This is part 1 of a 2-part report. Part 2 is: ASMPT: Q&A on 40% gross margin, semicon recovery

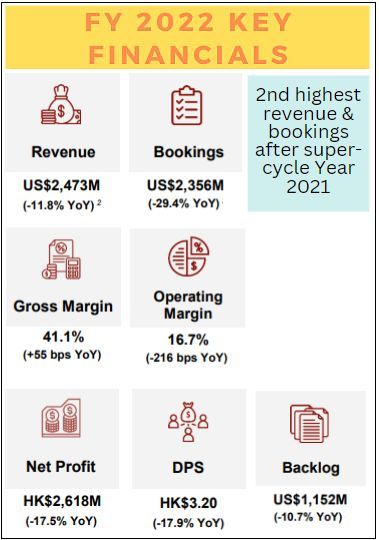

After the semiconductor industry's super-cycle year 2021, the following year was hit by events including the Russia-Ukraine conflict, ongoing trade tensions, inflation and cautious consumer sentiment in the face of an economic slowdown.

CEO Robin Ng said at an earnings call this week: "Part of our success was our ability to effectively tap the competitive advantages of our unique and broad-based portfolio of semiconductor and electronics manufacturing solutions. "These span mainstream, applicative, and advanced packaging tools, and serve various end-market applications across a global pool of customers. We truly believe our solutions portfolio continues to be a differentiator for us." |

||||||||||||||||

Reflecting different business cycles, the SEMI segment's revenue fell 25.2% y-o-y while SMT segment grew 9.8%. Regarding ASMPT's unique and broad-based portfolio, the Group’s SMT segment delivered record revenue in 2022, fuelled by strong demand from the Automotive and Industrial end-markets.

Reflecting different business cycles, the SEMI segment's revenue fell 25.2% y-o-y while SMT segment grew 9.8%. Regarding ASMPT's unique and broad-based portfolio, the Group’s SMT segment delivered record revenue in 2022, fuelled by strong demand from the Automotive and Industrial end-markets.

The SMT segment also recorded its highest ever share of contribution to Group bookings in 2022.

"These developments clearly reflect the resilience of our business model even in a semiconductor downcycle."

As for the end-markets, with macroeconomic uncertainties and dampened consumer sentiments, the Consumer, Communication and Computer end-markets were weak in 2022.

However, the Automotive and Advanced Packaging end-markets did well, delivering an aggregate of about 40% of Group revenue for 2022:

|

• The Automotive end-market benefitted from the global transition to electric vehicles and thus counted China's fast-growing EV manufacturers among its customers. • Advanced Packaging solutions contributed roughly US$500 million in revenue for 2022, or about 20% of total Group revenue. |

Heading into 2023, Automotive and Advanced Packaging set ASMPT's orderbook up well, boosting the total backlog to US$1.15 billion. Most of it will be delivered this year.

The Group expects revenue for first quarter of 2023 to be between US$455 million to US$525 million. At mid-point of guidance, this will be a decline of 11.4% quarter-on-quarter.

| As for dividends, the policy is to maintain payouts of about 50% of Group’s profits on an annual basis. For 2022, the Board proposed a final dividend of HK$1.90 per share. Including an interim dividend of HK$1.30 per share, the total payout for 2022 is HK$3.20 per share. |

For more on the results, see the Powerpoint deck here.