|

Zixin Group: Riding the Wave of China’s Food Security and Agri-Tech Boom Since President Trump announced tariffs on 4 Apr, global markets have been in a tailspin. |

Zixin is a China-based agri-tech company listed on the SGX. It benefits from China’s focus on food security and sustainable agriculture. With vertically integrated operations in sweet potato seedlings production, sweet potato cultivation, R&D, processed foods, and feedstock for animal feed, Zixin presents an intriguing growth story for investors seeking exposure to the China consumer and agri-tech sectors. Zixin operates in Liancheng County, Longyan City, Fujian Province, China. Liancheng County has been dubbed China’s “sweet potato capital of the world” (Click HERE for the reference).

Why is it interesting?

Zixin has multiple streams of incomes. Let’s take a look.

A) Fresh sweet potatoes – prices are rising CEO Liang ChengwangOne of Zixin’s business segments is to sell sweet potatoes in China. Its higher-grade sweet potatoes are sold as fresh produce.

CEO Liang ChengwangOne of Zixin’s business segments is to sell sweet potatoes in China. Its higher-grade sweet potatoes are sold as fresh produce.

1HFY25 revenue from sweet potatoes was RMB48.6m, 31% of total revenue. This is likely to increase over time.

Since 2HFY24, Zixin outsourced to a smart warehouse, automating washing, sorting, and cold storage. This reduces spoilage, improves quality, and extends shelf life from 1-2 weeks to 1-2 months, enabling premium pricing and better margins.

Longer shelf life allows Zixin to:

| • Sell at optimal prices rather than rushing to market • Distribute to supermarkets and e-commerce beyond Liancheng • Build inventory, benefiting from rising sweet potato prices |

Channel checks indicate fresh sweet potato prices have risen in the areas which Zixin operates in.

B) High-Value Processed Foods – increasing both in absolute amount with higher margins

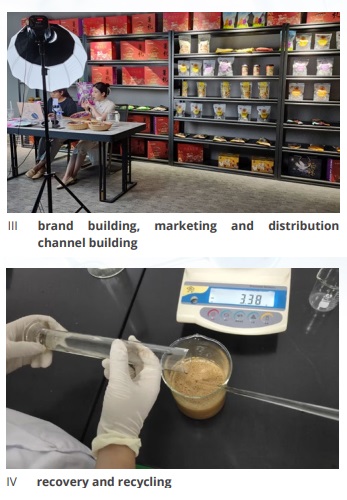

Zixin also sells processed sweet potato products, using lower-grade harvests and third-party purchases for its own brands and OEM clients like Three Squirrels.

A new high-tech facility (83.6 mu, 86,000 sqm) will boost annual capacity from 13,700 to 35,000 tonnes.  Phase one includes three automated lines for higher-margin products: purple sweet potato powder, additive-free vacuum-packed steamed sweet potatoes, natural-flavoured steamed varieties and orange peel sweet potatoes.

Phase one includes three automated lines for higher-margin products: purple sweet potato powder, additive-free vacuum-packed steamed sweet potatoes, natural-flavoured steamed varieties and orange peel sweet potatoes.

These premium products are expected to achieve gross margins of 35-40%, up from 28-30%, due to advanced processing and growing demand for healthy foods. In April, Zixin achieved a breakthrough in sweet potato chips and fries, overcoming texture challenges.

Market response has been strong, with sizable distributor orders and a new production line added to meet demand. This product range is expected to become a flagship offering.

C) Sweet Potato seedlings – another potential revenue driver in FY26F

Seedling sales rose 42% YoY in 1H FY25, with Phillip Securities projecting a 7% increase in 2H FY25.

Further growth is expected in FY26, supported by the planned expansion of greenhouse capacity from 100 mu in FY24 to 200 mu.

Further growth is expected in FY26, supported by the planned expansion of greenhouse capacity from 100 mu in FY24 to 200 mu.

Zixin owns 300 mu of dedicated seedling farmland in Liancheng County, ensuring high-quality yields. Historically, seedling sales were minimal, but expansion should drive growth via higher volumes for sale to external parties and rising prices.

We may see more of such contribution in 1HFY26F as sale of seedlings usually occurs in 1H after Chinese New Year.

D) Extension to address feed security

Zixin has started commercial production and sale of probiotic-infused sweet potato feedstock, which is a key milestone in completing its circular economy model.

In Jan 2025, it secured an initial order of 1,080 tonnes (RMB3.2m) from a poultry farm, and another 180-tonne order (for probiotic-infused fermented sweet potato feedstock) in March.

Production is outsourced, with Zixin supplying the probiotic formula and technical guidance.

The feedstock improves feed consistency for livestock, reduces soymeal and corn reliance, and supports food safety. From FY26F, Zixin will use sweet potato stems—yielding up to eight times more per acre than peels—unlocking greater capacity.

E) Strategic Partnership with CITIC in Hainan

In July 2023, Zixin’s subsidiary took a 3% stake in a Lingao, Hainan urban revitalization project with CITIC Construction.

|

Stock price |

2.9 c |

|

52-week range |

1.4-3.2 c |

|

Market cap |

S$46 m |

|

PE (ttm) |

9 |

|

Dividend yield |

-- |

|

P/B |

0.4 |

|

1-year return |

38% |

|

Source: Yahoo! |

|

This JV will replicate Zixin’s integrated sweet potato value chain in a region with five times the cultivation land (500,000 acres) and two annual harvests. The asset-light model means most capital outlay is borne by government and third parties.

This strategic partnership with Citic Construction, the 2nd largest state-owned conglomerate in China by AUM of foreign assets, is a testament to Zixin’s strengths.

Key initiatives include:

|

(i) Selecting and cultivating suitable seedlings for sale and providing farming solutions to local farmland owners,

|

F) Net Cash Position Enhances Flexibility

As of 1HFY25, Zixin holds RMB136.2m (S$24.5m) net cash—57% of its market cap—providing ample resources for expansion and R&D.

G) Tailwinds from strong government support

China promotes sweet potatoes to reduce soybean imports. Support includes land allocation, rental-free periods, and subsidies for the construction of cold storage and fermentation plants. The Liancheng government committed RMB120m for cold storage facilities and awarded Zixin’s operator a four-year free rental.

H) Smart money has already noticed Zixin

In Oct 2024, Thomas Khoo increased his stake in Zixin to 10.35% by acquiring 6.5m shares at $0.02815 / share. This was a sharp increase since he first emerged as a substantial investor (above 5%) in Zixin in Jun 2024.

J) Valuations are compelling

Zixin’s NAV/share is S$0.062.

Phillip Securities estimates FY25F earnings at RMB34.8m, implying a FY25F PE of 6.9x. Contributions from processed foods, seedlings, and feedstock are expected to rise in FY26F

Naturally, almost all investments carry risks. Below is a list of some risks.

|

Potential risks 8. First time looking at Zixin: This is my first look into Zixin. For a more complete picture, refer to Phillip Securities initiation report dated 30 Sep 2024 (click HERE); 27 Nov 2024 report (Click HERE) and SGX website (Click HERE).

|

Conclusion

Zixin offers multiple income streams, strong government support, and low valuations.

While risks exist, especially around execution and market demand, Zixin’s growth prospects and financial strength make it worth a closer look.

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, you can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, I can be reached at

P.S: I am vested in Zixin and have informed my clients on Zixin too.

Disclaimer

Please refer to the disclaimer HERE