Excerpts from analysts' reports

OCBC Investment Research initiates coverage of Kim Heng Offshore, 34-c target.

Analyst: Low Pei Han

"The current outlook for the O&M industry is positive, and well-executed acquisitions may result in a re-rating of the stock. Initiate with BUY and S$0.34 fair value estimate." "The current outlook for the O&M industry is positive, and well-executed acquisitions may result in a re-rating of the stock. Initiate with BUY and S$0.34 fair value estimate."

-- Low Pei Han |

Looking at next leg of growth

Core business delivers good returns

Under-priced at current levels

Long-time player in the O&M industry

With over 40 years of experience, Kim Heng Offshore & Marine Holdings Limited offers a one-stop comprehensive range of products and services that caters to different stages of offshore oil and gas projects from oil exploration to field development and oil

production. Its core competencies lie in rig repair and maintenance, refurbishment of rigs, offshore fabrication and supply chain management.

Core business delivers good returns

The group enjoys good relationships with established players in the industry, counting Transocean and Seadrill (amongst others) as a few of its key customers. The ongoing requirement for rig maintenance and repair also means that it is less cyclical than the newbuild business, and ad-hoc jobs with urgent client requirements present opportunities for higher margin work as well.

This has allowed the group to deliver ROEs of 30-50% in FY11-13 and ROICs of 27-33% over the same period, and is expected to buttress the group’s earnings as it seeks further avenues of growth.

Seeking next leg of growth

The group used to be entirely controlled by the Tan family, and though it remains a major shareholder with several members of the family in senior management, there is now also the presence of a private equity fund, Credence Partners, that aims to grow

with the company. We expect to hear about acquisitions to boost the group’s capabilities (such as in the subsea business), and perhaps an expansion beyond Singapore.

Under-priced; initiate with BUY

We value Kim Heng based on 11.5x FY14/15F P/E, close to the industry average for offshore service providers. The group’s proven track record and established relationships with clients lends confidence that it can weather downturns and be a beneficiary during up-cycles. The current outlook for the O&M industry is also positive, and well-executed acquisitions may result in a re-rating of the stock. Initiate with BUY and S$0.34 fair value estimate.

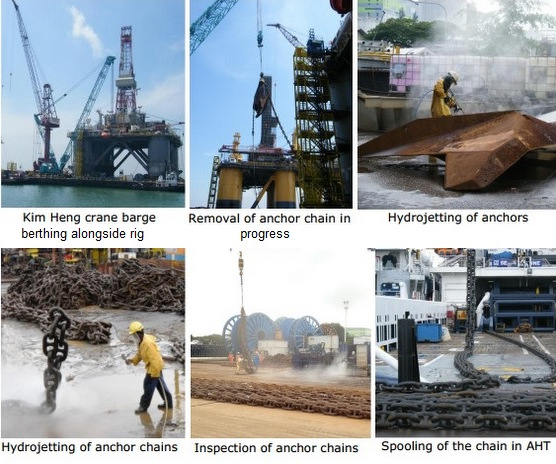

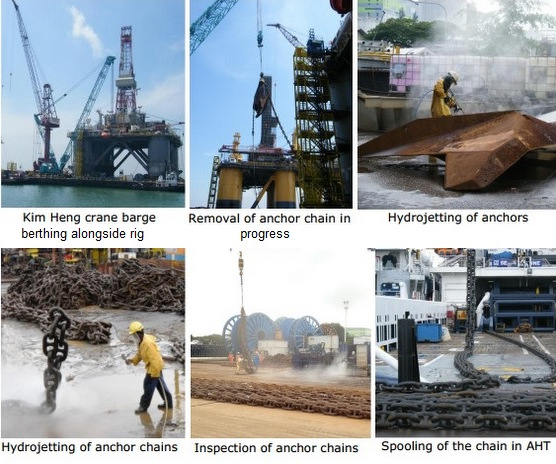

Some of the work under oil rig services and support >> Anchor chain removal, inspection and maintenance.

Some of the work under oil rig services and support >> Anchor chain removal, inspection and maintenance.

|

Family-owned with PE presence

Thomas Tan, executive chairman and CEO of Kim Heng Offshore & Marine. Photo: CompanyInvestors may like to take note that the group is controlled by the Tan family – they collectively hold a ~45% stake in the group, and several members of the family are involved in the business. At the same time, there is also the presence of a private equity firm, Credence Partners (17.6% stake), which seeks to help the group to grow. Thomas Tan, executive chairman and CEO of Kim Heng Offshore & Marine. Photo: CompanyInvestors may like to take note that the group is controlled by the Tan family – they collectively hold a ~45% stake in the group, and several members of the family are involved in the business. At the same time, there is also the presence of a private equity firm, Credence Partners (17.6% stake), which seeks to help the group to grow.

Well-known names are also investors in the group

Credence Partners Pte Ltd is a Singapore-based private equity firm, providing growth stage capital and expertise to small and medium-sized enterprises. During Kim Heng’s IPO offering in Jan, the bulk of shares were placed out to institutional and individual investors at S$0.25/share.

Among the latter, Havenport Asset Management, OneEquity SG Pte Ltd and the CEO of Ezion Holdings (Mr. Chew Thiam Keng) were allocated 35m shares, representing about 20.1% of the total invitation of 174m shares. In total, Credence has invested S$25m, acquiring a post-IPO shareholding of 17.6%.

In a Jan 2014 announcement, Credence’s Chairman Mr Koh Boon Hwee said that the firm expects to stay invested in Kim Heng for the next three to seven years, working with Kim Heng’s management to build up the company.

|

"The current outlook for the O&M industry is positive, and well-executed acquisitions may result in a re-rating of the stock. Initiate with BUY and S$0.34 fair value estimate."

"The current outlook for the O&M industry is positive, and well-executed acquisitions may result in a re-rating of the stock. Initiate with BUY and S$0.34 fair value estimate." Some of the work under oil rig services and support >> Anchor chain removal, inspection and maintenance.

Some of the work under oil rig services and support >> Anchor chain removal, inspection and maintenance.