x CY11 P/E, as we roll over to end CY11 target.

• Ziwo continues to generate healthy cash flows from its business, with operating cash flows in 3Q10 coming in at Rmb32.6m (+8.7% qoq).

• Optimistic about 4Q10. The healthy growth of its sales volume has indicated clear and continuous strength in the market demand for Ziwo’s products. Coupled with its

gradual ramp up of additional production capacity, we are optimistic that the Group would continue to deliver healthy results in 4Q10.

Recent story: ZIWO, SERIAL SYSTEM: What analysts now say...

DMG says Oceanus' 3Q profit slightly below expectations, but maintains 'buy' rating

Analysts: Tan Chee How & Terence Wong

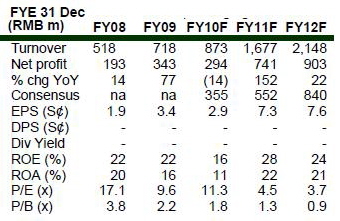

In addition, cash sales of abalone fell 56% QoQ to S$32m (-57% YoY) because of higher proportion of abalone sold to Oceanus’ 70%-owned processing plant, which cannot be booked under P&L.

We revised our FY11F/FY12F PATMI by +29%/-20% respectively on the back of i) higher tank number, ii) larger volume of abalone sold prior to FY12F, and iii) higher raw material and consumables costs.

We also switched our valuation method from forward P/E to Discounted Cash Flow (DCF).

Based on DCF, we arrived at an unchanged TP of S$0.400 (WACC: 16.4%; terminal growth rate: 1.5%). Maintain BUY.

Recent story: OCEANUS (No.1 in abalone farming): Venturing into lobster farming