Excerpts from latest analyst reports….

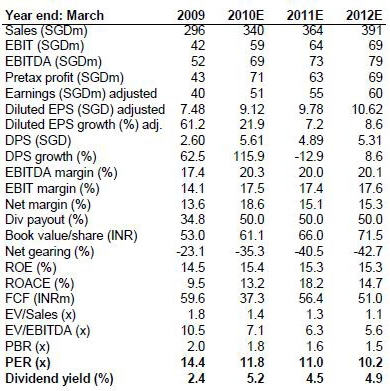

Standard Chartered initiates coverage of Super ($1.08) with $1.39 fair value

Analyst: Pauline Lee

* We initiate coverage with an OUTPERFORM rating and a fair value of $1.39/sh, providing potential upside of 29%.

* With a 23-year track record, Super has grown from a pioneer in the 3-in-1 beverage market, to a leading manufacturer of instant F&B products. It has one of the largest manufacturing facilities in the world and distributes over 300 products across 52 countries.

* We believe Super is at the early stage of re-rating as it divests non-core assets to focus on a new growth phase led by ingredient sales and commits to a 50% dividend payout.

At the early stage of re-rating. We believe a re-rating has just begun as management is now focused on core business, while committing to double the dividend payout. Its improving ROE should support a positive re-rating. We see potential upside to our forecast of 14% core EPS CAGR in 2009 – 12E, underpinned by a seasonally strong 2HFY10 and strong demand arising from new customers in the Horeca (Hotel/Restaurant/Café) space.

Ingredient sales could spawn a SGD1bn company within the next 5-10 years. We expect ingredient sales to double to SGD63m in the next three years. Ingredient sales, which saw revenue surge more than tenfold since its launch in 2007, presents great growth potential, in our view. Given its scalable production capacity and potentially huge demand from global F&B chains, ingredients could surpass its branded-consumer business in the long run.

Catalysts. We see the next catalysts coming in the form of M&A and a narrowing of valuation gap to its TDR shares.

Key risks. The key risks lie in raw material price fluctuations and increased competition.

Recent story: SUPER is good and cheap, says Taiwan stock guru

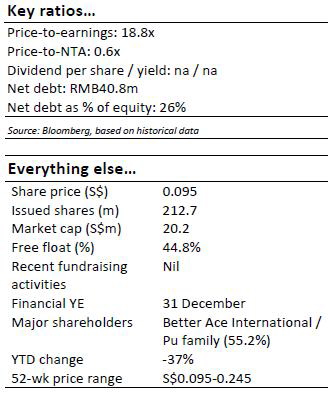

Kim Eng Research says Yong Xin Int’l may soon get sizeable orders from Apple, RIM

Analyst: Gregory Yap

String of bad luck: The company has not had it easy since it listed in 2007. Surging raw material prices led to a RMB12m loss in 2008.

Its attempt to diversify into coal processing in 2009 was called off after its partner went under, which led to an even larger RMB25m loss in 1H10 due to write‐offs for its stocks and receivables. Finally, its chairman and CEO, Pu Dexing, died following an attack in his office by a known assailant.

Bulk of coal saga written off in 1H10. During a recent visit to its factory in Wuxi, China, management clarified that the 1H10 loss of RMB25m included write‐offs needed for the termination of the coal processing business, ie, its exposure to inventory and receivables (RMB$4.3m and RMB17.4m, respectively).

Core business has growth potential. Excluding coke trading, 1H10 revenue actually grew by 59% YoY to RMB82.6m with a profit of RMB5m.

Revenue from cold‐rolled and stainless steel strips jumped by 153% to 67% of group top line.

We think the growth potential for stainless steel strips could be very high, especially since raw material prices have come down, capacity utilisation is still low at 10% and the company may be on the verge of getting sizeable orders from two global smartphone manufacturers – Apple and RIM.